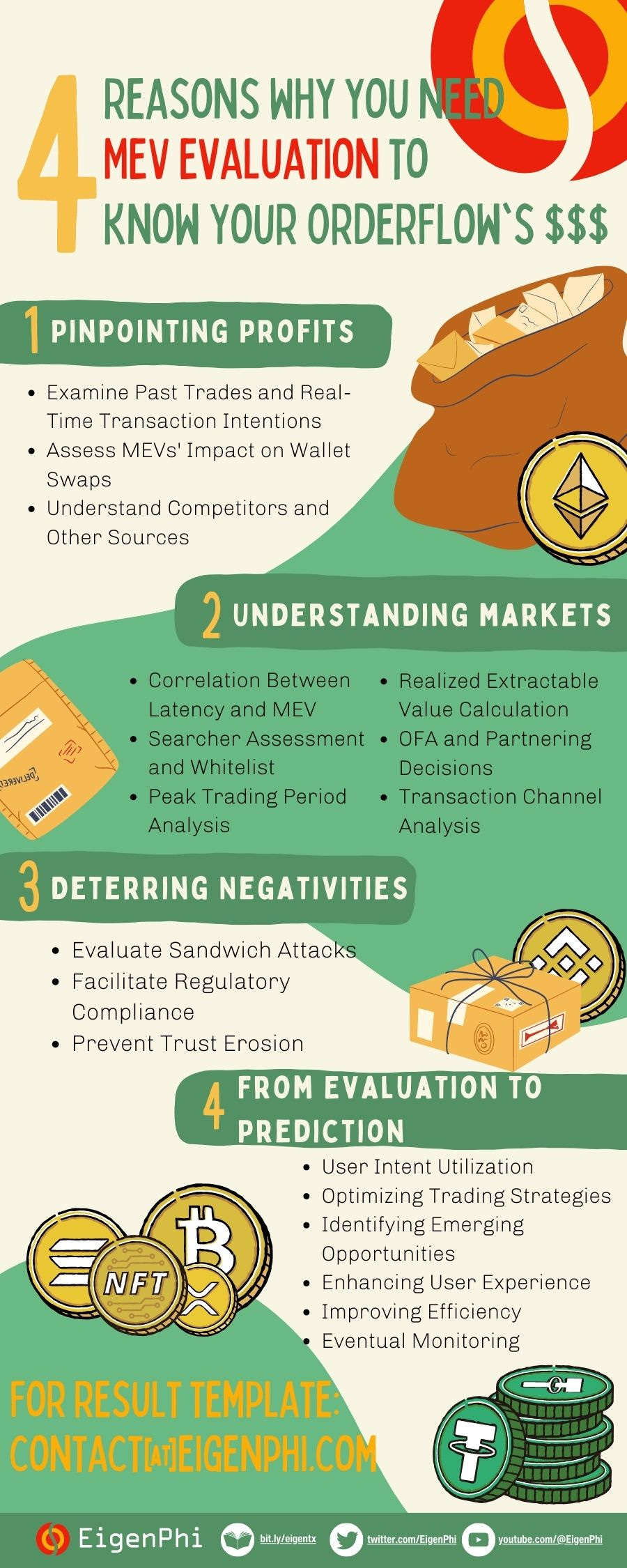

Your Order Flow, Your Value: 4 Reasons Why Everyone Should Know Your Order Flow's Worth

Pinpointing profits, understanding markets, deterring negativities, and identifying emerging opportunities.

Have you ever wondered how much money your order flows leave on the table? In traditional finance, payment for order flow (PFOF) is a murky but lucrative business dominated by players like Citadel, which paid a whopping $2.6 billion for PFOF from 2020-2021.

Now, after the Merge on Ethereum, the Proposer-Builder Separation (PBS) in the MEV supply chain ecosystem is actively shaping the market for crypto order flow, drawing the community's attention.

However, key players such as wallets, dApps, MEV redistribution projects, and RPC providers are missing a critical piece: the ability to quantify the value of their order flow from an MEV perspective. That's where MEV evaluation comes in, empowering DeFi participants to unlock hidden profits, gain market insights, and compete more effectively. Read on to find out how.

Pinpointing Profits in Order Flow

As order flow originators, such as users, wallets, dApps, and RPCs, you can view order flow as a river teeming with profit opportunities. MEV evaluation guides you to the best spots to capture value, serving as a tool that traders and market players leverage to profit from transaction sequencing and execution.

Here's how MEV evaluation transforms your order flow into profits:

Examine past trades and real-time transaction intentions: MEV evaluation reveals how much money you can make from order flows and share that value with your users.

Assess past MEVs' impact on wallet swaps: It quantifies back-runs and their Profit and Loss, all connected to your wallet's signal transactions.

Understand competitors and other sources: MEV evaluation provides unique bottom-up, fully quantifiable, and holistic analysis, unlike other limited options with ambiguous scopes, on transactions, profits, and revenues from RPC rebate mechanisms and RPC nodes, transaction execution routings, routers APIs, etc., to inform your strategy.

Predict future MEV statistics: With this data, you can forecast your order flows' future MEV trends and gain a competitive edge in the Crypto industry.

While monetizing order flow matters for individuals, MEV evaluation also enables the assessment of overall market fairness. It provides transparency into the activities of various players to promote equitable participation. This builds integrity around trading strategies and deals beyond just making money.

Understanding Market Dynamics & Assessing Competition and Fairness

MEV is closely tied to how assets move and deals get done in the crypto world. By looking at the value of this flow through the lens of MEV, people in the market can get a better idea of what's going on with players like block builders, traders, and those providing liquidity. This insight helps them make smarter trading decisions. Moreover, MEV evaluation can spot if anyone's trying to control the market or take more than their fair share. It's a tool to promote competitiveness, equitable deals, and proper incentives.

If you're an MEV Redistribution service provider, RPC provider, or Wallet provider, MEV evaluation equips you with essential insights, including:

Correlation Between Transaction Latency and MEV Value: Analyzing processing time helps optimize systems, reduce wait times, and enhance value, so you never miss an opportunity.

Searcher Assessment and Whitelist: This evaluation checks the performance and reliability of network searchers, creating a trusted whitelist and boosting fairness and efficiency.

Peak Trading Period Analysis: Study market behavior during turbulent times or significant events, like the depeg of USDC, to strategize and seize opportunities.

Realized Extractable Value Calculation: Determine the actual value extractable from the market, shaping transparent redistribution systems and ensuring fair distribution.

Scale of OFA (Order Flow Auctions) and Partnering Decisions: Understand the market size of OFAs to align partnerships with market trends and competition.

Transaction Channel Analysis: Observe how transactions flow through various channels, identifying weak spots or cheats to enhance speed and fairness.

MEV evaluation is not merely about understanding market dynamics; it's a pathway to a more open, fair, and responsive crypto world. By embracing MEV evaluation, you contribute to a more equitable market and address potential negative externalities.

Deterring Negative Activities

MEV strategies like front-running and sandwich attacks can undermine market fairness and disrupt trade settlements. MEV evaluation counters these negative effects by measuring the value and behaviors of order flow, ensuring an equitable distribution of opportunities. Here's how it works:

Evaluate Sandwich Attacks: In the past 30 days, led by Jaredfromsubway.eth, sandwich attacks caused a loss of $13.5M. By measuring these attacks, you can understand the number of affected transactions, the total manipulated value, and the revenue attackers gained. This knowledge reveals the prevalence of sandwich attacks within your services and their impact on market fairness.

Facilitate Regulatory Compliance: MEV extraction methods might trigger legal and regulatory issues, especially if they include unfair or manipulative practices. MEV evaluation helps you navigate these concerns and minimize legal risks.

Prevent Trust Erosion: If users feel the system is unfair or that MEV extraction puts them at a disadvantage, trust in the platform may erode, deterring participation. MEV evaluation helps maintain trust by promoting transparency and fairness.

These benefits of MEV evaluation serve as foundational tools for descriptive and diagnostic analysis, paving the way for predictive and prescriptive insights.

Next: From Evaluation to Prediction

The market never stands still, and in this dynamic environment, MEV evaluation shines as a tool to detect both broad trends and subtle cues. Here's how it can guide you through the market's complexities:

User Intent Utilization: MEV evaluation offers pricing insights for unconfirmed transactions, helping you make informed business decisions about your client's transaction order flow.

Optimizing Trading Strategies: With predictive insights from MEV evaluation, traders can time their transactions to cut costs or boost profits.

Identifying Emerging Opportunities: MEV's predictive analysis can reveal new market opportunities like untapped arbitrage or liquidity pools.

Enhancing User Experience: By foreseeing delays or bottlenecks, platforms can offer users more accurate estimates and smoother trades, such as avoiding sandwich attacks through reasonable slippage.

Improving Efficiency: MEV evaluation's prescriptive insights can streamline resource allocation, optimize gas usage, and reduce transaction latency.

Eventual monitoring: By comparing results from Simulation vs. Reality, and results of similar signals, MEV evaluation quantifies outcomes of user intents for different scenarios, i.e., Fast vs. Safe vs. Kickback, or Account Abstraction supply chain analysis.

In summary, MEV evaluation is more than a tool; it's a strategic asset that can uncover opportunities, refine interactions, and boost efficiency in a constantly changing market landscape.

Unlock the Power of MEV Evaluation

In closing, MEV evaluation is a powerful tool to maximize opportunities and minimize risks in the ever-changing crypto ecosystem. By putting a value on order flow, it enables participants to unlock profits, gain strategic insights, and ensure market fairness. Traders can pinpoint arbitrage opportunities, projects can assess and monetize their order flows, and platforms can optimize operations, ward off manipulation, and foster trust. MEV evaluation lights the way forward through the complexity of DeFi.

The time to seize these benefits is now. Will you lead the pack?

Don't miss your opportunity and get your MEV evaluation result template by emailing: contact [at] eigenphi.com.

Watch this video to understand more about MEV Evaluation:

And feel free to share this infographic with people who need MEV Evaluation!

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram | EigenTx