Metamorphosis of Jaredfromsubway.eth: cunninger Jared 2.0 with more layers

Evolution of Sandwich MEV Attacks and the Rise of a New Trading Bot

Where is Jared’s Bot?

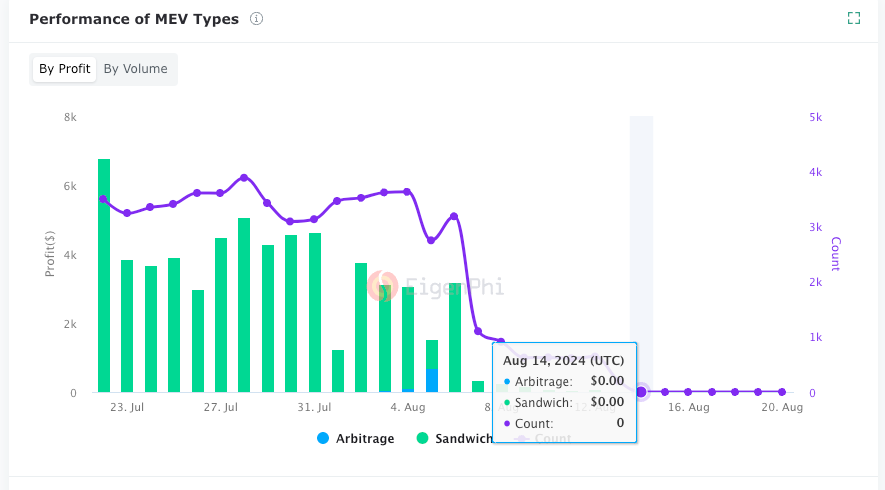

If you’ve been following Jaredfromsubway.eth, the biggest Sandwich MEV Attacker, and one of the top 3 traders on Uniswap behind Wintermute and Beaverbuild, you would know that Jared had been using this contract address — 0x6b75d8af000000e20b7a7ddf000ba900b4009a80 — to make his sandwiches. However, our dashboard showed that the bot’s trading volume and profit have plunged since August 7th and have fallen to zero since the 14th.

