274 Transactions, One Strategy: How This Searcher-Builder Seized 4 of 6 Consecutive Blocks with a 6-Token Arbitrage

in 48 seconds, no user, other than Yoink, can get their trades on-chain.

Our last post proved that the notorious MEV Frontrunner Yoink and Builder “I can haz block?” belong to the same entity. Now it’s time to see how this search-builder integration works in the block and the detrimental effect of it.

This chart shows that August is the highest-earning month for Builder “I can haz block?” among the last 12 months, based on our Builder Performance Analysis Dune dashboard, pocketing $3.8M miner tips.

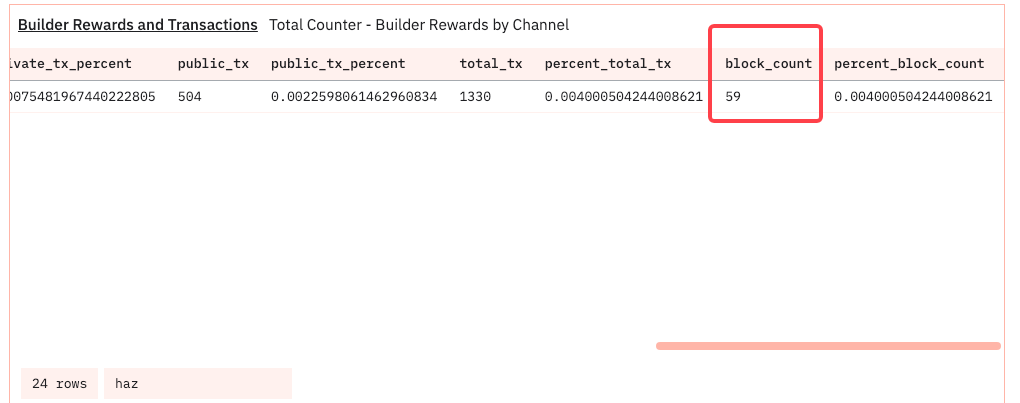

The dashboard also shows the Builder “I can haz block?” only produced 59 blocks in Aug.

Reaping $3.8M on 59 blocks, that’s $64.4K per block. What kinds of transactions would give such lucrative margins? We need to dig into the blocks.

We have the builder’s address, 0x229b8325bb9Ac04602898B7e8989998710235d5f, from our last post. When we opened the related Etherscan page, we found that Builder “I can haz block?” produced 4 out of 6 consecutive blocks on August 27.

In the image above, each block has two rows: one for the builder's payment to a validator and the other for the builder's transfer of assets to Yonik’s MEV Bot 0x689.

Starting from Block 20622179, a rarely-seen scenario is unveiled.

This block has 78 transactions, 74 of which are arbitrages from Yonik’s MEV bot 0x689, occupying Pos 0 to 73.

Open the other blocks, and you can find the familiar astounding scene.

In Block 20622181, Bot 0x689 takes the top 74 positions of the 84 transactions.

The top 74 positions of the 80 transactions in Block 20622183 belong to Bot 0x689.

Block 20622184 only has 50 transactions, 42 occupied by Yoink’s Bot.

Here is a scary fact: in these four blocks, only 28 transactions from users other than Yoink were allowed, meaning this searcher-builder took 90% of the block space, while all the others, whoever you are, lost the opportunity of putting your trades on-chain in the 48 seconds of the four slots.

Observe, and you can tell that all these 264 transactions in the four blocks were doing the same 6-token arbitrage while following the pattern shown in the figure.

Bot 0x689 takes advantage of the price discrepancies between Tetraguard and Uniswap V2 pools and sends earnings to Builder “I can haz block?” as the miner tips.

Now, let’s pause for a second. Builder “I can haz block?” only packed 59 blocks, about 0.4% of the total blocks produced in August. What are the chances that it won 4 out of 6 successive blocks?

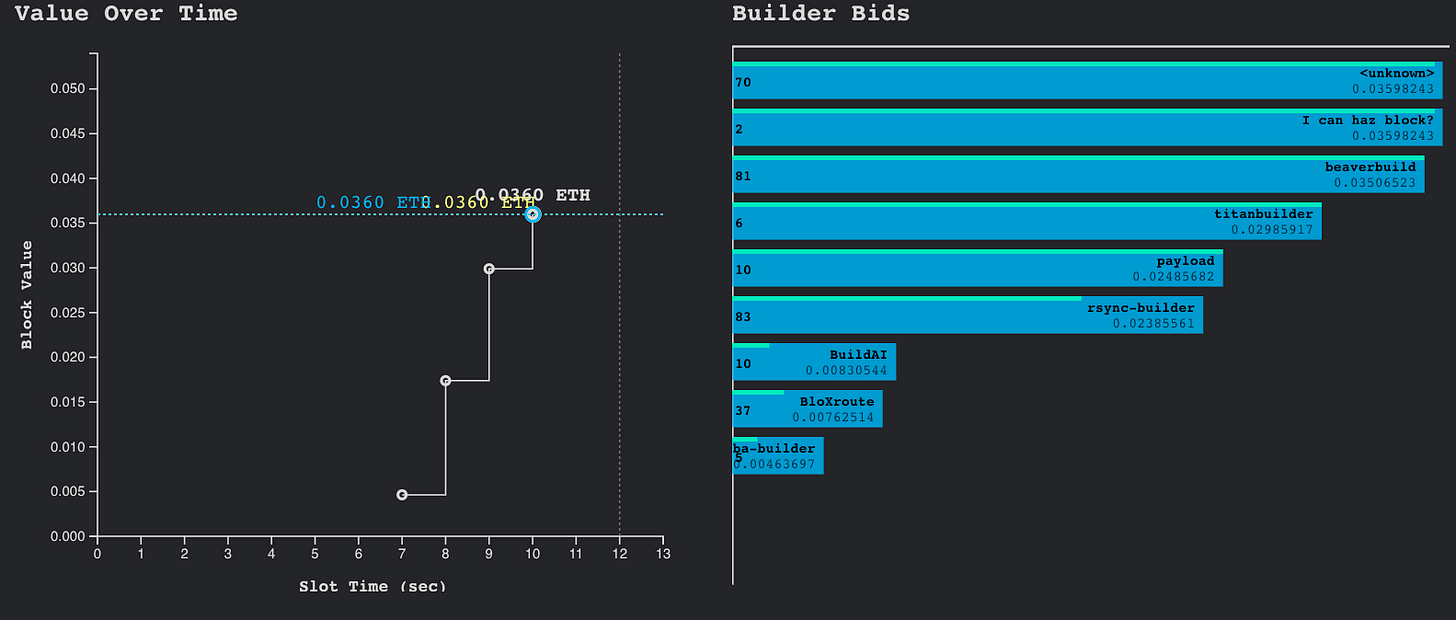

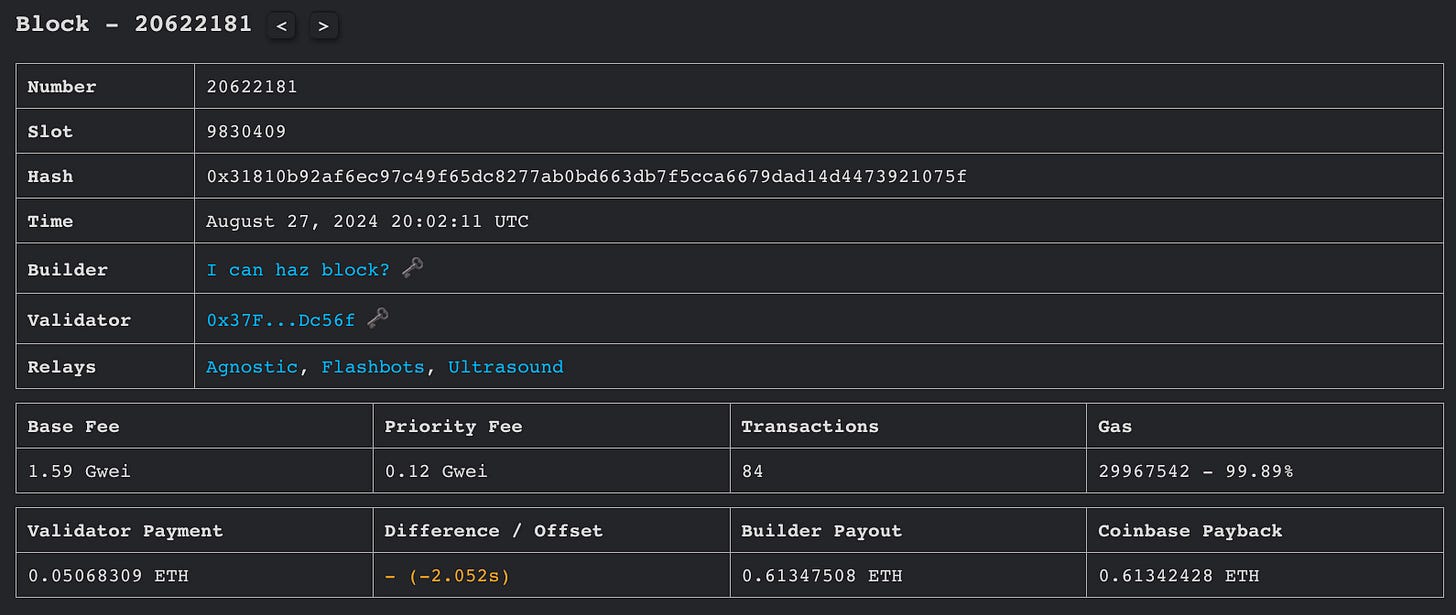

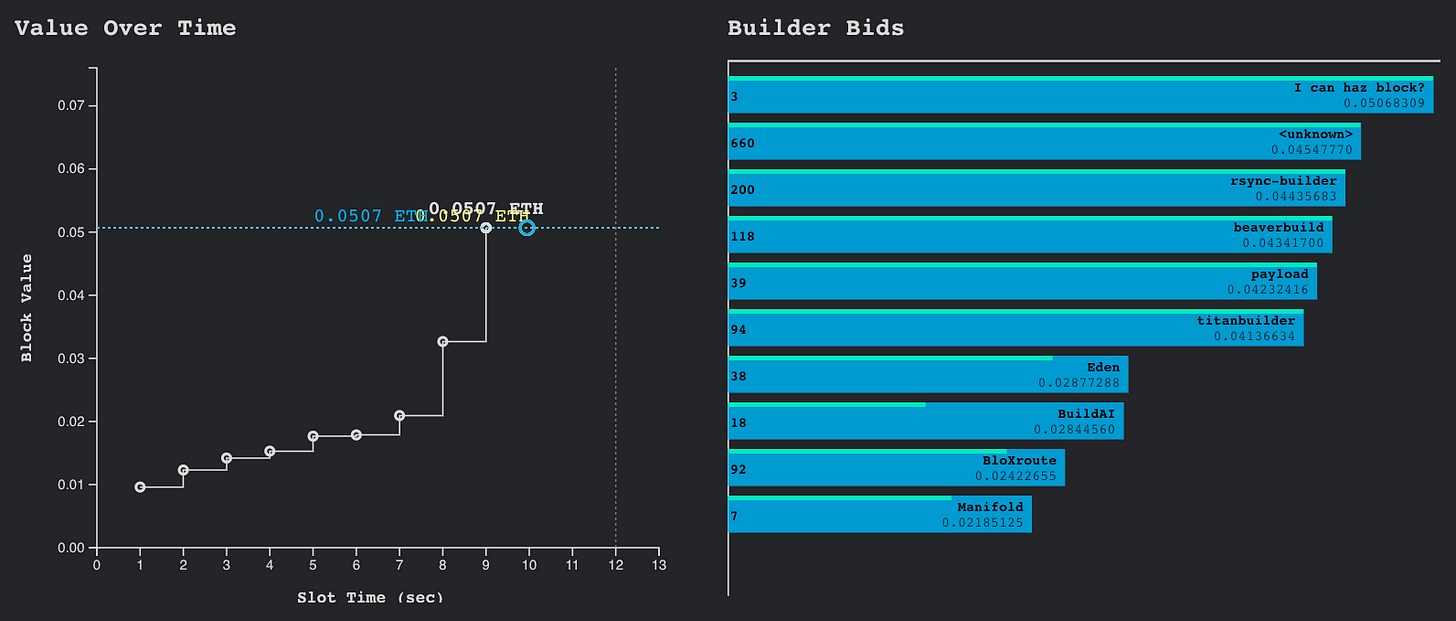

If you visit the pages for these blocks on payload.de, they do show that Builder “I can haz block?”’s bids are relatively high, but not all the highest, as shown below.

Each block has 2 images: the first one displays the block's general info, and the second one shows the bids; the blue line indicates the winning builder submission written to the blockchain, and the yellow number is the best bid submission for the slot.

There are some disparities on Payload.de’s pages. Feel free to leave your thoughts as comments on why these happened.

Block 20622179 on Payload.de. It’s inconsistent that the winner in the first image identified as “I can haz block?”, yet the bids chart displays “unknown.”

Block 20622181 on Payload.de correctly indicates who won the bidding war.

Block 20622183 on Payload.de. The bid champion is again recognized as “unknown,” although the builder is marked as “I can haz block?”.

Block: 20622184 on Payload.de. This page does not show who won the bidding war other than presenting the builder as “I can haz block?”

Yoink was productive on building blocks on August 27. However, the outcome is only 5.84 ETH, much lower than what they earned from August 2nd to August 6th, during which they raked 1,456 ETH, worth over $3.6M.

In which way did Yoink and “I can haz block?” put such a fortune into their pockets? Stay tuned for the last part of this trilogy.

However, the detrimental effect of this searcher-builder’s strategy is clear: it pushes retail users out of the way. By dominating block space with high-frequency, large-scale arbitrage transactions, they capture lucrative opportunities before everyday users can. This results in increased gas fees, crowded transaction pools, and fewer chances for retail traders to execute their trades at favorable prices. The monopolization of block production by entities like this creates an uneven playing field, leaving smaller participants at a disadvantage and driving further centralization of power in the blockchain ecosystem.

Read the first part of this series.

Searcher-Builder Integration Revealed: Builder “I can haz block?” , a.k.a. Frontrunner Yoink, snagged $3.8M Miner Tips in August

Recent on-chain activity has unveiled a compelling case of MEV extraction optimization. It blurs the lines between MEV bots and block builders and illustrates the potential damages for Ethereum users because of this searcher-builder integration while earning $3.8M for the entity behind it.

Visit our Head First of DeFi to decode the DNA of DeFi Transactions & Strategies to learn more about the DeFi Lego.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram