The Hunt Expands: New Species, New Tactics Emerging in the Biodiversity Age

How the newest MEV predators target LPs, mass-produce attacks, and hide their fangs in smart-contract camouflage.

Flash-loan giants showed how raw capital could weaponize composability.

But capital wasn’t the only edge. In the shadows of bundle tunnels, three even stranger predators emerged—each staking out a brand-new ecological niche in Ethereum’s blockspace.

1️⃣ Liquidity Mirage Makers stopped chasing traders and started stalking liquidity providers, inflating pool prices just long enough to trap LP deposits in a rigged window of time.

2️⃣ Jared’s Assembly Line took sandwiching from side hustle to factory floor—split bundles, JIT hybrids and multi-victim stitching that turned meme-coin pools into conveyor belts of profit.

3️⃣ Tax-Token Tricksters ditched visible ambushes altogether, hiding transfer fees and rug switches inside the token contract, then layering in sandwich bots for a triple-evil combo.

Together they prove a simple rule of the biodiversity era:

If a value path exists—even for a few milliseconds—someone will evolve to exploit it.

Let’s meet the next generation of MEV life-forms—built on illusion, scale, and camouflage.

Liquidity Mirage Makers — Not All Sandwiches Target Swaps

In the early days, MEV bots lurked behind every swap, tailing traders like pickpockets in a crowd. But a smarter predator evolved—one that stopped chasing swappers but liquidity providers (LPs).

The first case surfaced on November 4, 2022, tucked neatly inside what looked like a normal Ethereum block. A user was adding liquidity to a Uniswap V2 pool—standard behavior for an LP. But behind the scenes, a bot had already prepared a three-part ambush.

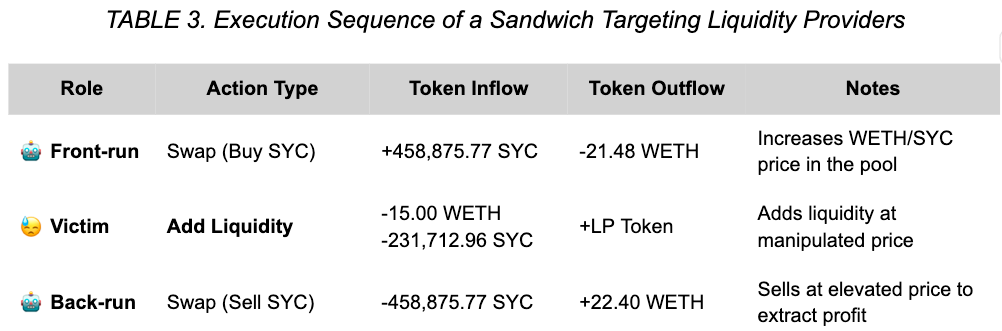

Packed together in a single bundle were:

1. a price inflation trade to distort the pool’s exchange rate,

2. the LP’s own “add liquidity” transaction—now trapped in the inflated ratio, and

3. a price correction trade to return the pool to normal and extract the spread.

The bot didn’t wait for the LP to act—it already knew what was coming. And within that one atomic bundle, it frontloaded the illusion, captured the LP’s mispriced deposit, and backloaded the profit.

Then came the real slaughter.

On January 20, 2025, a whale added 9.95 wBTC (~$870K) to a Uniswap pool—without setting amountAMin, the only guardrail against slippage. The attacker executed the same blueprint. Curve warped, deposit landed, price snapped back. The LP got dust. The bot got the bag.

What makes LP ambushes so insidious is their subtlety. They use low gas, evade mempool detection, and hide in clean-looking blocks. On the surface, it’s just a liquidity provision. Underneath, it’s a mirage—a rigged price window engineered just long enough to rob the depositor blind.

Jared’s Ascendancy — Apex Predators

The bundle tunnels soon echoed with bigger footsteps.

It began on April 3, 2023, with a shock to the system: a rogue validator exploited a timing vulnerability in MEV-Boost, front-running multiple sandwich bots and siphoning off ~$20 million that was meant for builders.

It was a brutal reminder that even predators have predators, and that validator power could be weaponized with surgical precision.

The impact was immediate—several top-performing sandwich bots were hit hard, with significant profit losses and operational setbacks.

For a time, sandwich activity visibly contracted, as searchers recalibrated their strategies and reconsidered the risks of competing in an increasingly hostile and validator-aware environment.

But the void didn’t last long.

In May 2023, a new name roared to the top of the MEV food chain: jaredfromsubway.eth. Armed with hyper-optimized bots and riding the meme-coin frenzy, Jared spent over $7 million in gas in just weeks, eventually monopolizing 87% of all sandwich attacks. This wasn't one bot—it was a full-scale MEV production line, slicing through meme coin pools with ruthless efficiency.

By August 2024, Jared had evolved again. Jared 2.0 rolled out sophisticated tactics like split-front-run bundles and swap-JIT hybrids—clever designs where three transactions could deliver two distinct sandwiches, with zero wasted movement. Bundles were now shared, costs amortized, and victims stacked side by side. With transaction reuse, just-in-time liquidity, and multi-victim stitching, Jared slashed per-attack costs to the bone. Even tiny retail swaps—once unprofitable to target—were now viable prey.

This wasn’t just an MEV strategy. It was predation as a platform—a scalable, automated, precision-crafted pipeline where capital efficiency, not capital size, determined dominance.

Tax-Token Tricksters Camouflage & Triple-Evil Combos

When the mempool jungle got too competitive, some predators learned to hide in plain sight—donning smart-contract disguises and booby-trapped tokens to lure in unsuspecting prey.

Some attackers will split front-runs across multiple EOAs to bypass per-transaction token limits, carefully timed the back-runs to collect taxed tokens.

One of the most grotesque examples came in 2024, with a token called Yield Stone. On the surface, it looked like just another meme coin. Underneath, it was a trap—a 35% transfer tax, a hidden rug-switch, and a backdoor coordination with a sandwich bot. The result? A 94-layer mega-sandwich that ensnared 74 victims in a single block. It wasn’t just a sandwich. It was a triple combo of front-running, taxing, and rug-pulling, all executed in one atomic bundle.

Wrap-Up

What began as simple sandwiches in the mempool has now evolved into a full-scale arms race of composability, disguise, and precision.

In this era, we saw attackers move beyond the swap—targeting liquidity providers, borrowing massive capital across chains, and embedding themselves deep within protocol logic. Flashloans became tactical bridges. Bundles became multi-victim containers. Tokens themselves were weaponized.

Each new predator brought its own twist:

Leverage Raiders rewired DeFi’s plumbing to move whale-size capital with pawn-size wallets.

Liquidity Mirage Makers preyed on good-faith LPs by crafting price illusions timed to the millisecond.

Jared’s Assembly Line transformed MEV from a craft into an industry, scaling attacks by optimizing every step of the sandwich.

Tax-Token Tricksters blurred the line between protocol and exploit, hiding multi-stage rug-pulls inside tokens that begged to be touched.

Together, they turned bundle tunnels into a breeding ground for specialized MEV lifeforms, each adapted to a niche of capital, timing, or deception.

But beneath the surface, pressure was building. Builders were consolidating. Validators were watching. And defenses—some structural, some cryptographic—were beginning to emerge.

Coming Up Next: 2025 Reality Check — Old Tricks, New Speed

Think the predator boom has peaked?

Not even close.

In the series finale we jump to today’s blockspace, where:

⚡ Six sandwiches land in five minutes — vintage tactics turbo-charged by auto-tuning code and zero-latency relays.

🥪 Tiny retail swaps (yes, even your coffee-size trades) get sliced alongside whales.

🔁 Defense tools trigger a new feedback loop: every wallet warning, private RPC, and encrypted mempool spawns an even faster counter-measure.

🏛️ Protocol questions turn existential — who really decides your transaction order now, and what happens if builders, relays, or validators blink?

Same playbooks, Formula-1 reflexes, and a widening gulf between protected and unprotected flow.

The jungle never sleeps; it just upgrades.

Subscribe to catch Part 4 — The Jungle Never Sleeps as soon as it drops.

Read the previous parts of this series:

The Prehistoric Age of Sandwich MEV Before the Bundle: When Gas Auctions Ruled the Chain

In the hidden lanes of Ethereum’s blockspace, a new kind of creature has evolved—stealthy, adaptive, and precision-engineered for profit. These aren’t just bots. They are financial predators with a genetic lineage shaped by protocol quirks, mempool mechanics, and incentive asymmetries.

The Assembly Lines Era: Bundle-Boosted Beasts Changing the Game Via Private Tunnels

The first part of this series has reviewed the prehistoric age of Sandwich MEV.

How Flash-Loan-Enabled Arms Race Goes Modular In the Age of Predator Proliferation

🧬 Previously on The Rise of the Sandwich Species

You can click this link or open https://bit.ly/hfdefi to download the free ebook Head First DeFi, Decoding the DNA of Crypto Transactions & Strategies. We are adding more intriguing cases in 2024. Let us know if you want to be part of it.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram