Weekly Highlights with EigenPhi - Week 8, Feb

What you need to know for the past week

🚀EigenPhi Update

HOLD FAST!!! It's Time to Inspect the Sandwich Spillover on BSC Chain.

Last week, we announced the First BSC Sandwich module of DeFi.

The NEW EigenPhi is released and ready to take your data experience to the next level. Any feedback and suggestions are welcome.

We extend our heartfelt gratitude for your support over the past year and look forward to continuing to provide you with the best possible experience. Thank you for your continued support!

📢Keeping UP with EigenPhi

Currently, most reports and articles on the topic of MEV revolve around the introduction of the concept and how to introduce order into the MEV market. In addition to the general concern about the functioning of the MEV macro market mechanism, we call on you to join EigenPhi in focusing on another micro-level issue: MEV trading, as a representative, implies that liquidity data offers unprecedented opportunities and challenges. Here it is, the 2022 Annual MEV Report!

On Feb 15th, we invited the experts in the field of DeFi Risk to share their thoughts on topics including ‘How many types of oracle attacks?’ and ‘How to design an oracle-attack-resistant system?’. The recording was uploaded and pinned on the Twitter official account.

Bonq DAO protocol on Polygon, similar to MakerDAO's lending service, got rekt on Feb 1st, 2023. About $1.2 million worth of stolen assets have been converted. Once again, the protocol’s oracle became the vulnerability. Another example of trying and failing to conquer the Tokenomics Trilemma, which will be illustrated in the following research.

EigenPhi Research and Dr. Chuanwei Zou from Wanxiang Blockchain just released the research about tokenomic trilemma of the blockchain token dynamics. And we analyze why is it difficult for independently issued algorithmic stablecoins to maintain anchorage and avoid entering a death spiral.

The token dynamics of blockchain follow the same theory of a tokenomic trilemma: being difficult simultaneously to achieve three conditions of free tradability, anchored price, and independent issuance.

Current DeFi protocols may not place enough value on liquidity data. There is a real need for detecting risk precursors by monitoring early liquidity anomalies.

The trend of high leverage, liquidity risk, and maturity mismatch issues requires new solutions.

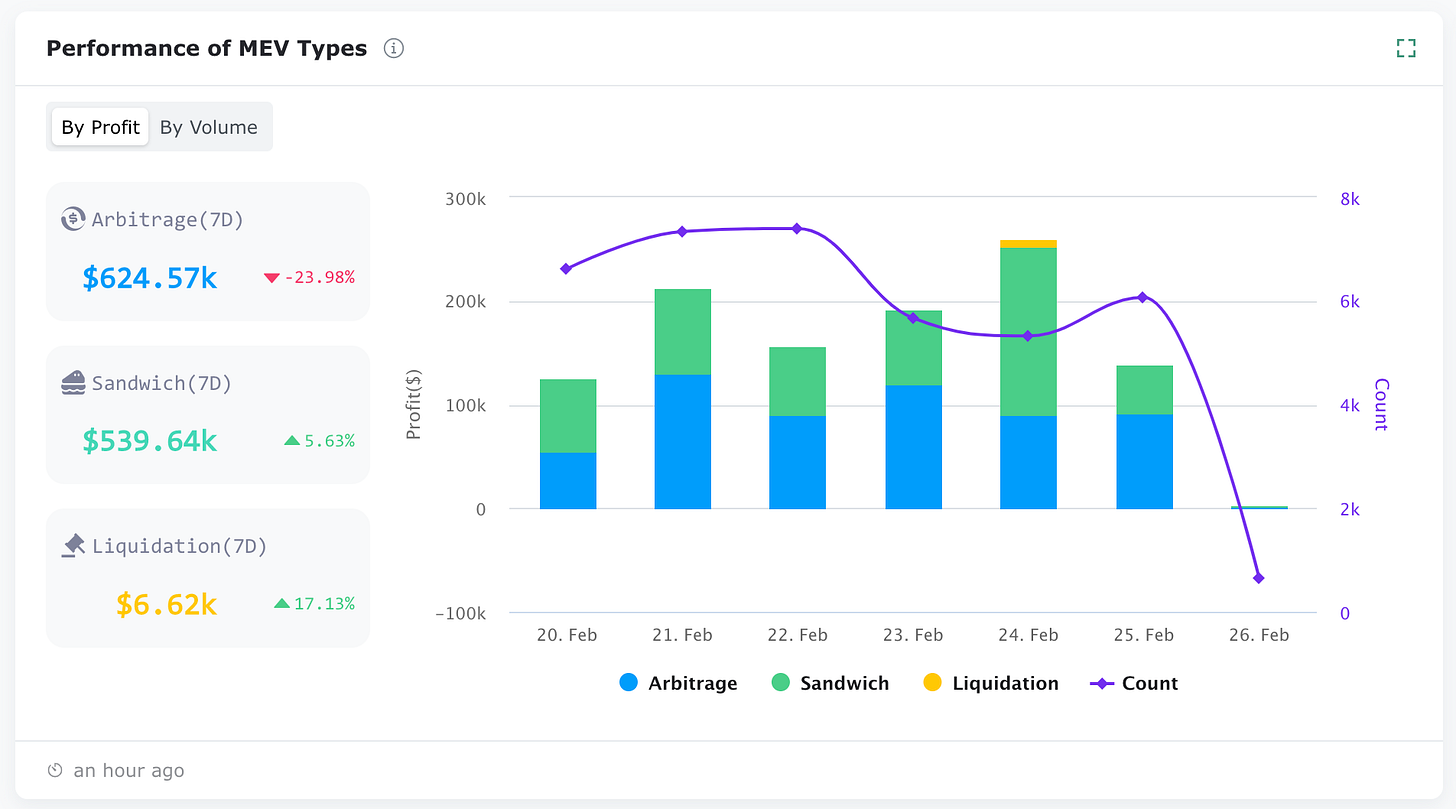

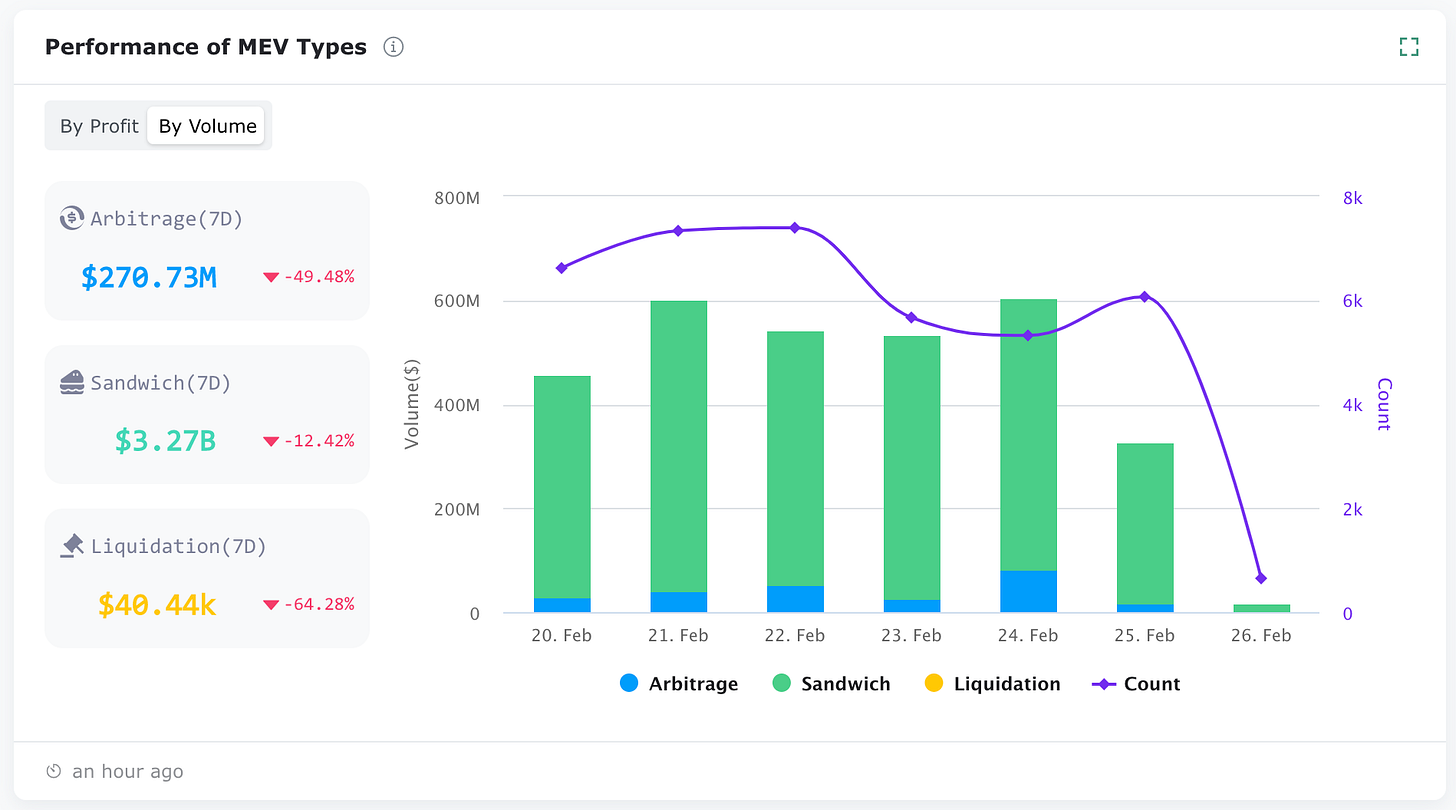

📈MEV Market Overview

Performance of MEV

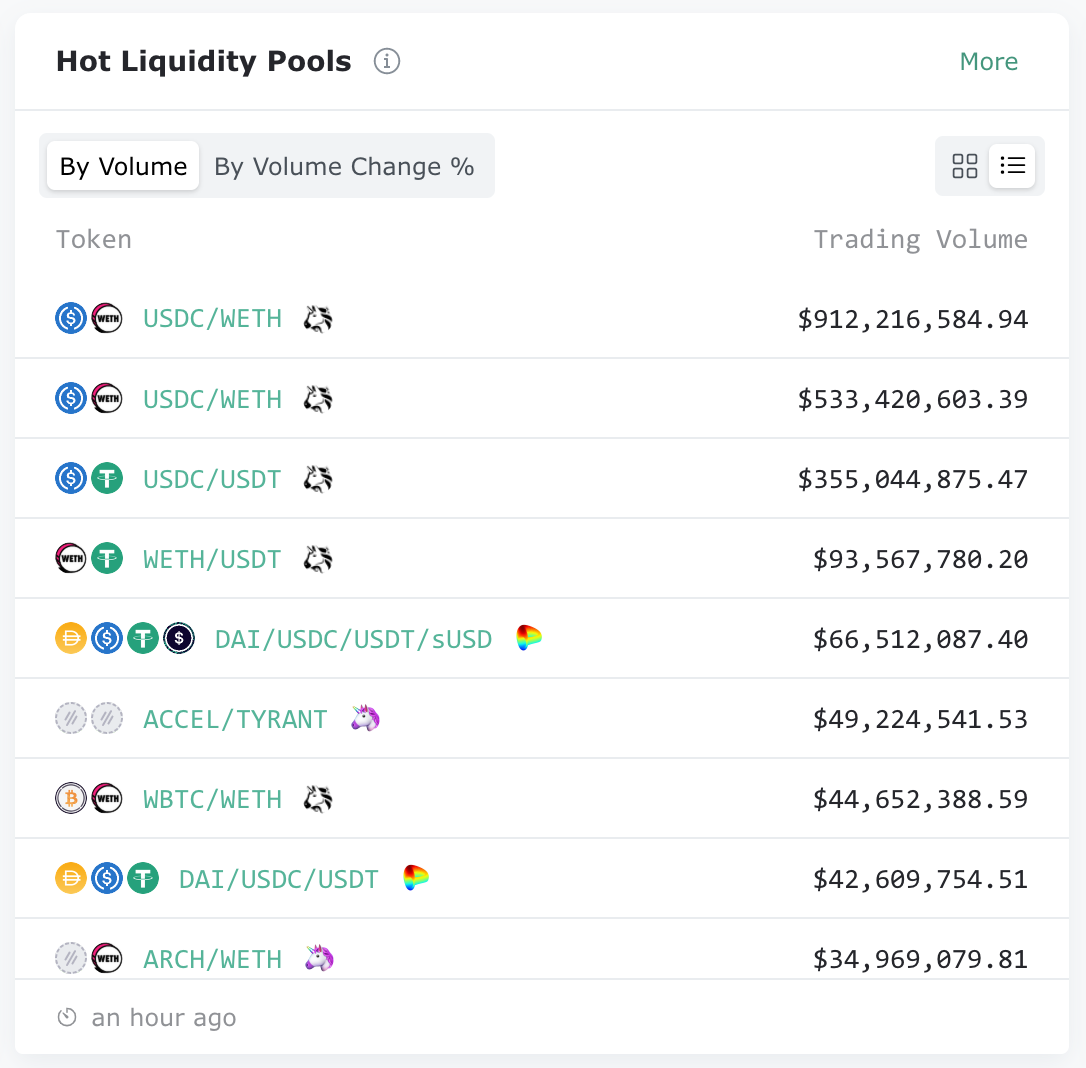

Hot Token & Hot LP

TOP 6 Hot Tokens (by trading volume):

WETH ($2,672,423,922.62)

USDC ($2,190,476,744.67)

USDT ($623,003,704.61)

DAI ($191,093,148.94)

WBTC ($83,330,798.02)

ARCH ($73,800,128.27)

Hot Liquidity Pools (by trading volume):

High-ROI MEV transaction this week

The sandwich attack reaped a profit of $538,053.03 which was less than that of last week. This bot ranked in the top 3 of EigenPhi's profit leaderboard, with 1,080 ATTACKS in 7 DAYS yielding a profit of $139,581.61. Keep an eye on this one!

Please feel free to View on EigenTx

Follow us via these to dig more hidden wisdom of DeFi: