The Unseen Bidding War That is Happening Every Second

Decoding the Fierce Competition Behind Ethereum's Block Creation

The Unseen Bidding War Series:

On Ethereum, the unseen bidding war for block creation is fierce and relentless. This process, rooted in the Proposer-Builder Separation (PBS) mechanism, is where builders like Titan compete to win blocks by submitting the highest bids. PBS allows proposers to auction off the right to build a block, leading to a competitive bidding environment. However, this has also led to concerns about centralization, as dominant builders can monopolize the bidding process. The nature of this bidding war is intricate, involving precise timing, high-frequency transactions, and strategic placement of bids. Titan's success in this arena highlights the critical importance of understanding these hidden dynamics. At the same time, the high-frequency bidding environment of PBS creates significant barriers to entry for smaller builders, discouraging innovation and participation.

This article's goal is to uncover the sophisticated tactics that enable builders like Titan to consistently secure blocks by analyzing bidding data and strategies. It will also offer insights into the competitive mechanisms driving the blockchain ecosystem.

Data Scope

Our data primarily comes from 2 sources.

Block data: we use the mevboost-data project from @Data_Always.

Bidding data: the only public bid data we can get is from Eden’s MEV-Boost Bids.

Builder labels have 2 sources: the mevboost-data project from @Data_Always, and the MEV-Boost Decomposition presentation during the 2024 TLDR DeFi Research conference.

Due to the huge data size of bids, we only selected 921 blocks won by Titan, one of the biggest neutral block builders. From these 921 blocks, Titan received 213 ETH from parties sending all kinds of transactions.

Block range: 921 blocks between 19433573 ~ 19440930

Time range: 2024-03-14 13:34:23 UTC ~ 2024-03-15 14:25:47 UTC

Number of biddings of these 921 blocks: 1,698,090

Number of builders involved during the period: 27

Now, let’s look at how these 1.7 million biddings played out.

30,000-foot Birdview of Bidding Patterns on Block Building

This chart shows the bidding data, focusing on transaction counts of each bidding, from 27 builders regarding the 921 blocks won by Titan.

In a count-down manner, the X-axis represents the time difference (ts_diff) in seconds, showing when bids are placed relative to the block creation time, which will be presented as T in the 12-second slot. Negative values indicate bids placed after T, and positive values indicate bids placed before T.

The Y-axis represents the number of transactions in each bid, indicating the volume of transactions builders include in their bids, ranging from 0 to over 600.

Here are the key observations from the chart.

Before T, there are 3 obvious times seeing more bids coming:

8 seconds to T, with most bids having transaction numbers lower than 100.

4 seconds to T, with most bids having transaction numbers lower than 200.

3 seconds to T, with most bids having transaction numbers lower than 400.

High Concentration of Bids During the 6 Seconds Around T.

There is a significant concentration of bids within the range of 3 seconds before T and even more within the 3 seconds after T.

This indicates that most builders focus their bidding efforts close to the block creation time and compete during the Timing Games to maximize their chances of winning. These builders try to place their bids as late as possible to maximize their chances of winning the block with the most up-to-date transactions possibly carrying more value.

Dense Clusters of High Transaction Counts.

Dense clusters of bids with transaction counts between 200 and 500 are observed, suggesting that high transaction volumes are a common strategy among builders.

The highest density of bids is seen around T to T+2 seconds, highlighting the critical time window for placing high transaction count bids.

The focus on strategic, resource-intensive bidding close to block creation time may lead to over-optimization, diverting resources from network development and security.

Early and Late Bidding Patterns:

While most of the bids are concentrated close to T, there are also clusters of bids from T+5 to T+10 seconds, indicating that some builders place bids too late.

However, some builders start bidding as early as T-10, employing too-early bidding strategies.

Strategies that are either too early or too late have lower chances of winning.

Scattered Low Transaction Bids:

There are scattered bids with lower transaction counts (below 100) spread throughout the range, which may be part of a strategy to maintain a presence without committing significant resources.

We can’t fully grasp the bidding overview without looking at the bidding values shown in the chart below.

The key findings are:

Most bids fall within the lower value range: 0 - 2 ETH, showing a high density of lower-value bids, especially close to block time.

There are noticeable clusters in the moderate range of 2 - 6 ETH, particularly around T-1 to T+4 seconds.

Fewer but significant high-value bids, 6 - 12+ ETH, especially the majority of high-value bids, over 12 ETH, happen around T to T+ 4 seconds, indicating strategic high-stakes bidding from Timing Game players during critical moments.

Early bids, before T-3, and late bids, after T+3, generally have lower values, typically below 2 ETH.

In conclusion, aggressive late bidding with high transaction volumes is a common approach. It gives block builders the advantage of high bid values, eventually making them winners of the bidding war. However, it also creates some level of economic inefficiencies. But you can’t blame the players.

Now, it’s time to put specific builders into the picture.

The Colorful Picture of Different Players in the Auction House

First, the analysis puts emphasis on the top 3 builders: Beaverbuild, Rsync, and Titan.

Some builders, without known labels, are marked with FAILED_BUILDER and the first 8 hex digits of their pubkeys.

Please be advised that there are builder imposters categorized under the same label: imposter.

The label “default key,” marked in the data from the MEV-Boost Decomposition presentation, indicates that there are 2 keys either as default keys in mev-boost or as being used by many builders or imposters.

Titan (blue)

Transaction Count Range: Titan’s bids range from 0 to over 600 transactions.

Bid Timing: Titan places bids from 3 seconds before the block creation time to approximately T+12 seconds.

Bid Clusters: Titan shows a dense cluster of bids from T+1 to T+4 seconds, with the highest concentration of bids between 200 and 500 transactions.

Insights: Titan employs a highly aggressive strategy, focusing on placing a high volume of transactions close to T. This strategy maximizes their chances by frequently updating bids and adapting quickly to market conditions. The broad range of transaction counts indicates flexibility and responsiveness to competitive pressures.

We will have more details on Titan later.

Beaverbuild (orange)

Transaction Count Range: Beaverbuild’s bids typically range from 0 to 400 transactions.

Bid Timing: Bids from beaverbuild start around T. A few scenarios extend to approximately T+12 seconds.

Bid Clusters: Dense clusters of bids are seen from T+1 to T+4 seconds, with a significant number of bids in the 100 to 300 transaction range.

Insights: Beaverbuild focuses on maintaining a competitive edge within the crucial few seconds after T, similar to Titan but with slightly fewer transactions.

rsync (green)

Transaction Count Range: rsync’s bids range from 0 to 400 transactions.

Bid Timing: Rsync-builder places bids from around T to approximately T+10 seconds.

Bid Clusters: There are dense bids from T+1 to T+4 seconds, with transactions between 100 and 300.

Insights: Rsync-builder follows a strategy similar to beaverbuild, focusing heavily on the few seconds after T with moderate transaction volumes.

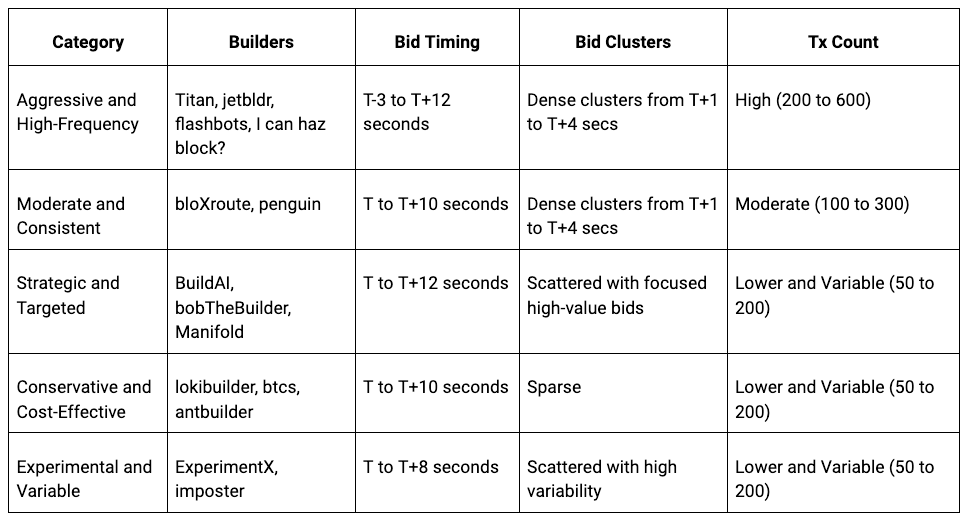

The table below summarizes the rest of the builders’ bidding strategies.

Now, we can color the bidding value points with the matching builders, giving us the builder bid value distribution as below. Please remember that these are the blocks won by Titan, meaning the data is biased on Titan bidding high with more order flows.

We summarize the bid value distribution of the top 3 builders in the table below.

The other builders can be put into categories as below:

How did Titan, among all builders, win these 921 blocks? The following charts focusing on Titan reveal its secrets.

Titan's Strategic Bidding: Analyzing 524,295 Bids to Win 921 Blocks

Of the 1.7 million bids, Titan submits 524,295.

This chart shows the relationship between bid transaction counts and block production time T concerning Titan. The red dots indicate the on-chain bids.

Here are key observations:

For the on-chain bids:

On-chain bids are mostly concentrated between 100 and 300 transactions, with a significant cluster of around 200 transactions. The timing is mostly from T-1 to T+1, as the following chart shows.

The presence of on-chain bids within the high-density bid area suggests that these bids are critical and strategically placed during the most competitive moments.

3 seconds before T is when Titan starts bidding, and the process usually dials down around T+3. This period is when the majority of high transaction count bids are submitted.

There is a significant concentration of bids with transaction counts between 200 and 400,

Less frequent but noticeable peaks in transaction counts, reaching over 600, can be observed. These peaks likely represent high-stakes bids intended to secure block production.

Again, the next chart’s data is biased toward Titan since it only shows the bids of the blocks won by Titan. The values of the on-chain bids are shown as red dots.

We walk through the on-chain bids first.

For the on-chain bids:

The majority are low-value bids, 0 - 2 ETH. Moderate-value bids, 2 - 6 ETH, are less frequent and scattered rather than clustered. High-value on-chain bids, 6 - 12+ ETH, are rare but present.

On-chain bids are concentrated close to the block creation time, especially from 0 to T+1.

The findings regarding on-chain bids can be applied to all bids from Titan. It’s worth noting that few bids landed on-chain after T+3.

As a result of the half million bids, Titan won 921 blocks. Let’s see what we can find from them.

A Deep Dive Into the 921 Blocks

This diagram displays Titan's winning blocks distribution based on the timing (ts_diff in seconds) of their winning bids for the 921 blocks.

Here are the key observations and insights:

1-Second Peak Window of Winning Blocks Close to T:

The chart shows a clear peak window in the number of blocks won by Titan around the block creation time: T to T+1 seconds. The number of blocks won drops sharply as we move away from this period.

The highest number of blocks won occurs just before T, between T and T+0.1 seconds, with the peak reaching over 80 blocks.

Asymmetry in Timing: The distribution is asymmetric around T, suggesting the effect of the Timing Games.

Sparser Wins After T+1: There are fewer winning blocks after T+1, indicating that winning bids placed after this time are less common and less successful.

Very Early and Very Late Bids: The chart shows few winning blocks for bids placed significantly earlier (before T-2) or later (beyond T+2) relative to the block time. This emphasizes that bids placed too early or too late are generally unsuccessful.

Next, let’s dive into the transaction counts of these blocks. The next chart shows the average (avg_num_tx, red bars) and the median (med_num_tx, blue bars) transaction counts for each time interval.

In most intervals, the average and median transaction counts are close to each other, indicating a relatively symmetric distribution of transaction counts in winning blocks.

The few intervals where the average significantly exceeds the median suggest the presence of some outlier blocks with very high transaction counts.

The transaction counts tend to be lower in the intervals before T-1, suggesting that bids placed are generally less successful or involve fewer transactions.

The last chart of this post examines Titan’s average and median bid values during T-3 and T+3.

We can see from the chart that:

Overall, the average bid values tend to be higher than the median bid values, indicating the presence of higher-value outlier bids that raise the average. However, there are many intervals, and the median bid values are close to the average, indicating a relatively symmetric distribution of bid values.

The average bid values peak significantly at specific time intervals, particularly around T-2 to T-2.1 seconds and T+1.9 to T+2. These peaks indicate that Titan places higher-value bids to secure critical blocks at these intervals.

In the end, let’s summarize this behind-the-scene bidding war.

Strategic Dynamics of the Ethereum Bidding War

We look at three aspects of the battle.

Critical Timing Window: The highest concentration of bids occurs within a few seconds before and after the block creation time (T), particularly from T-3 to T+3 seconds. This indicates that builders strategically place their bids close to the block creation time to maximize their chances of winning with the most current and relevant transaction data. The emphasis on precise bid timing in PBS, especially the Timing Games, gives builders an advantage with better infrastructure, increasing the risk of centralization.

High Transaction Volume: Builders frequently submit bids with high transaction counts, often ranging from 200 to 600 transactions. This strategy suggests that including more transactions in a bid increases the chances of winning by offering higher potential rewards from transaction fees and MEV (Miner Extractable Value).

Variable Bid Values: The bid values are distributed across a wide range, with most bids falling within the lower value range of 0-2 ETH. However, there are noticeable clusters of moderate (2-6 ETH) and high-value bids (6-12+ ETH), especially during critical moments close to the block creation time. This indicates a mix of conservative and aggressive bidding strategies among different builders.

Titan's Winning Strategies and Tactics

There are 3 outstanding characteristics of Titan’s way of block-building.

Aggressive and Dominant Presence: Titan submitted 524,295 bids out of 1.7 million, highlighting its aggressive strategy to dominate the bidding landscape. This large number of bids indicates a commitment to maintaining a competitive edge by frequently participating in the bidding process.

Strategic On-Chain Bidding: Titan strategically places on-chain bids within the critical time window, with a significant concentration close to the block creation time (0 to T+1 seconds). These bids are primarily low value (0-2 ETH), ensuring continuous presence while occasionally placing higher-value bids (6-12+ ETH) to secure critical blocks during competitive moments.

High Transaction Count Bids: Titan's winning bids often include high transaction counts, especially within the critical window from T-3 to T+3 seconds. The dense clusters of bids with 200 to 500 transactions indicate a strategy focused on maximizing transaction volume to increase the likelihood of winning blocks and capturing higher rewards from transaction fees and MEV.

Let’s Improve the Game

The Proposer-Builder Separation (PBS) mechanism, while designed to create a competitive bidding environment for block creation, has inadvertently triggered an intense and relentless bidding war among builders like Titan. Though this system fosters competition, it has led to centralization concerns, with dominant builders monopolizing the process. The intricate nature of this bidding war, involving precise timing, high-frequency transactions, and strategic bid placements, highlights the need for better data and design improvements.

To facilitate a healthier and more robust ecosystem, it is crucial to address the barriers to entry for smaller builders and mitigate the economic inefficiencies caused by aggressive bidding strategies. Ensuring transparency and fairness in the bidding process and reducing vulnerabilities from timing games are essential steps towards achieving this goal. By collecting and analyzing comprehensive bidding data, Ethereum can refine its PBS mechanism, promoting a more decentralized and competitive environment that benefits the entire community.

The The Unseen Bidding War Series:

Visit DeFi Strategies Case Studies by EigenPhi or bit.ly/head-first-defi to learn more trading tactic analyses.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram

Differences in metrics around T and away from T can perhaps be better explained by selection bias. If a block is selected away from T, it is likely because the block was an outlier with more MEV. (Note that number of blocks selected in these zones is less, which is easy to forget in average and median plots.) This reflects in the last plot of value v/s time. In the last plot's discussion,

"The average bid values peak significantly at specific time intervals, particularly around T-2 to T-2.1 seconds and T+1.9 to T+2. These peaks indicate that Titan places higher-value bids to secure critical blocks at these intervals."

I think selection bias explains the peaks (away from T) better than the builder bidding higher out of desperation to get a block included.