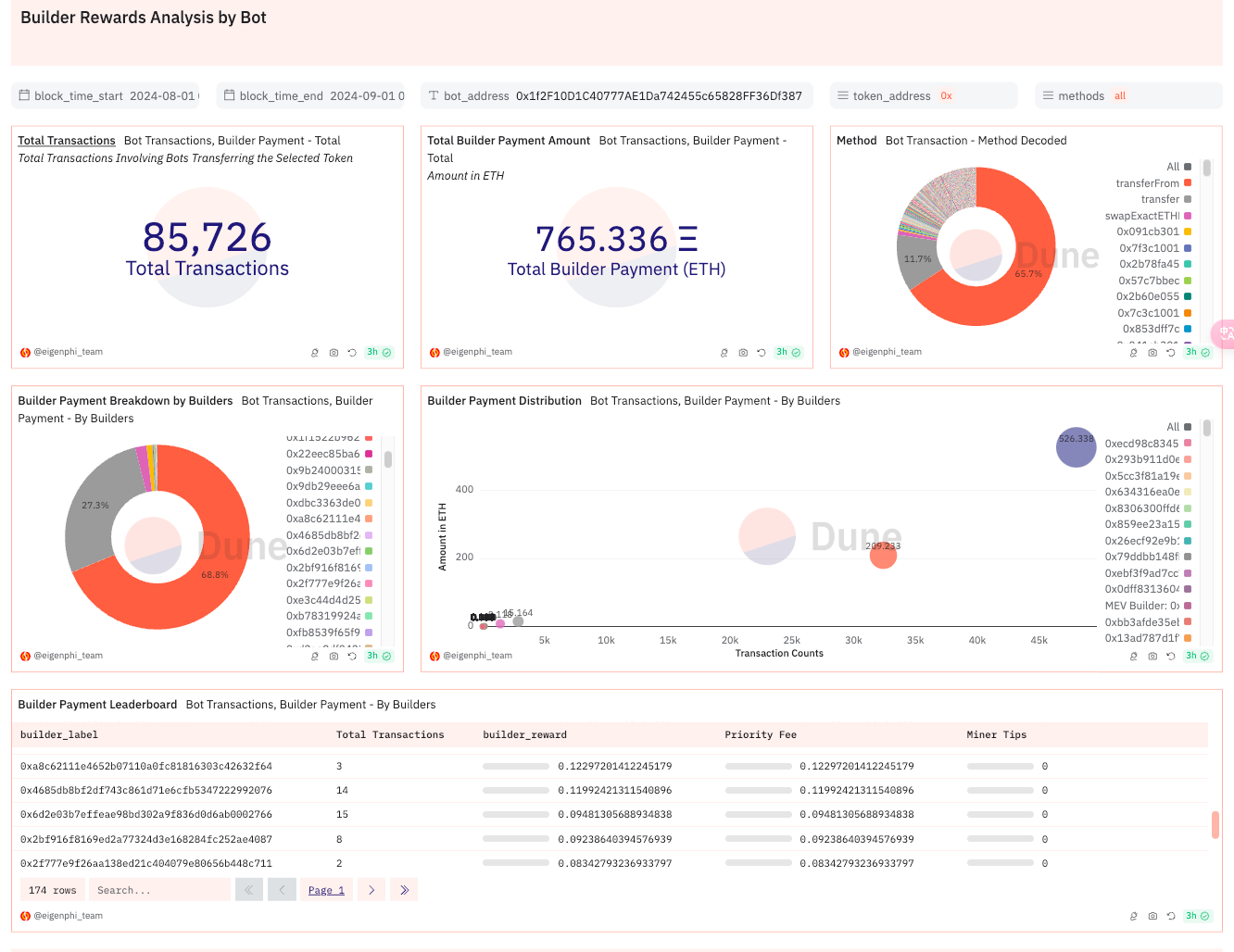

Even though, using our Builder Rewards Analysis by Bot Dune dashboard, you can see that, in 2 weeks starting from Aug 1, this bot has given out 851 ETH, worth $2.2M, using today’s ETH price, as builder rewards via 51,187 transactions.

Among all the builders, beaverbuild received the most rewards, 686 ETH, worth $1.76M via 30K transactions.

Next in line is Titan, who collected 129 ETH, worth $331K, from Jared via 16K transactions.

Our Dune dashboard also shows that of the 51,187 transactions, Jared sent 51,032 via public channels and 155 via private conduits.

With all this being said, it doesn’t mean Jared has stopped making sandwiches. During the past 2 weeks, we have noticed an emerging MEV contract rampaging with all kinds of new on-chain trade squeezing methods.

The new contract — 0x1f2f10d1c40777ae1da742455c65828ff36df387 — was created by the same EOA that produced the old bot. Our sandwich attacker profile shows it has cooked about 40K sandwiches, which generated 765 ETH rewards for the builders, with beaverbuild receiving 526 ETH and Titan 209 ETH.

New Bot, New Recipes, New Flavors

The new bot has upped his game with new tricks. Take the 5-layer sandwich, shown in the image below, as an example.

In the front piece transaction, at Pos 2 of Block 20540857, the bot swapped 194,132.885 USDT for 73.8917 WETH, raising the exchange of USDT/WETH in the Uniswap V3 pool.

In victim TX 1 at Pos 3 of the same block, the first victim suffered a loss by swapping USDT for WETH in the Uniswap V3 pool with a higher rate.

In the centerpiece transaction at Pos 4, the bot swapped 289,109.1702 USDT for 108.9744 WETH, raising the rate again.

The user in victim TX 2 got ripped off again with an even higher price.

In the end, the bot swapped all 182.8662 WETH received in both the front piece and the centerpiece transactions for 483,301.2534 USDT, resulting in a revenue of 59.1982 USDT.

You may have noticed that the bot swapped 5856.673 USDT for 2.2375 WETH. We have no proof that this exchange is related to the sandwich. However, according to Sorella Labs, this could be part of a CEX-DEX arbitrage, indicating Jared's more advanced trading strategies.

The above example is only the tip of the iceberg. Jared 2.0 would use adding liquidity transactions as the front piece and/or the centerpiece and removing liquidity transactions as the back piece. The combination can be various, putting several transactions in between, becoming sandwich attack victims.

The following image illustrates a 7-layer sandwich following a similar pattern, only having more victims.

The next image appears to follow the same pattern as the previous one. However, the 3 attack transactions are different beasts.

The front piece adds liquidity to the Uniswap V3 pool for USDT/WETH.

The centerpiece adds and removes liquidity in the same pool.

The back piece removes liquidity from the pool.

Jared’s new tricks disrupt our PnL calculation of sandwiches, and we are working on revision. Meanwhile, please check out our latest dashboard on builder rewards analyses.

Want to learn more about Jared 1.0? Visit our Head First of DeFi to decode the DNA of DeFi Transactions & Strategies.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram