MEV Myth Buster #4: No Trade is Too Small To Be Exploited

Jared 2.0 Steps Up Its Sandwich-Making on Low-Margin, High-Frequency, Hyper-Optimized Execution.

🦄 Myth

Small Fish Swaps Are Not on the Radar of Sandwich Attackers.

Many of you must have heard of jaredfromsubway.eth, the most notorious Sandwich chef who has been the top 1 gas spender.

Most users assume that sandwich bots like Jared go after big trades—whale-size swaps with big slippage.

But Jared 2.0 proves that no trade is too small to be exploited.

🧠 What Happened

In Block 18563314, Jared 2.0 chained six transactions into three overlapping sandwiches of two types, recycling a victim’s and its own liquidity to front-run and back-run everyday swaps—proof that penny-sized attacks scale.

🔬Microstructure

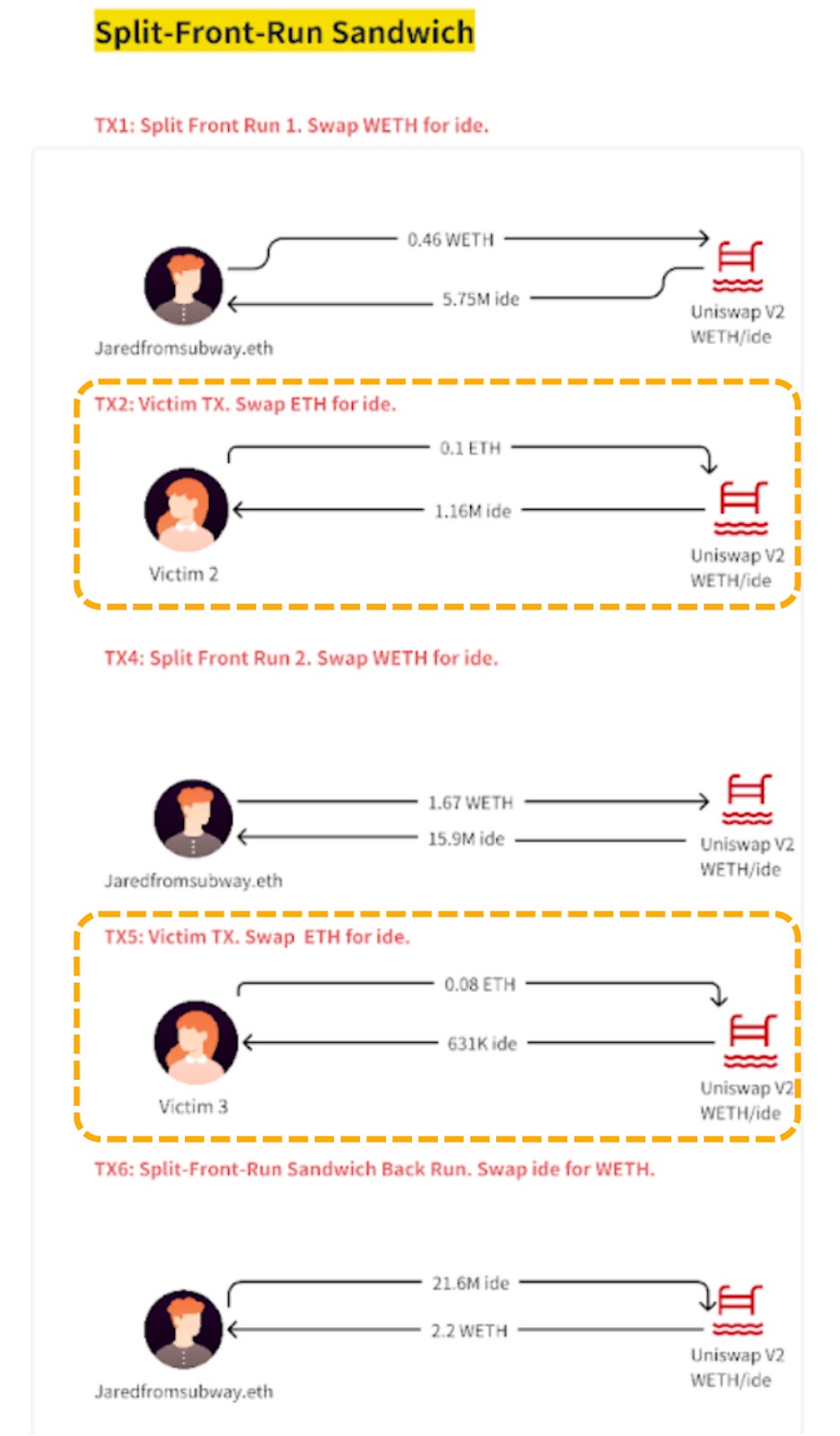

Look at this Split-Front-Run Sandwich with two victims, which essentially makes it two sandwiches:

TX 1, TX2, and TX6.

TX 4, TX5, and TX6.

The first victim in TX2 swapped 0.1 ETH, and the second victim in TX5 swapped 0.08 ETH. They were both preyed on by Jared 2.0.

The second type of Sandwich, Swap-JIT Sandwich starts with a Just-In-Time liquidity provision—or JIT.

Now, let's look at how these sandwiches happened.

🧬 Key Steps Breakdown

Split-Front-Run Sandwich Combo

Both victims in TX2 and TX5 wanted to swap ETH for ide.

Upon detecting such intents, Jared pushed up the rate in TX1 by using steps 1 & 2, shown in the chart. This made TX1 the frontrun of Sandwich TX1-TX2-TX6.

In TX4, Jared swapped WETH for ide with steps 1 & 2 too, enabling this transaction to be the frontrun of Sandwich TX4-TX5-TX6.

In TX6, Jared traded ide back to WETH, finishing as the backrun for two simple sandwiches.

Such a strategy has three effects:

Reduce gas overhead and capital lock-up.

Extract maximum value.

Lower cost to frontrun the 2nd victim in TX5 by using TX2 to push up the price.

Swap-JIT Sandwich

This sandwich comprises TX1, TX3, and TX4.

In TX1, Jared added ETH/GROK liquidity to a Uniswap V3 pool, then immediately swapped GROK for ETH. This shifted the pool price—the frontrun.

The victim’s swap of GROK for WETH happened in the same pool, but now at a much worse rate.

In TX4, Jared removed the liquidity added in TX1 and finished the backrun of the sandwich.

Jared replaces the usual back-run swap with add/remove liquidity operations, resulting:

Cheaper execution: avoiding swap fees and reducing slippage cost.

Profitable tactic of sandwiching smaller trades.

To summarize, Jared reused several transactions to finish his strategy.

Parts of TX1 and TX4 were used in the Split-Front-Run combo.

Parts of TX1 and TX4 were used in the Swap-JIT sandwich.

TX6 was reused as the backrun for both sandwiches in the Split-Front-Run combo.

Being a victim, TX2 was also reused as part of the strategy to raise the price of WETH against ide.

🧑🤝🧑Key Entities

Bot 6b75 is the newest sandwich bot used by Jaredfromsubway.eth.

🔁 Not a Fluke

Despite all this sophistication, Jared averages just 20 cents profit per sandwich. But by reducing costs and increasing throughput, it can run hundreds or thousands of these per day.

At its peak, 87% of all sandwich attacks came from Jared 2.0.

⚠️ Your Takeaway

Jared 2.0 attacks hundreds or thousands of user trades daily by reducing costs and increasing throughput.

Sandwiching is no longer just targeting fat-margin whale trades. It’s about low-margin, high-frequency, hyper-optimized execution.

Read the previous MEV Myth Busters.

You can click this link or open https://bit.ly/hfdefi to download the free ebook Head First DeFi, Decoding the DNA of Crypto Transactions & Strategies. We are adding more intriguing cases in 2024. Let us know if you want to be part of it.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram