Weekly Highlights: EigenPhi Teaming Up With DefiLlama Mitigating Sandwich - Week 12, 202

Last week, we released the MEV 2022 review video, analyzed the impact of Shapella upgrade on LSD and MEV, and held a Twitter Space with MEV experts.

EigenPhi is partnering up with DefiLlama! The collaboration aims to provide traders with alerts and warnings about potential MEV attacks, allowing them to make informed decisions while trading on DEXes. EigenPhi is taking steps to combat MEV by leveraging real-time data and analysis. We are really glad to see that EigenPhi is creating value for users and continuing to contribute to the positive development of the DeFi space.

On March 19th, we released the video "Ethereum MEV 2022 Performance Review: The Secret Powerhouse of DeFi." It takes you on a fantastic trip on MEV and shows why MEV was the hidden powerhouse of DeFi. We uncovered the methods MEV used to generate nearly 50% of the entire trading volume on DEXes, as well as how MEV searchers are able to profit from activities such as arbitrage, sandwich attacks, and liquidation. We also delve into how the rewards from MEV are distributed, and how the recent Merge has impacted the revenue for Ethereum's block builders.

The Shanghai-Capella upgrade hits the Ethereum mainnet on April 12 — this EIP will allow validator staking withdrawals on the main network. The upgrade will significantly impact Liquid Staking Derivatives (LSD). After The Merge, Ethereum shifted from POW to POS. Liquidity staking allows users to deposit ETH to the validator, and in return, the users receive LSD and regular rewards. After the Shanghai upgrade, users can burn their LSD tokens and withdraw their deposited ETH, creating a massive change to the LSD market. As a result, we expect the trading volume of LSD on Ethereum will significantly increase, creating more MEV opportunities. This article will look closely at MEV opportunities in the last few months and provide predictions regarding future MEV opportunities.

What are the most important MEV metrics? In 2022, which events are the most impactful ones about MEV? What is Order Flow Auction, and how to prevent the Payment For Order Flow like the Citadel scenario? On Mar 23, EigenPhi invited MEV mega brains from 0x, bloXroute, Curve, Galaxy Digital, and Nomad to give their takes on these questions. You can hear the recording via the tweets below. We will publish the highlights pretty soon.

The Arbitrum $ARB Airdrop was officially LIVE on March 23rd. There were 625,143 addresses eligible to claim an airdrop that was worth 1.162 billion in total. As we all know, it could be an unpleasant experience for some users as the website crashed down for hours, causing worries in the market. The price of $ARB was fluctuating and it was hard to track the address of holders. EigenPhi is here to help by visualizing $ARB transactions with our EigenTX Chrome Extension(https://bit.ly/3RnUOUp).

Market Overview

Performance of MEV Types

Hot Token & Hot LP

TOP 6 Hot Tokens (by trading volume):

WETH ($2,420,695,430.69)

USDC ($1,505,978,077.69)

USDT ($1,047,088,705.87)

WBTC ($460,021,153.34)

DAI ($293,994,047.19)

HEX ($107,401,907.08)

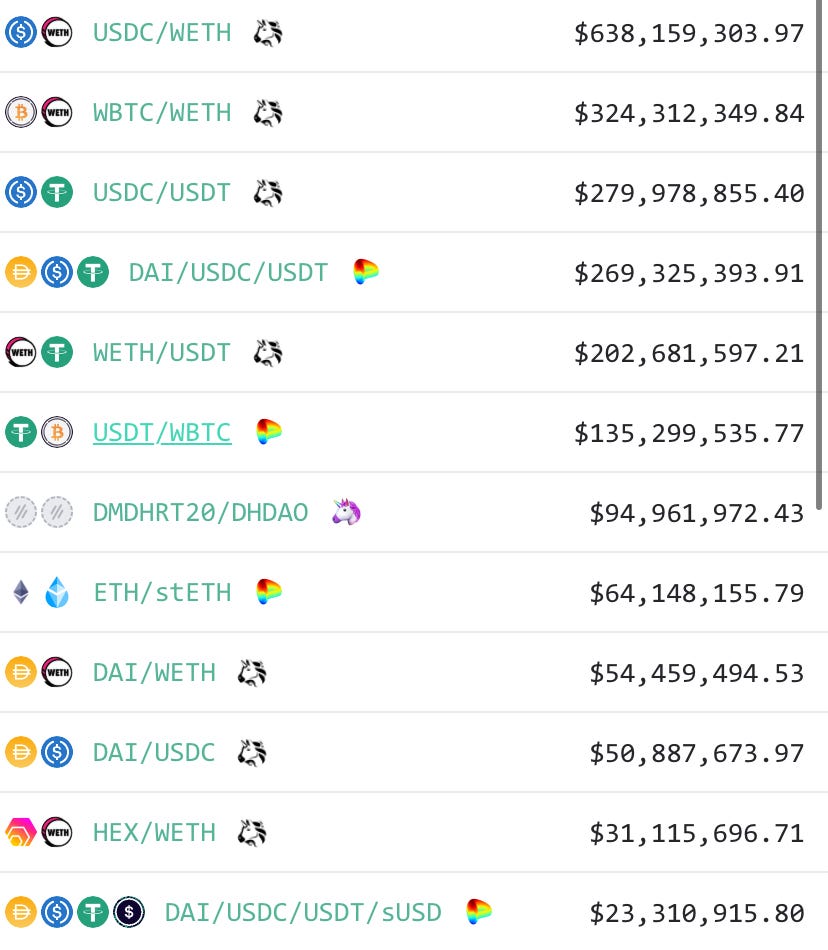

Hot Liquidity Pools (by trading volume)

Follow us via these to dig more hidden wisdom of DeFi: