Week 17-18 Highlight: Incoming All Star MEV Dinner, unveiling Jaredfromsubway.eth, and squeezing CoW!

This Bi-Weekly Digest highlights the upcoming MEV Diner Event, Research about Jared, and Sandwich MEV’s Impact on CoW Swap.

1. ALL STARS MEV DINNER: Pioneering the Future of MEV in DeFi

Join bloXroute Labs and EigenPhi on Saturday, May 20, at ETHDam for the exclusive "MEV Dinner Talk" Hosted at Delirium Cafe in Amsterdam; the event promises a dynamic mingling and knowledge-sharing platform for MEV and DeFi trading enthusiasts.

We're excited to present Mars Cheng, EigenPhi's CEO, and Founder, as a keynote speaker. Before spearheading EigenPhi, Mars was instrumental in creating crypto trading systems at Huobi, serving millions of users as their CTO.

In his much-anticipated talk, "LSD MEV: Charting the Course Post-Shapella," Mars will delve into various intriguing subjects. The key highlights include the prospects for LSD token holders post-Shanghai upgrade, the impact of sandwiching withdrawals on validators during LSD MEV opportunities, and the emerging trading strategies in the LSD market.

The event will also feature insightful private seminars and a networking dinner with DeFi trading experts and MEV thought leaders, discussing the broader implications of MEV on DeFi and the alternative techniques that Optimism, Polygon, and Shutter presented.

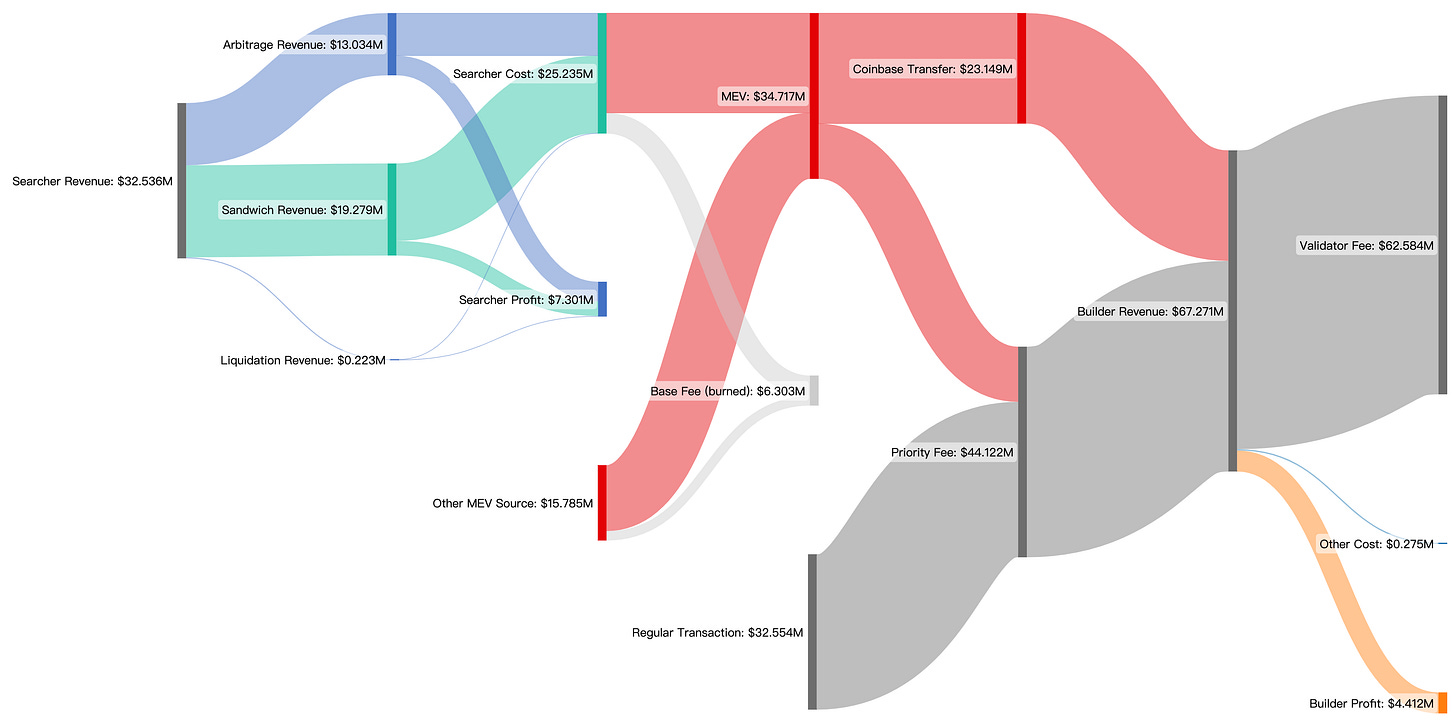

2. New MEV Supply Chain Research Released

On May 9, Eigenphi unveiled Who Takes The Tastiest Piece of The MEV Supply Chain Cake?, shedding light on the beneficiaries of the MEV supply chain. The research shows that builders and validators significantly benefit from the MEV supply chain, with validators being the top beneficiaries. The analysis also underlines the oligopolistic nature of the MEV market, with significant entities like Lido holding a substantial market share. MEV accounted for 51.6% of builders' revenue in January–February 2023. In addition, 93% of their earnings went to relay auctions to encourage validators to propose blocks.

Builders received only $4.4 million on $67.3 million in revenue. Validators earned $62.6M throughout the same period. Strategic positioning is crucial in the oligopolistic MEV sector, where Lido controls 30% of the market. MEV's significant impact on builders' earnings suggests that these dominating companies will define the Ethereum ecosystem's future. Thus, MEV supply chain knowledge is essential for success in this dynamic area.

3. Performance Spotlight: Jaredfromsubway. eth

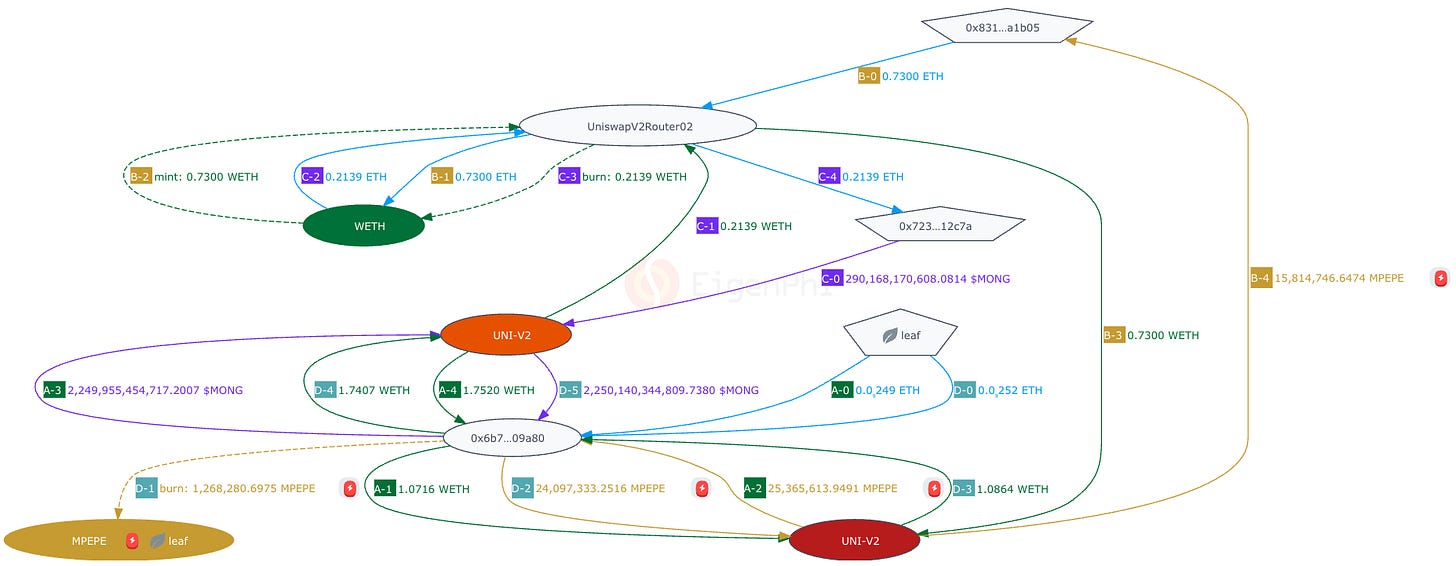

The performance of "Sandwich Bot," created on February 27, 2023, has stirred the Ethereum ecosystem. Despite high gas fees, the bot generated impressive profits of $6.3 million by mid-May. In addition, it had outperformed competitors by executing sandwich attacks and holding on to altcoins during back-run transactions when their prices were up.

On May 11, Eigenphi posted How to Unveil Jaredfromsubway. eth's Trading Tactics? Based on our analysis of Jared, we illustrated how to use EigenTx’s multi-tx combining feature to understand complex transactions of Jared step-by-step! Don’t miss the most detailed tutorial!

4. Assessing Sandwich MEV's Impact on CoW Swap: A Unique Player in DeFi

CoW Swap, built on the innovative CoW Protocol, is changing the landscape of token swaps on the Ethereum blockchain. This decentralized exchange stands out with its unique "Coincidence of Wants" matching method and batch auctions, eliminating the need for intermediaries and offering a seamless trading experience. CoW Swap's design also addresses the persistent front-running issue, rendering it MEV-resistant.

Despite these robust safeguards, the "Sandwich Bot," has managed to accrue considerable profits, demonstrating the evolving nature of MEV strategies. However, a deep dive into the data reveals that CoW Swap remains relatively resilient to such attacks. In 2022, only about 1.9K sandwich attacks were recorded, draining a mere 1.5% of the total fee revenue. These figures are significantly lower compared to other decentralized exchanges. Even after Ethereum's Merge, CoW Swap's unique solvers effectively mitigated the increased volume of sandwich attacks. This resilience underlines CoW Swap's secure and efficient platform for token exchanges, setting new standards in the DeFi space.

5. Dive into MEV with our Curated Playlist

On May 12, Eigenphi launched a specially curated MEV searcher playlist on YouTube, designed to encapsulate the essence of MEV exploration. As detailed in a recent Twitter thread, the playlist blends electronic, ambient, and experimental music, each track meticulously selected to enhance the thrill and precision inherent to MEV searching. It offers an immersive audio experience for DeFi enthusiasts and newcomers, inspiring innovation and progression in this dynamic field. Let this unique blend of upbeat and contemplative tracks accompany you on your DeFi journey, intensifying your engagement with the captivating world of MEV.

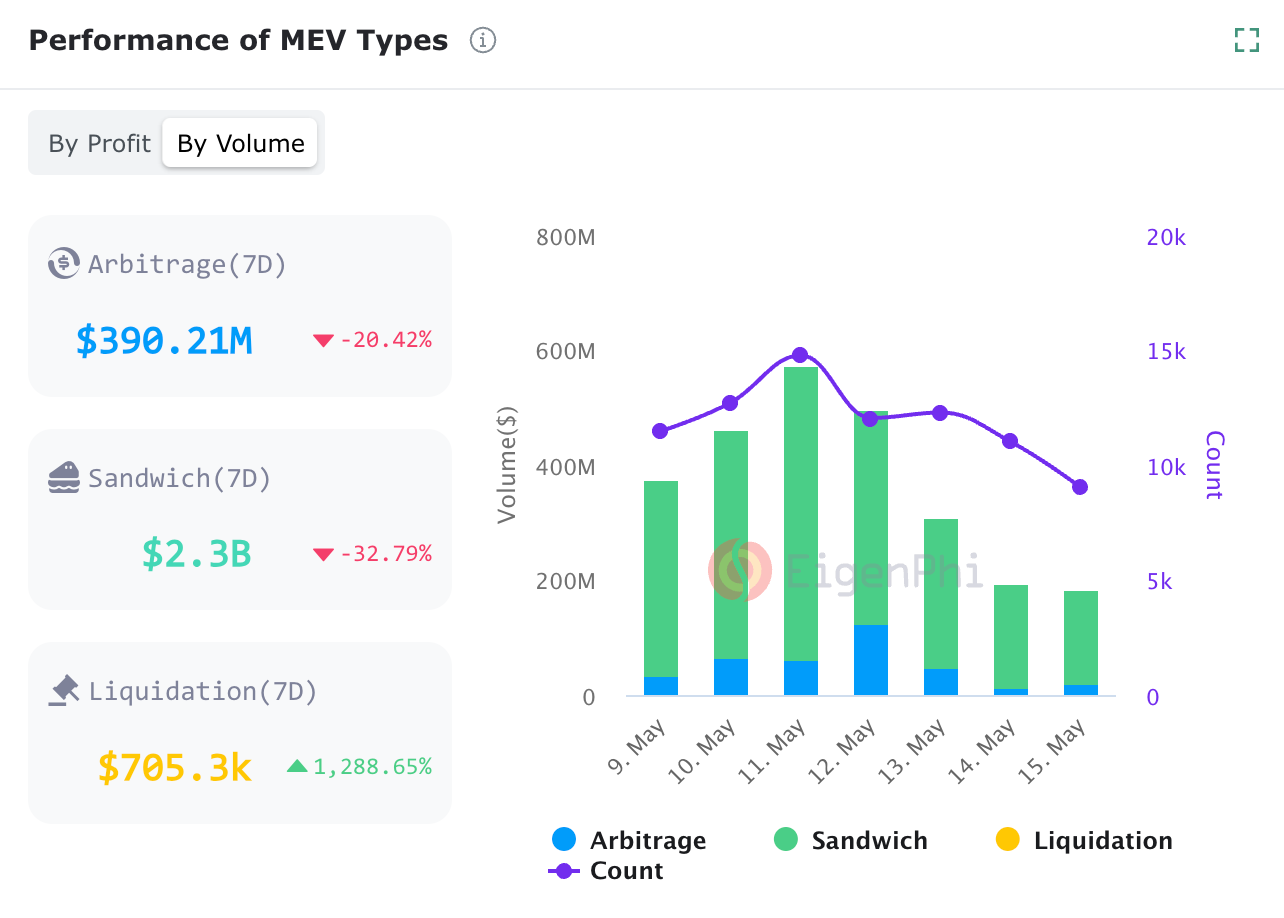

Market Overview.

Performance of MEV Types

Hot Token & Hot LP

TOP 6 Hot Tokens (by trading volume):

WETH ($2,190,415,907.33)

USDC ($636,916,872.23)

USDT ($384,485,145.13)

LADYS ($46,333,362.96)

DAI ($163,693,746.78)

PEPE($141,109,263.56)

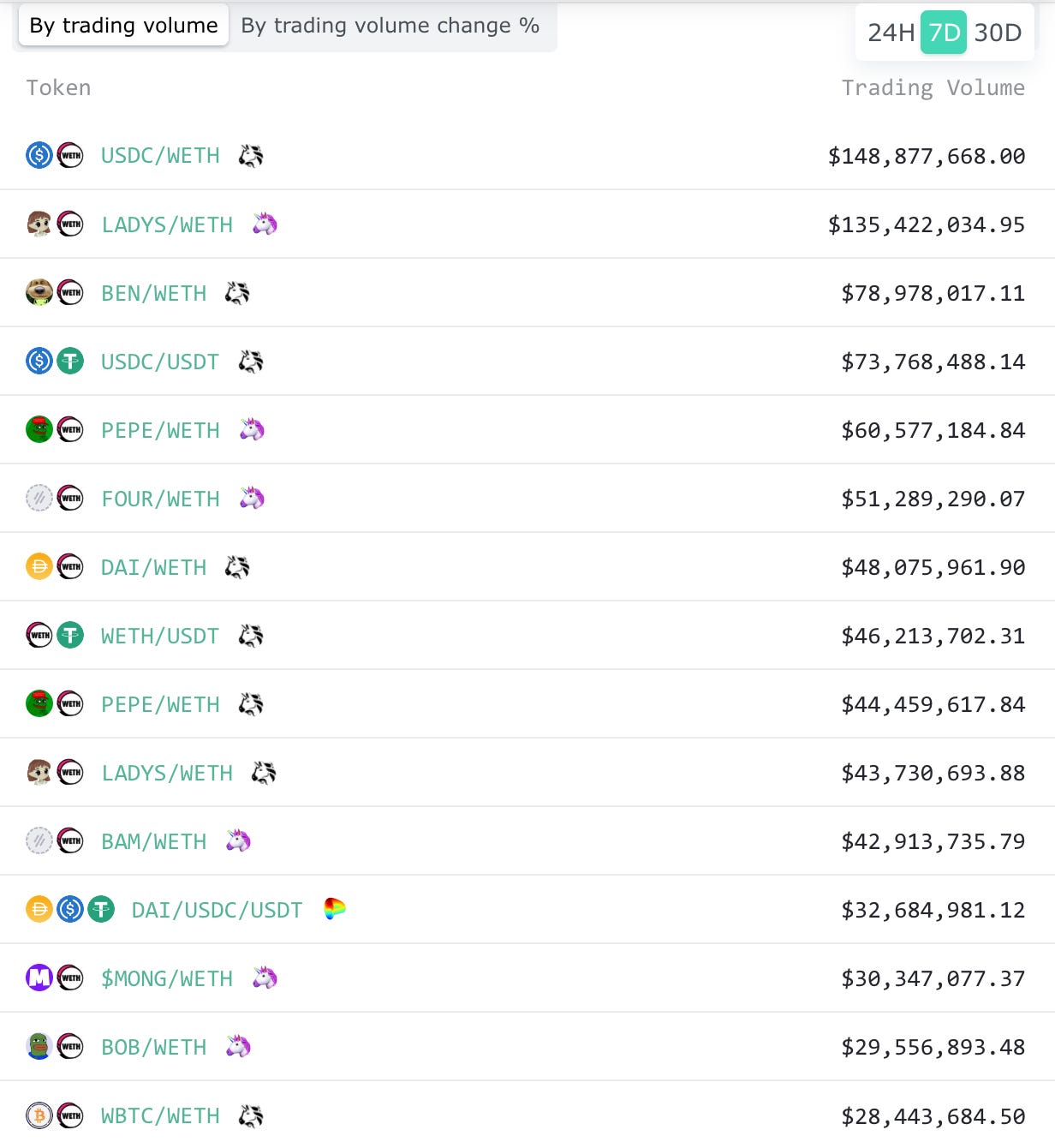

Hot Liquidity Pool (by trading volume)

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram