Key Takeaway

Stablecoin trades, particularly sandwich attacks involving USDC-USDT and DAI-USDT pairs, drive DODO's significant trading volume, accounting for over 60%. Attackers contribute 58.7%, while targeted trades comprise 2.13%.

1inch's "Fusion" mode provides varied trading options, but depending on user choices and slippage considerations, it may cause trade speed inconsistencies or an increased risk of sandwich attacks. Many trades routed through the 1inch Aggregator to DODO are vulnerable.

Evidence of sandwich attacks on DODO has surfaced; it would be better for relevant parties to take action to protect users and liquidity providers.

Decentralized exchanges (DEXs) have gained prominence in the evolving cryptocurrency market landscape. Amidst this backdrop, DODO has emerged as a standout. Surprisingly, despite a market cap of just $42 million, it ranks consistently in the top three in DEX trading volume. What's the secret behind this disproportionately high trading volume?

Preliminary research reveals that nearly 99% of DODO's trading volume is from stablecoin trades, with pairs like USDC-USDT and DAI-USDT frequently falling victim to sandwich attacks. Regardless, DODO continues to collect modest transaction fees, which has become its primary source of revenue. Astonishingly, sandwich attacks account for over 60% of its trading volume alone.

In this context, the role of the 1inch aggregator cannot be overlooked. Due to some modes of 1inch lacking slippage restrictions, users may incur significant losses when redirected to DODO. A concern that could potentially exacerbate user losses.

This article aims to uncover the truth behind DODO's high trading volume, juxtaposed with an analysis of 1inch Aggregator's slippage settings mechanism. We hope to provide readers with a clear perspective, understanding the causes and consequences of these phenomena.

DODO's Market Cap and Trading Volume

DODO's performance in the decentralized exchange landscape has caught many eyes. Statistics from Dune show a comparison of DODO's trading volume with its competitors.

Consider Uniswap, for example, which has an annual trading volume soaring to $39.4 billion, while DODO trails closely behind at $3.3 billion. But the difference becomes even more pronounced when you juxtapose this against market capitalization. Uniswap has a $41 billion market cap, while DODO is a mere $42 million. This stark discrepancy undoubtedly prompts questions: How can DODO command such a high trading volume with a relatively low market cap? Could this indicate an underlying factor that is out of the ordinary? Let's delve deeper to explore the reasons behind this phenomenon.

DODO's Stablecoin Trading: Immense Volume, But Why?

Data from Dune reveal that the primary trading pairs on DODOEX's Ethereum platform predominantly involve stablecoin exchanges.

This discovery raises even more questions. Why is the significant trading volume observed in the stablecoin pair? What secrets might lie behind this phenomenon?

DODO's Stablecoin Pool Trading Analysis

The Main Stablecoin Trading Pairs on DODO Subject to Sandwich Attacks

Based on our research, there are significant sandwich attack activities on the DODO platform, primarily concentrated in two major stablecoin trading pairs: USDC-USDT and DAI-USDT. Upon analysis, the total number of transactions on DODO subject to sandwich attacks reaches 1,322. Of these, transactions involving USDC-USDT amount to 739, constituting 55.99% of the total, while those involving DAI-USDT account for 583, or 44.01%. These numbers clearly unveil the concentration of sandwich attack activities within these two trading pairs on DODO.

Here is the volume distribution for the two stablecoin trading pairs, illustrating that approximately 60% of the trading volume originated from sandwich trades.

Hidden Fee Mechanism within DODO's Stablecoin Pool

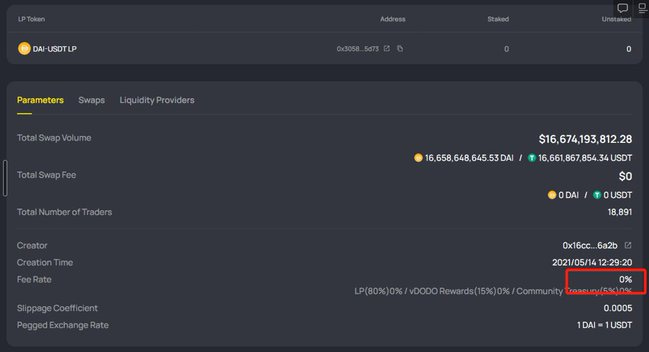

Although the Fee Rate for USDC-USDT and DAI-USDT is set at 0%, a more in-depth investigation reveals that DODO actually imposes a 0.001% (0.1 basis points) fee on these stablecoin transactions.

EigenTx shows evidence of this subtle but continuous charging method, where a portion of the fee from each transaction is transferred to DODO's Proxy wallet. Here is an EigenTx example of how the fee is collected to the proxy wallet: 0x03b7a09e878f8bed9c481e36e0a802a78a1c533be563e1dbb26b8d7394121e5c.

DODO Sandwich Attack Analysis

3 Sandwich Attackers Dominate DODO

After filtering through AttackerEOA, we found that in the first half of 2023, sandwich attacks targeted a total of 1322 transactions, involving only 3 unique AttackerEOA, with one accounting for 51.3% of trade volume, reaping as much as 84% in profits.

Upon further analysis of the volume, revenue, and profit, we obtained the following results:

Among them, account 0xf480 contributed to 51.3% of the volume and earned a profit share of 84%, totaling over $430,000.

Sandwich Attacks (attack + victim transactions) Contributed Over 60% of Trading Volume to DODO Pools, with Attack Volume Vastly Outpacing Victim

Our further investigation into the overall impact of attacker and victim on the total volume yielded these results:

Victim transactions have a volume of $292,14 million, contributing 2.13% to the total volume. This means that attacks have targeted 2.13% of the trade volume on DODO.

The volume from the attacker's sandwiching is $8,03 billion USD, comprising 58.7% of all trades.

From points 1 and 2, we deduce that the full suite of sandwich trades accounts for over 60% of the volume.

The volume of the attackers is substantially larger than the victim transactions, averaging 27 times greater. This figure represents a significant deviation from what one would normally expect.

Sandwich Attack Case Analysis: Victim Receives 0.87 USDT in Exchange for 1 USDC

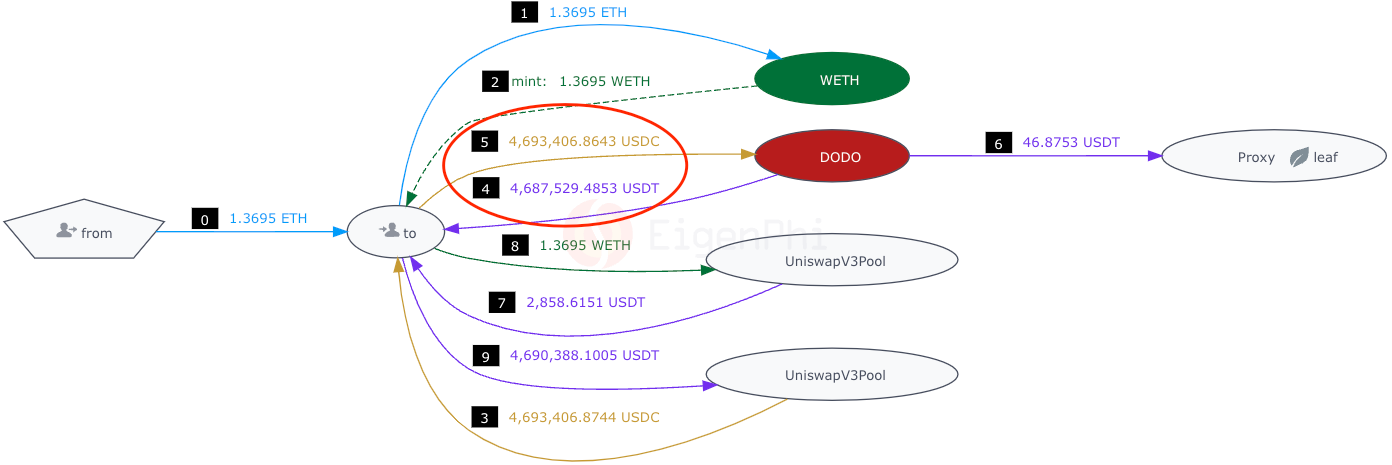

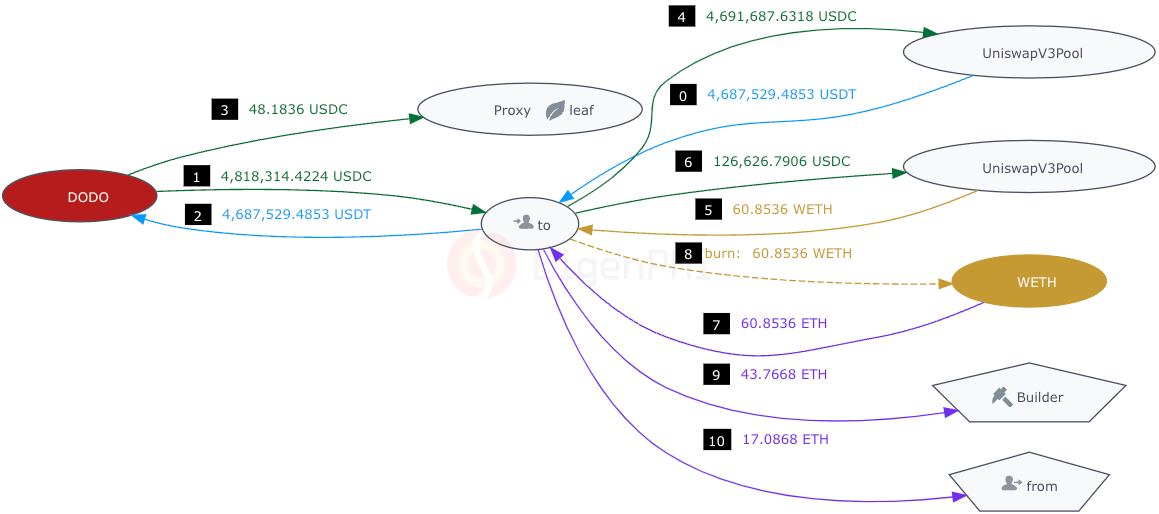

Using the sandwich attack with the highest revenue as an example:

0xe6b0426d150eda46094d3785a14fa7830245daea50ad685bfdf05b34603efc2d

Front-run:0x591ce52528b7c293ebc27ca106086dc3659b459ea19dd322516676e359ce88a0

In: 4,693,406.864341 USDC

Out: 4,687,529.485349 USDT

Ratio: 1 USDC can be exchanged for 0.998747737163668 USDT

Victim: 0x03b7a09e878f8bed9c481e36e0a802a78a1c533be563e1dbb26b8d7394121e5c

In: 977,479.767689 USDC

Out: 851,720.5951 USDT

Ratio: 1 USDC can be exchanged for 0.8713434520631305 USDT

For stablecoins, this 1:0.87 exchange ratio is quite astonishing, and it has also brought substantial profits to the attackers.

Back-run: 0x4ef89839e75a3175fa7821160e0de352e7fc2b3cb59728c9ae66ebb108e5f36e

In: 4,687,529.485349 USDT

Out: 4,818,314.422425 USDC

Ratio: 0.9728567034838342 USDT can be exchanged for 1 USDC

Further, in the USDC - USDT and DAI - USDT pools, the following table/chart illustrates the proportion of volume that sandwich attacks (attacker + victim) contribute to the total trading volume.

Distribution of Victim Transaction 'To' Addresses, with the Top Two Originating from 1inch

The 'To' Address in this context refers to the contract address that the transaction calls. The following table displays the distribution of the 'To' addresses for Victim Transactions (only those with numbers greater than 20 are listed):

Analysis of Sandwich Attack Causes on DODO Trades

Following our analysis, we've identified the 1inch Aggregator as a significant source of 'To' addresses (contract addresses). We'll now explore the causes of the aforementioned sandwich attacks from both DODO's and 1inch's perspectives:

DODO does not have a whitelist, but its swap page does mention "private transactions" or non-public mempools, positioning them as a protective measure against potential losses from sandwich attacks. It's worth noting that DODO's slippage settings vary depending on the trading pair: a default slippage of 0.01% for stablecoins, 0.5% for mainstream pairs, and 3% for other pairs. When compared to mainstream platforms like Uniswap, which has a slippage set at 0.1%, certain trading pairs on DODO might appear to have a notably higher rate. Adjusting the default slippage settings might help DODO improve its stance on sandwich attacks.

1inch functions as a sophisticated decentralized trading platform, including both centralized and decentralized sources, facilitated by top-tier market makers. Their innovative 'Fusion' mode offers three tailored options:

Fast: For those seeking immediate execution, even if it means a slightly less favorable rate.

Fair: Allows users a short wait in exchange for a more attractive rate.

Auction: Users can wait up to ten minutes, aiming for the pinnacle of trade rates.

In conclusion, if a user chooses slower transactions to limit slippage, they could compromise speed. On the other hand, seeking fast transactions could lead to higher slippage. This increases the risk of sandwich attacks, which is why many trades via the 1inch Aggregator are at risk.

EigenTx is essential for such research. Now you can make a dent for its future and earn $100U. Click here to attend the 3-minute survey!

Using MEV Evaluation, wallets, market makers, and RPC providers can quantify the impact of MEV on different sources of order flows. Watch the video below to get more benefits of MEV Evaluation.

Are you interested? You can download the template here!

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram | EigenTx

Hi, to correct the statement that DODO's default slippage setting is at 3%, actually it is default slippage 0.01% for stablecoins, 0.5% for mainstream pairs and 3% for others on DODO(dodoex.io).