The Unseen Bidding War: Rsync’s Strategic Maneuvers

Analyzing Adaptive Strategies of the Builder Behind Wintermute

The The Unseen Bidding War Series:

Let’s delve into the intriguing world of Rsync’s bidding on the 921 blocks won by Titan in March 2024. With its integration with Wintermute, a well-known fact, Rsync submitted 52,985 bids to relays, roughly 1/10 of Titan’s 524,295 bids and BeaverBuild’s 546,621 records. This unique behavior could be attributed to Rsync's stable high-value order flow, a key aspect of its integration with Wintermute.

Concentration of Transactions: Most of Rsync's bids cluster between 200 and 400 transactions per block.

Timing of Bids: Rsync's bids are mostly concentrated from T-0.5 to T+2 seconds relative to the block creation time (T).

When we compare Titan and Rsync data, a clear pattern emerges. Initially, Titan had a lead, submitting bids 2.5 seconds earlier than Rsync. However, the situation has since evolved, a trend we will explore later. Additionally, Titan's bids span a wider range of transaction counts, from 100 to 400, indicating a more diverse approach.

In the diagram below, let’s look at the gas_used of bids from Rsync.

Most of Rsync's bids use between 10M and 20M gas units, with a peak of around 15M to 20M. In contrast, Titan’s bids cover a significantly broader range, including 20M to 30M gas units, as shown below.

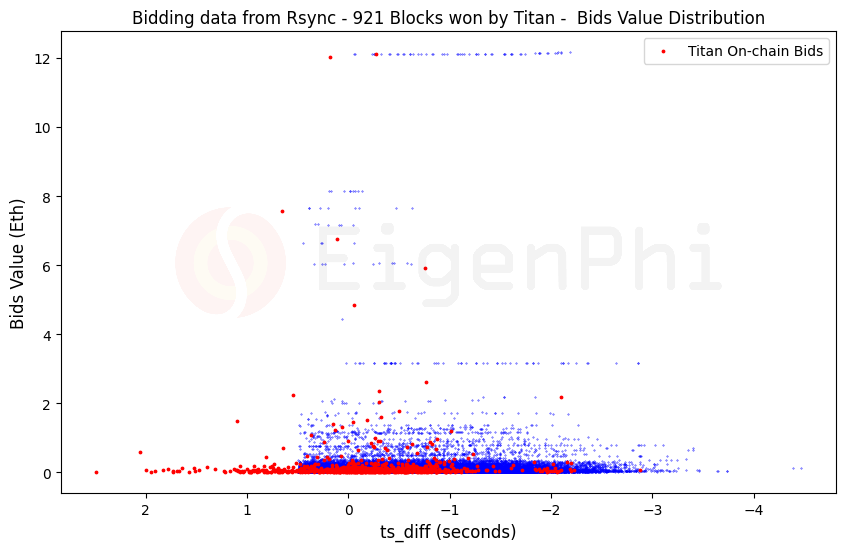

The total number of Rsync’s bids is only one-tenth of Titan’s and BeaverBuild’s, therefore its bid value distribution is much sparser than the other two, highlighting the unique nature of Rsync's data.

The majority of Rsync's bids are low in value, predominantly falling between 0 and 2 ETH.

High-value bids (above 4 ETH) are rare. The few instances of bids between 4 and 8 ETH are spread out and not clustered.

However, a notable outlier at 12 ETH represents an aggressive bid but is an exception rather than the norm for Rsync.

If you overlay Titan’s bid value with Rsync, the latter is hardly seen, while the former’s spread shows more variety.

We mentioned in the last post that we now have the latest bid data, thanks to the team of flashbots. Let’s examine how Rsync adapts to the new context.

The biggest change is the timing of bids.

Before: Bids were spread across a broader time range, from T to T+4 seconds, with higher-value bids spread evenly within this range.

Now: The timing of bids is more clustered towards the block creation time, specifically from T-4 to T+0.5 seconds. This indicates a strategy shift towards concentrating bids closer to the block creation time.

This change indicates that the tactics of The Timing Game have evolved, which can be found in Titan and BeaverBuild’s timings as well.

Here are the key elements of Rsync's Bidding Strategy:

Transaction Concentration: Rsync’s bids cluster between 200 and 400 transactions per block.

Bid Timing: In the past, most bids occurred from T-0.5 to T+2 seconds, initially lagging 2.5 seconds behind Titan. Recent data shows Rsync’s bid timing is now clustered closer to T, from T-4 to T+0.5 seconds, similar to Titan and BeaverBuild.

Gas Usage: Bids use between 10M and 20M gas units, peaking at 15M-20M, compared to Titan’s broader 20M-30M range.

Bid Value Distribution: Bids are sparse, mostly 0-2 ETH, with rare high-value bids up to 12 ETH.

Now, we’ve done the general bidding analysis, specifically on BeaverBuild, Titan, and Rsync, and we have examined how their tactics evolved during the past 3 months to remain competitive in the bidding war. These changes highlight their adaptive strategies, emphasizing the dynamic nature of the block-building landscape in the PBS era.

Please feel free to leave a comment about the data dimensions you are interested in.

The The Unseen Bidding War Series:

Visit DeFi Strategies Case Studies by EigenPhi or bit.ly/head-first-defi to learn more trading tactic analyses.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram