Weekly Highlights: MEV Landscape after Shanghai Upgrade on LSD - Week 15, 2023

Shanghai upgrade means a milestone for LSD market, but also a turning point for MEV.

On April 17 at 8 PM EST, EigenPhi will host a Twitter Space discussing MEV and DEX with industry experts:

Uri Klarman, CEO of bloXroute.

Evgeny Lyandres, founder of VirtuSwap, Alex Zaidelson, Head of Business and Data of VirtuSwap

Mark Richardson, Project Lead of Carbon DeFi

Dr. Sophie Liu, Data Scientist of EigenPhi.

Set up your reminder for the Twitter Space here: https://twitter.com/i/spaces/1mrGmkRPPqgxy

On April 12, the Shanghai-Capella upgrade hit the Ethereum mainnet, which allowed validator to withdraw their staked ETH on the main network. This creates significant changes to the Liquid Staking Derivatives market.

EigenPhi has looked closely at the MEV opportunities in the last few months and provided predictions regarding the future Ethereum MEV landscape. We expect that the Shanghai upgrade will increase the trading volume of LSD on Ethereum, leading to more MEV opportunities. Get ready for a game-changing shift in the world of Ethereum as it enables validator staking withdrawals on the main network and revolutionizing the LSD market.

You can read the full post below:

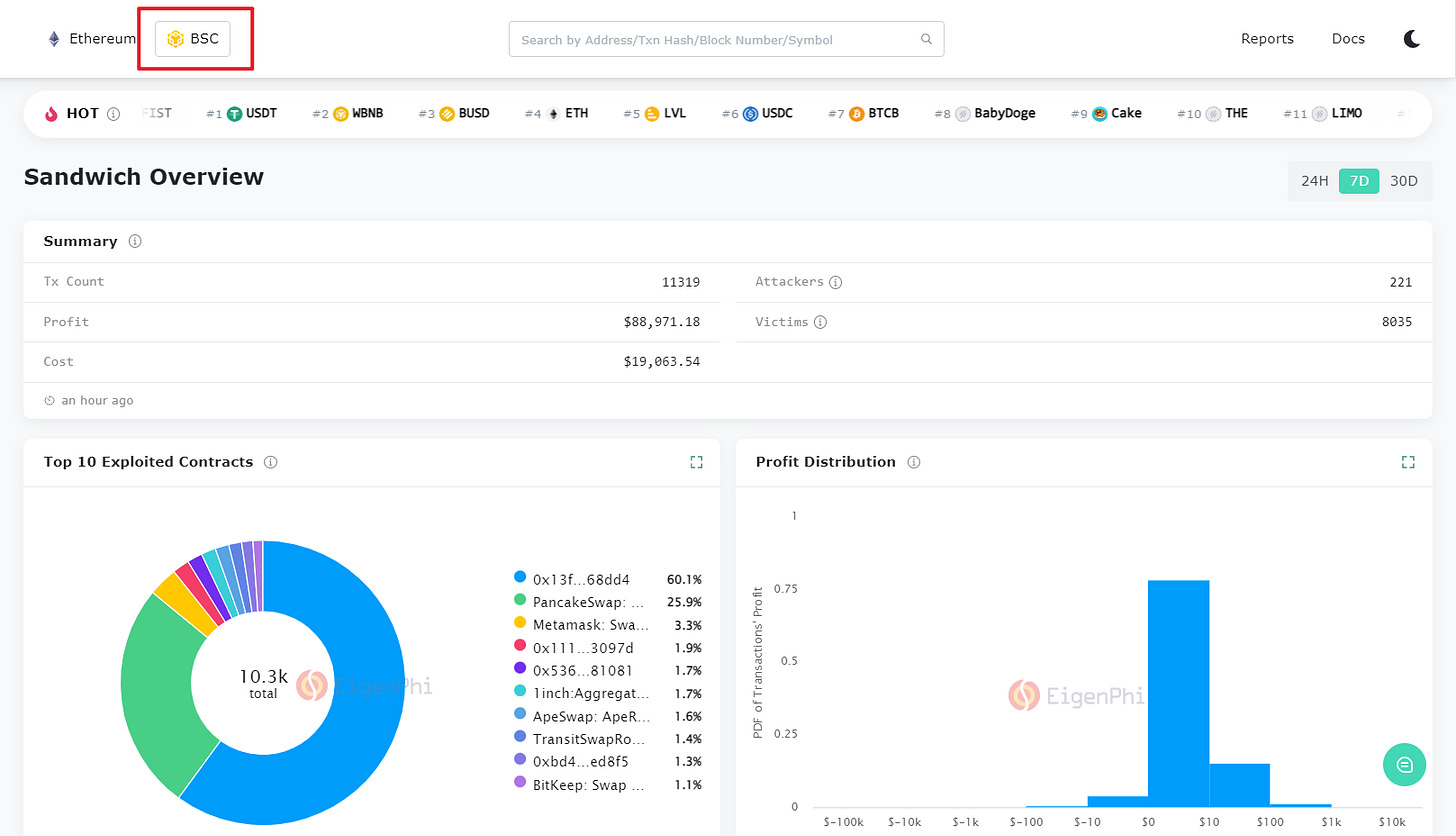

EigenPhi has recently introduced the BNB Chain Dashboard and data module for sandwiches, with which you can easily compare with sandwich activities on Ethereum. Take a try and check the data now: https://eigenphi.io/mev/bsc/sandwich

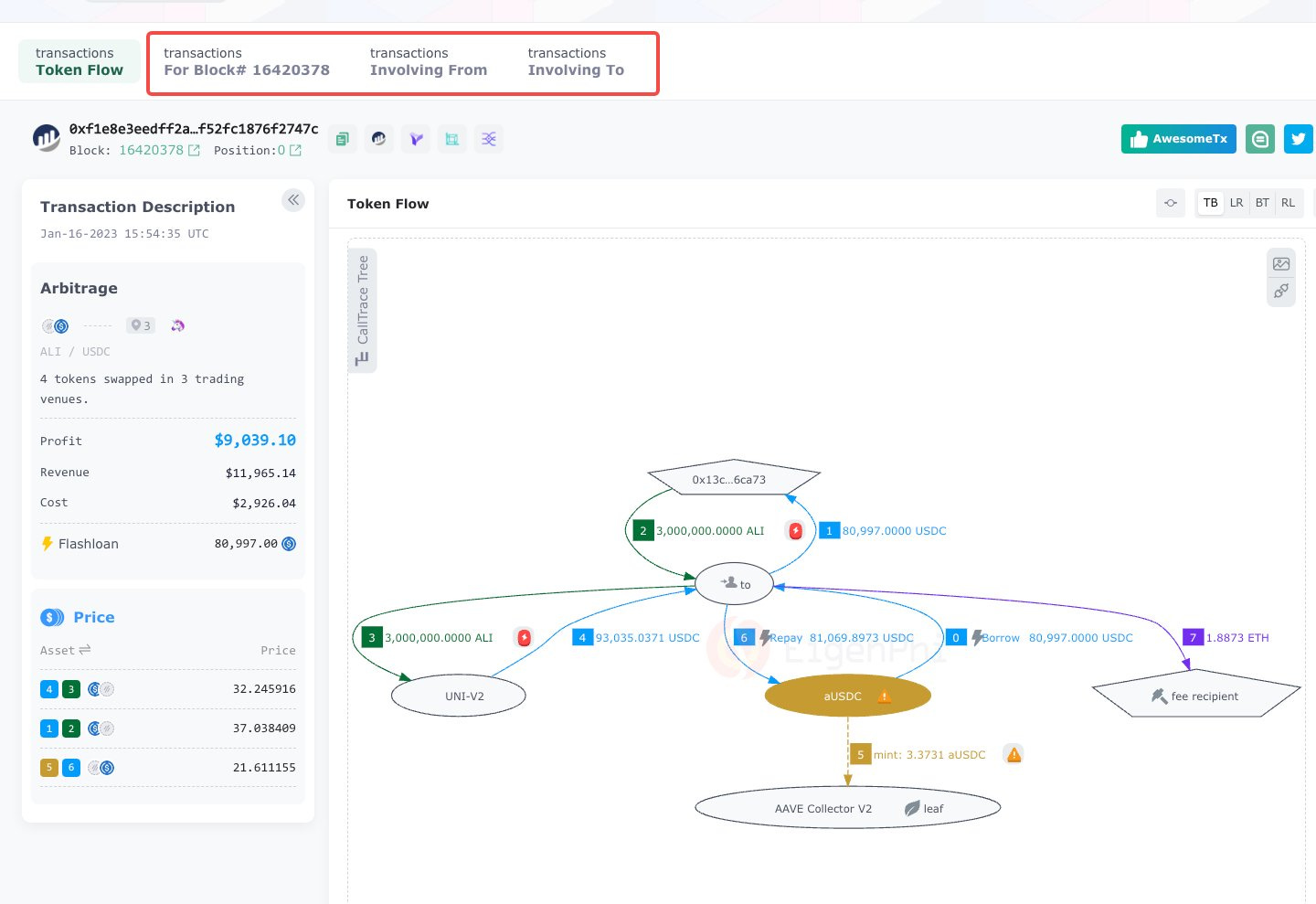

We also upgraded the Related Tx pages by adding new filter features. Now you can easily select tx methods, block numbers, from & to dates, and from & to hash addresses.

The Related Tx pages also allow you to:

list all the tx in the same block.

check out all the #MEVs started from the same "from address"

dig into all the arbs and liquidations sending 💰 to the same "to address."

On April 13, EigenPhi’s Data Scientist Sophie Liu shared our insight on the impact of MEV and the risks of market liquidity manipulation at the Hong Kong Web3 Festival, based on EigenPhi’s systematic research data about the MEV market.

You can download the highlight document here.

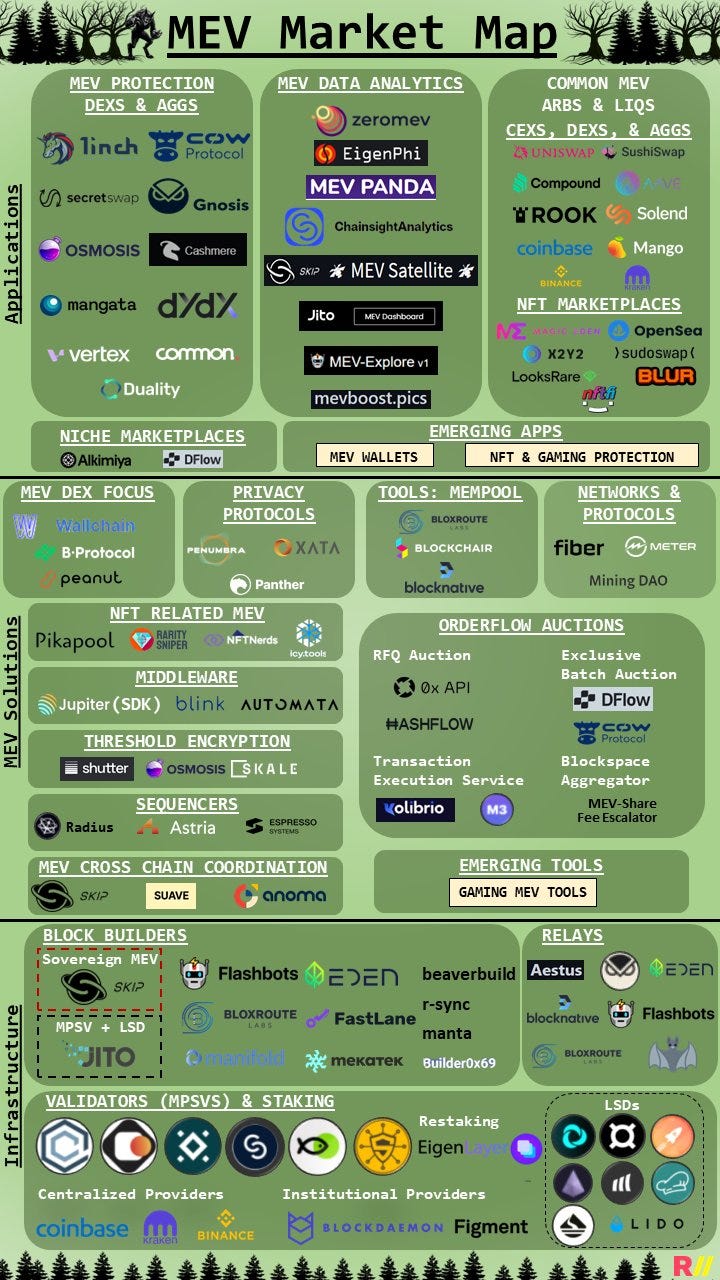

Here’s the MEV Market Map summarized by @analyticalali, who categorized the MEV Stack on three layers: 1) Infrastructure Layer; 2) Solutions Layer; and 3) Application Layer. EigenPhi was placed in the application layer. We provide analytical tools detailing MEV and liquidity on-chain data, as well as bespoke research for analysts, researchers, institutions, traders, protocols, and stakeholders.

You can also read the full article by @analyticalali here.

Market Overview

Performance of MEV Types

Hot Token & Hot LP

TOP 6 Hot Tokens (by trading volume):

WETH ($882,553,817.86)

USDC ($644,347,190.75)

USDT ($515,420,176.15)

WBTC ($119,945,377.32)

DAI ($67,077,601.26)

wstETH ($55,284,132.60)

Hot Liquidity Pools (by trading volume)

Follow us via these to dig more hidden wisdom of DeFi: