Weekly Highlights with EigenPhi - Week 52,Dec

What you need to know for the past week

🎈HAPPY NEW YEAR!!!

The Holidays are here! EigenPhi wish you a very happy holiday season. We hope you have a wonderful time with your family and friends and that you are able to relax and enjoy the festive celebrations.

Thank you again for all the support for EigenPhi along the journey. We will continue to bring more transparency to the DeFi space.

🚀EigenPhi Update

The NEW EigenPhi on Ethereum is released! Any feedback and suggestions are welcome.

Bug fixed

Install EigenTx - Chrome

📢Keeping UP with EigenPhi

At the beginning of the year, you absolutely did not expect to have a year like this. In 2022, we have witnessed innovations, changes, dramas and challenges in the DeFi world.

After the first five years of MEV, tremendous development and progress have been seen, but it still faces issues and challenges such as fairness, negative externalities, and supervision.

EigenPhi will soon publish an annual report on MEV. We would like to talk about our findings and views on these issues, and the outlook of MEV in 2023.

Photo by BoliviaInteligente on Unsplash Why do we need a control system based on liquidity sensors and a feedback loop to mitigate the imminent risks?

Bizarre staking rules of APE cost 3 NFT owners to lose both their NFTs and $75K worth of APE tokens.

An Arbitrage Captured the Price Caching Design Defect to Profit Over $110K

With the downfall of FTX and the collateral damages caused by its ripple effect, more and more people are turning their gazes and hopes to DeFi ecosystems.

In the Deep Winter of Crypto, How to Make the DeFi Stronger Again?

Soon, we will host a webinar. DeFi researchers, on-chain platforms, and project parties will be invited to discuss how to build a better transparent DeFi ecosystem after the collapse of FTX.

If interested, please feel free to contact.

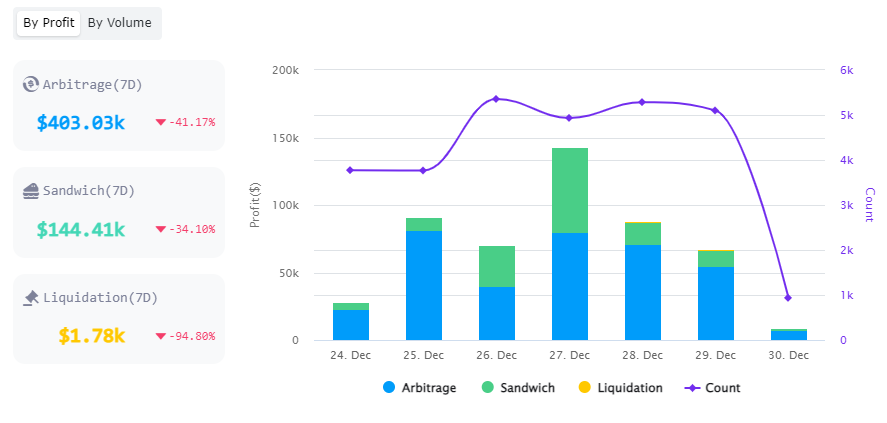

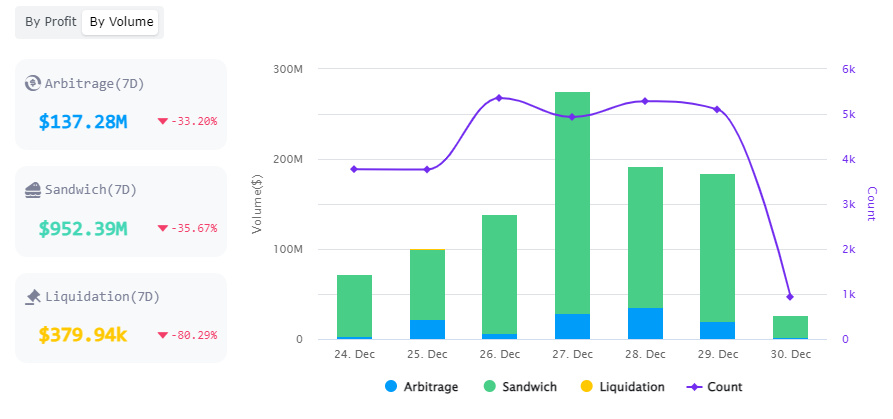

📈MEV Market Overview

Performance of MEV

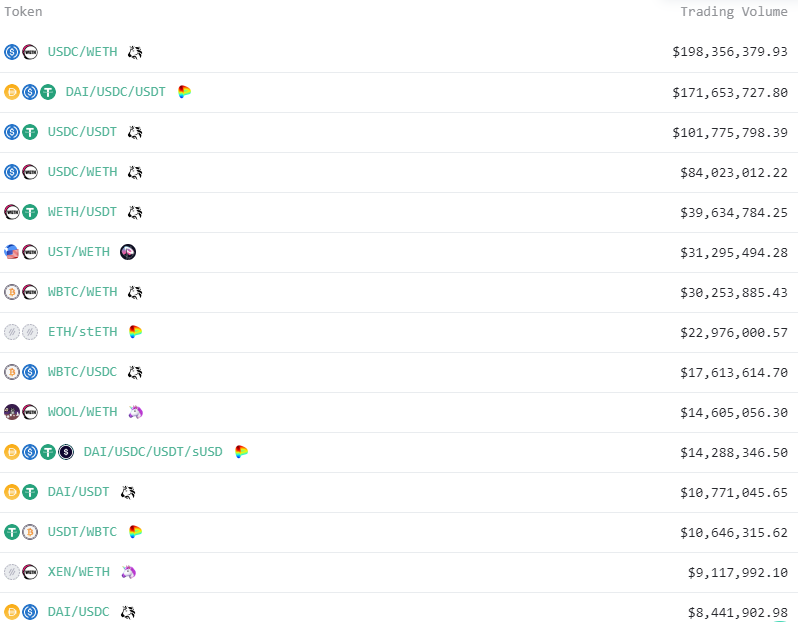

Hot Token & Hot LP

TOP 6 Hot Tokens (by trading volume):

WETH ($724,582,863.77)

USDC ($518,416,533.53)

USDT ($233,950,632.50)

DAI ($78,645,939.49)

UST ($69,878,828.65)

WBTC ($61,083,016.55)

MEV transaction this week

Brutal...We found a victim who lost $10k+ in seven days and was sandwiched for 17 times, 11 of which were from the same MEV bot.

Let's take one of the attacks as an example and see how it worked.

Follow us via these to dig more hidden wisdom of DeFi: