Weekly Highlights: Top 5 MEV bots were ripped off $20M - Week 14, 2023

Last week, we detected a major attack happened on block 1696664, provided solution to prevent users from attacks like that, released new algorithm for identifying MEV.

On April 3rd, An attacker broke the assumed atomicity of the sandwich attack transaction bundle. In block 16964664, which has 24 transactions, the attacker replaced the original victim's transaction with a new backrun targeting MEV bots, and the original backpiece of the MEV bot failed. The attacker transferred the profits to the address 0x3c98d, labeled as Sandwich the Ripper, currently holding $20 million in funds. We reviewed the whole exploitation in a tweet thread.

A more detailed explanation of the root cause.

You can also read the post here.

EigenPhi has introduced the improved MEV recognition algorithm, aimed at enhancing security and reliability for DeFi applications and smart contracts. The algorithm is expected to bring significant benefits to the DeFi community, boosting confidence in blockchain-based applications.

On April 5th, our collaboration with @CoWSwap, @beaverbuild, and @AgnositcRelayer for the launch of “MEV Blocker” is aimed at providing a solution to the MEV problem in Ethereum. With MEV Blocker and its RPC endpoints, transactions will be sent to trusted searchers who will block frontrunning and sandwich attacks. We were joined forces by 30+ big names in the Ethereum Ecosystem to launch “MEV Blocker” together.

Hong Kong Web3 Festival is taking place between April 12th and 15th. It is a festival that will bring together the world’s brightest minds, top Web3 projects and leading venture capitals presenting content-rich discussions and topics centered around Web3. EigenPhi’s Data Scientist “Sophie Liu” has been invited as a speaker at the festival where she will be sharing her insights on the impact of MEV and the risks of market liquidity manipulation.

Market Overview

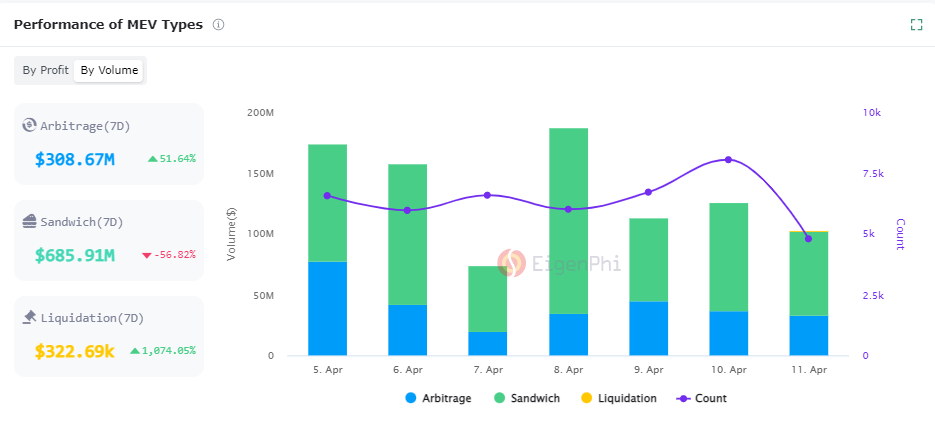

Performance of MEV Types

Hot Token & Hot LP

TOP 6 Hot Tokens (by trading volume):

WETH ($553,179,046.49)

USDC ($413,067,027.93)

USDT ($346,072,156.09)

WBTC ($51,428,565.67)

DAI ($46,387,884.62)

PARTY ($38,274,917.24)

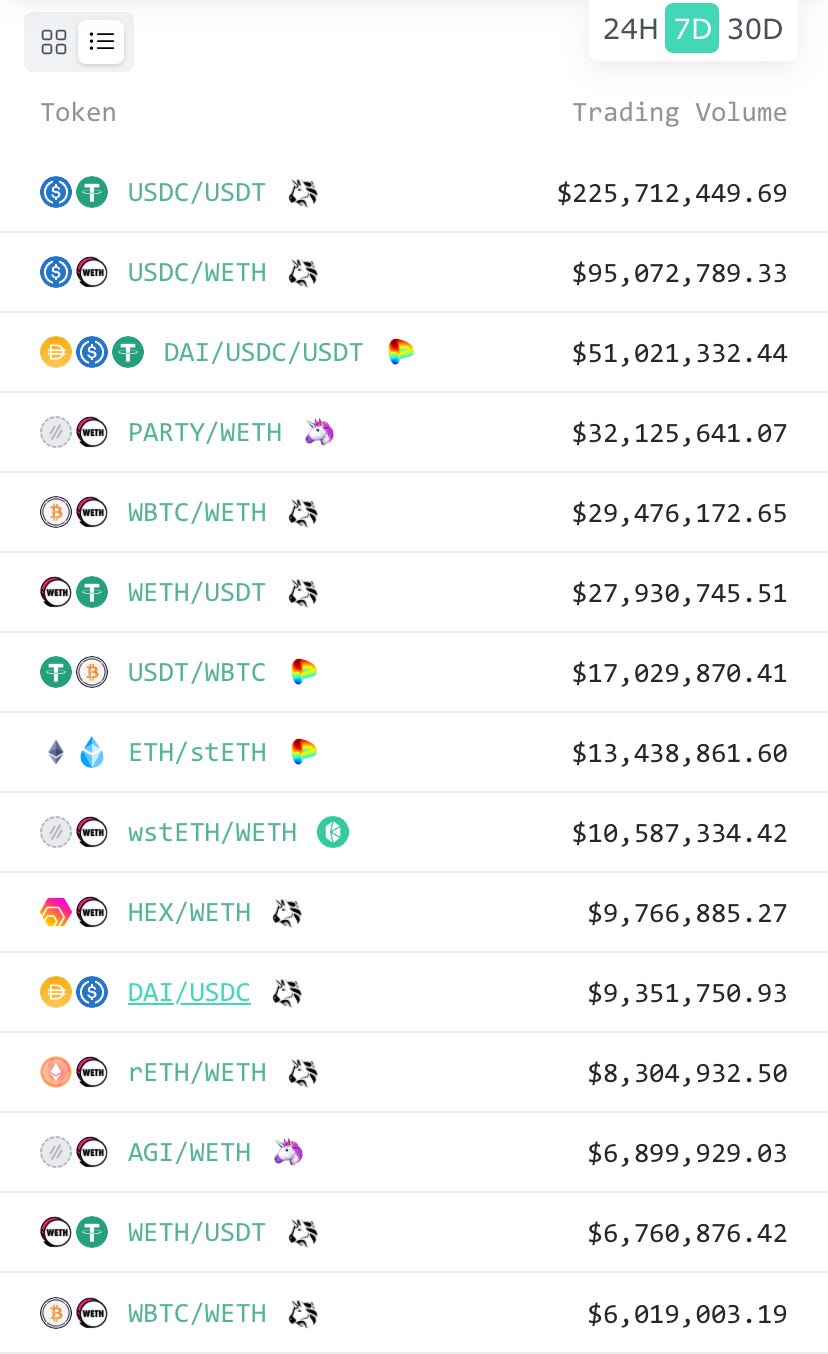

Hot Liquidity Pools (by trading volume)

Follow us via these to dig more hidden wisdom of DeFi: