How Flash-Loan-Enabled Arms Race Goes Modular In the Age of Predator Proliferation

Mega-fauna sandwich bots have been forged instant, zero-collateral liquidity.

🧬 Previously on The Rise of the Sandwich Species

In Part 1, Ethereum’s mempool was an open jungle—every transaction visible, every slippage setting a beacon. Primitive bots fought in gas-price knife fights, birthing the first sandwich attacks in a chaotic era of spear-and-stone warfare.

In Part 2, Flashbots built private tunnels beneath that jungle. Bots evolved. With sealed bundles, they gained atomic execution, invisibility, and coordination. What started as a defense for users became a factory for precision predators—MEV industrialized.

But evolution didn’t stop at speed or stealth.

It diverged.

Welcome to the age of biodiversity and specialization. Today, we will be focusing on Sandwich bots enabled by flash loans, due to the limit of Substack posts.

Tunnels Spawn New Life

When private tunnels first sealed off Ethereum’s chaotic mempool, many thought the worst was over. Predators would be tamed. Victims would be safer. Order would return.

They were wrong.

Instead, the tunnels created a fertile darkness—an ecosystem where the smartest predators didn’t just survive. They evolved.

In that darkness, new life-forms bloomed. Bigger, stranger, faster. Below, we trace four of the strangest—and most important—life-forms that crawled out of the bundle era.

Leverage Raiders — Flash-Loan-Powered Mega-Fauna

Why settle for what you own when DeFi lets you borrow millions for free? In the bundle era, some predators figured out how to punch far above their weight—not by bringing more money, but by borrowing physics itself. Two landmark attacks charted this evolution.

The Flashswap-Backed Borrower

This wasn’t your typical flash loan. It was something more elegant—and a little sneakier.

On August 3, 2022, the attacker kicked things off with a flashswap on Uniswap V3, pulling out 8.7 million USDC—but with a ticking clock. As with all flashswaps, the borrowed tokens had to be repaid within the same transaction. So how did they turn this short-term loan into a market-moving sandwich?

The trick was composability.

The attacker immediately deposited the 8.7M USDC into Aave, using it as collateral to borrow 4,297 WETH. But Aave requires over-collateralization—you can’t borrow the full value of your deposit. To bridge the gap, the attacker chipped in 1,250 WETH of their own funds, just enough to make the math work and complete the flashswap repayment.

That handled the frontrun.

Then came the backrun. After the victim’s swap was executed—inevitably at a skewed and painful price—the attacker flashswapped 5,572 WETH from the same Uniswap pool. 4,297 WETH was used to repay the Aave loan, reclaim the USDC collateral, and transfer that 8.7M USDC back to settle the original flashswap. The full lending position was opened and closed within a single bundle.

The result? The attacker sandwiched the victim, used the victim's price impact to generate profit, and walked away with no residual debt, no liquidation risk, and no open positions. The only cost was the bridge capital—a temporary 1,250 WETH—to meet Aave’s over-collateral requirement, and a juicy tip to the builder.

This wasn’t a simple frontrun. It was a capital origami trick, folding flashswaps and collateralized lending into a seamless, delta-neutral bundle. Effectively, they built a leveraged sandwich, nearly 4.5x their starting volume thanks to composability.

The Flash-Loan Leviathan

Then came the beast.

On November 30, 2022, a bot orchestrated what may be a watershed moment in sandwich evolution—not because it was the largest, but because it pushed sandwich to its structural and economic limits. The attacker coordinated $154M in assets across four protocols to intercept a whale’s swap on Curve, but the brilliance lies in how they shaped liquidity, not just chased it. The victim’s minimum acceptable return (min_amount) was set at 20,609,403.45 USDC—they received 20,609,422.16 USDC. The difference? Just 18.71 USDC. Yet the attacker walked away with 9,790.17 USDC in profit, extracted by manipulating pool pricing through a pair of precision-timed swaps.

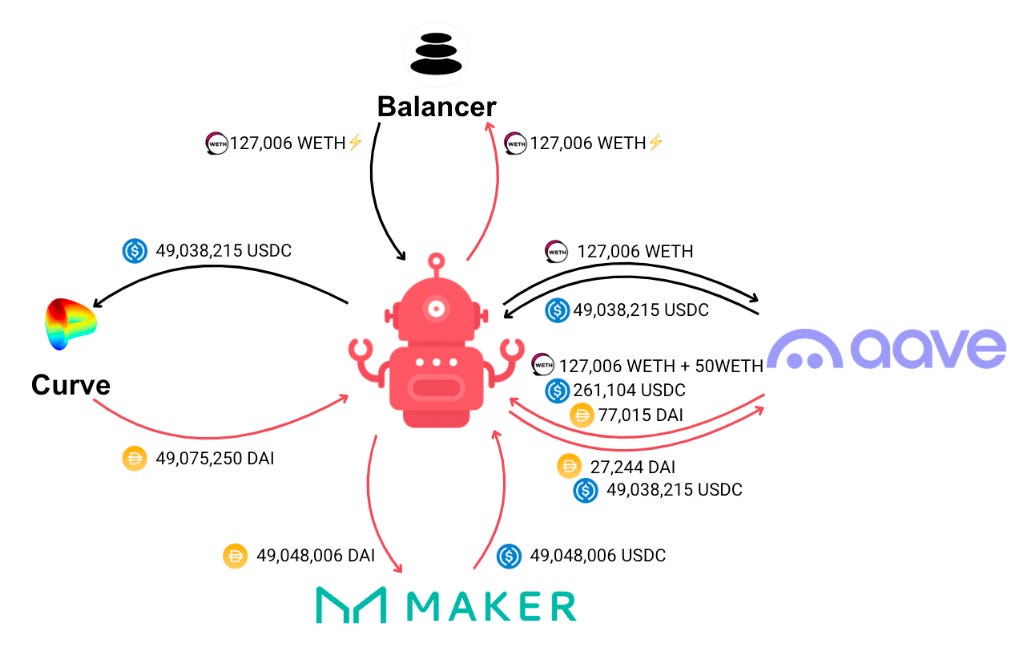

It began with a massive 127,006 WETH flash loan—borrowed in a blink from Balancer.

Armed with some personal funds (≈50 ETH, 77,000 DAI, and 261,000 USDC), the attacker rushed to Aave and posted everything as collateral. This opened the door to borrow a colossal 49 million DAI—the perfect amount to ambush a whale-sized swap on Curve. See the black path in Fig. 4.

Once the DAI was in hand, it was converted via the Curve pool for 49 million USDC. But the attacker didn’t stop there. They then passed this USDC through MakerDAO’s PSM, converting it 1:1 back into DAI—neatly closing the capital loop.

Swapping DAI to USDC on Curve came at a price: slippage. The attacker didn’t get quite enough DAI to fully repay their Aave loan. But it’s enough to withdraw part of the original collateral (127K WETH), and fully repay the Balancer flash loan within the frontrun transaction. See the pink path in Fig. 4.

At this point, Aave’s position was still open, with 27,244 DAI in unpaid debt. But the attacker wasn't done. That was just Act I.

In the backrun transaction, they struck again—this time in reverse.

Once the victim's trade inflated the Curve pool price, the attacker again flash-borrowed 127,006 WETH, re-collateralized it on Aave (alongside existing leftover collateral), and borrowed 49,038,215 USDC. This USDC was now more valuable, thanks to the victim's trade. The attacker swapped it back to DAI on Curve—this time getting 49,075,250 DAI due to favorable price impact.

From this, 27,244 DAI was used to fully close the Aave debt position from the frontrun. The rest? Sent back to MakerDAO for another round-trip conversion into USDC. With this, the attacker cleared the new Aave loan, reclaimed all remaining collateral, and repaid the flash loan once again.

What was left over? Profit, of course. No debt. No exposure. Just an immaculate, cross-protocol, delta-neutral value extraction.

It was a textbook symphony of DeFi composability—Aave, Curve, Maker, Balancer—each touched just enough to do their job, but not enough to realize they were part of a 9-figure ambush.

The following summary captures the attack’s key performance metrics and highlights just how exceptional it was in scope and execution.

Ecological impact. Flash-loan composability turned the size-of-treasury moat into a mirage. Any coder with a weekend and a good sandwich recipe could marshal nine-figure firepower, hit multiple venues, exit delta-neutral and leave nothing but ripples. Capital efficiency became a weapon; the food chain had to adapt—or get swallowed.

The August and November 2022 attacks represent two milestones in the evolution of sandwich strategies.

The first case introduced a leveraged sandwich model, using flashswaps and Aave lending to amplify capital with minimal risk. It was precise, low-capital, and efficient—marking the shift from simple frontruns to structured financial maneuvers.

The second case took this to another level: a $154M cross-protocol operation, combining flashloans, lending, stablecoin conversion, and Curve pricing dynamics. Its goal wasn’t just profit—it was maximum MEV extraction through liquidity control.

What distinguishes these cases is not just their scale, but their strategy: the attacker used DeFi protocols as building blocks to reshape transaction flow, pricing, and risk—inside a single bundle. Together, they signal the rise of a new MEV archetype: the liquidity engineer, not just a searcher.

The next post will showcase the other three sandwich varieties in the age of biodiversity.

Read the first two parts of this series.

The Prehistoric Age of Sandwich MEV Before the Bundle: When Gas Auctions Ruled the Chain

In the hidden lanes of Ethereum’s blockspace, a new kind of creature has evolved—stealthy, adaptive, and precision-engineered for profit. These aren’t just bots. They are financial predators with a genetic lineage shaped by protocol quirks, mempool mechanics, and incentive asymmetries.

The Assembly Lines Era: Bundle-Boosted Beasts Changing the Game Via Private Tunnels

The first part of this series has reviewed the prehistoric age of Sandwich MEV.

You can click this link or open https://bit.ly/hfdefi to download the free ebook Head First DeFi, Decoding the DNA of Crypto Transactions & Strategies. We are adding more intriguing cases in 2024. Let us know if you want to be part of it.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram