Week 16-17 Highlights: Multi-tx Token Flow, and Consensus Side Event

This Bi-Weekly Digest highlights the side event we co-hosted with bloXroute, our DeFi Partnerships, and the just released multi-tx token flow feature.

MEV Side Event at Consensus 2023: Latency Matters

On April 26, bloXroute and EigenPhi co-hosted the "MEV Past, Future, and the Present - Why Latency Matters" side event at Consensus 2023 in Austin, Texas. The engaging discussions revolved around Maximal Extractable Value (MEV) and its effects on the DeFi ecosystem while providing insights into MEV data from the past, present, and future. Over 250 people registered for the event, and more than 90 attendees actively participated in the conversations. As a result, guests understood the significance of latency in blockchain and DeFi applications and had the opportunity to network with fellow enthusiasts and industry leaders. The video will be released this week.

DeFi Reputation and Trust: Orange Protocol and EigenPhi Partnership

Orange Protocol, a DeFi reputation and trust minting protocol, has partnered with data analytics firm EigenPhi to integrate MEV and liquidity data analysis solutions as a data source provider. This collaboration will enable Orange Protocol users to identify and avoid malicious actors and risky transactions, thereby enhancing the reputation and trust within the DeFi ecosystem. Our shared goal is to boost transparency and security in the decentralized space, ultimately benefiting all DeFi stakeholders.

Sandwich Attacks: Profiting from the Dark Forest

Using data from EigenPhi, Bloomberg reported that on April 18, an anonymous trader under the digital wallet moniker "jaredfromsubway.eth" grabbed headlines in the DeFi space, amassing significant profits through a trading strategy known as sandwich attacks. By manipulating token prices on DeFi apps using trading bots, the trader netted an estimated $1.67 million in just two days. Although the strategy has generated nearly $4 million in the past month, it comes with high costs, as the trader spent around $1.3 million on transaction fees within 24 hours.

Stay in the Loop with EigenPhi's Latest Update

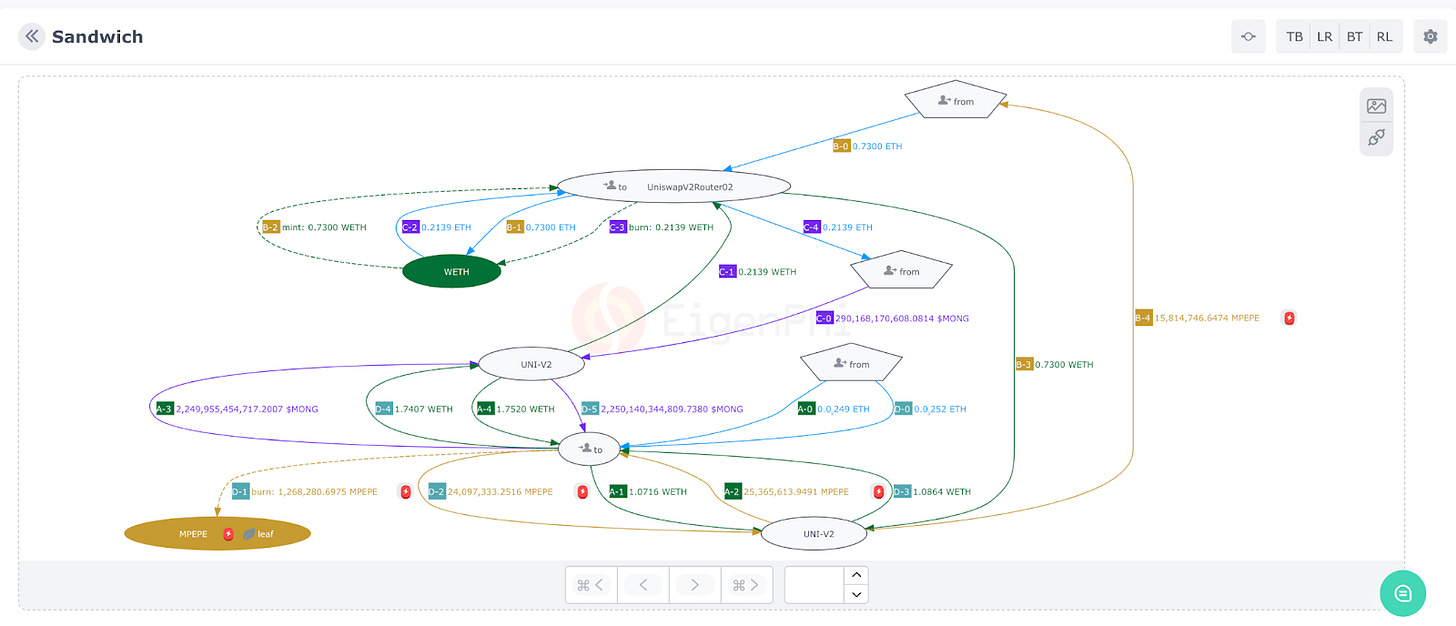

In response to the infamous "jaredfromsubway.eth" trading strategy, EigenPhi has introduced the EigenTx multi-tx merging feature, offering a comprehensive transaction visualization and block number search function. With distinct colors, numbers, and labels to differentiate various trading strategies, users can quickly analyze attackers' and victims' tactics. In addition, our complete transaction information charts provide a convenient way to view multi-txs, including MEV data, all in one place!

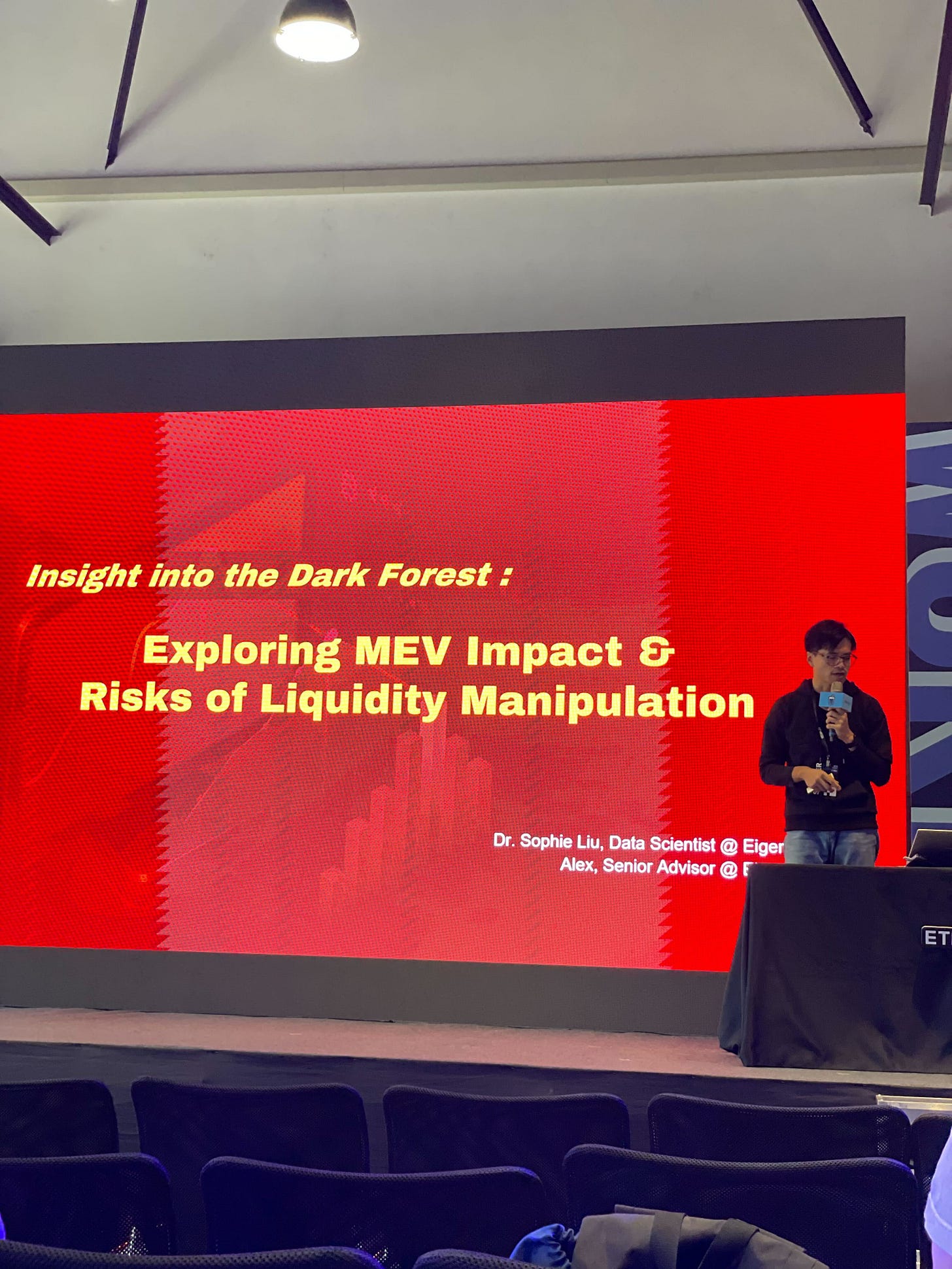

ETHTaipei: Exploring the MEV Impact and Risks of Liquidity Manipulation

On April 25, Alex, Senior Advisor at EigenPhi, presented the team’s insights on the impact of MEV and the risks of liquidity manipulation at the "Insight into the Dark Forest" event. They explored MEV trends in 2022, predictions for 2023, long-tail MEVs, and the theory of tokenomic trilemma concerning risk events, offering valuable knowledge to all market participants.

Missed our presentation? Don't worry; we've got you covered! Check out the must-read slides!

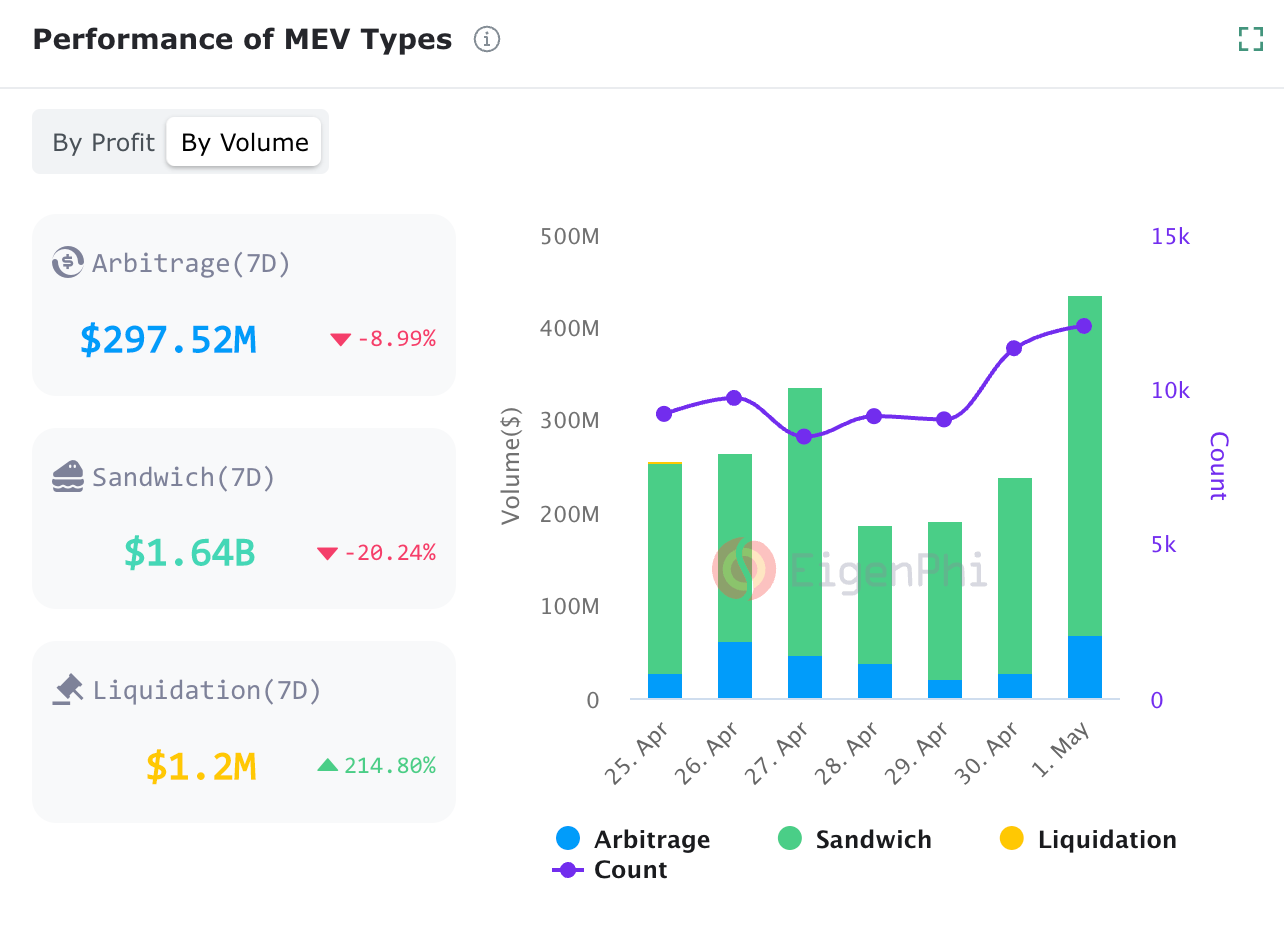

Market Overview.

Performance of MEV Types

Hot Token & Hot LP

TOP 6 Hot Tokens (by trading volume):

WETH ($1,308,735,502.40)

USDC ($729,531,992.28)

USDT ($519,842,681.05)

PEPE ($255,863,985.99)

DAI ($93,063,753.85)

WBTC($83,116,577.29)

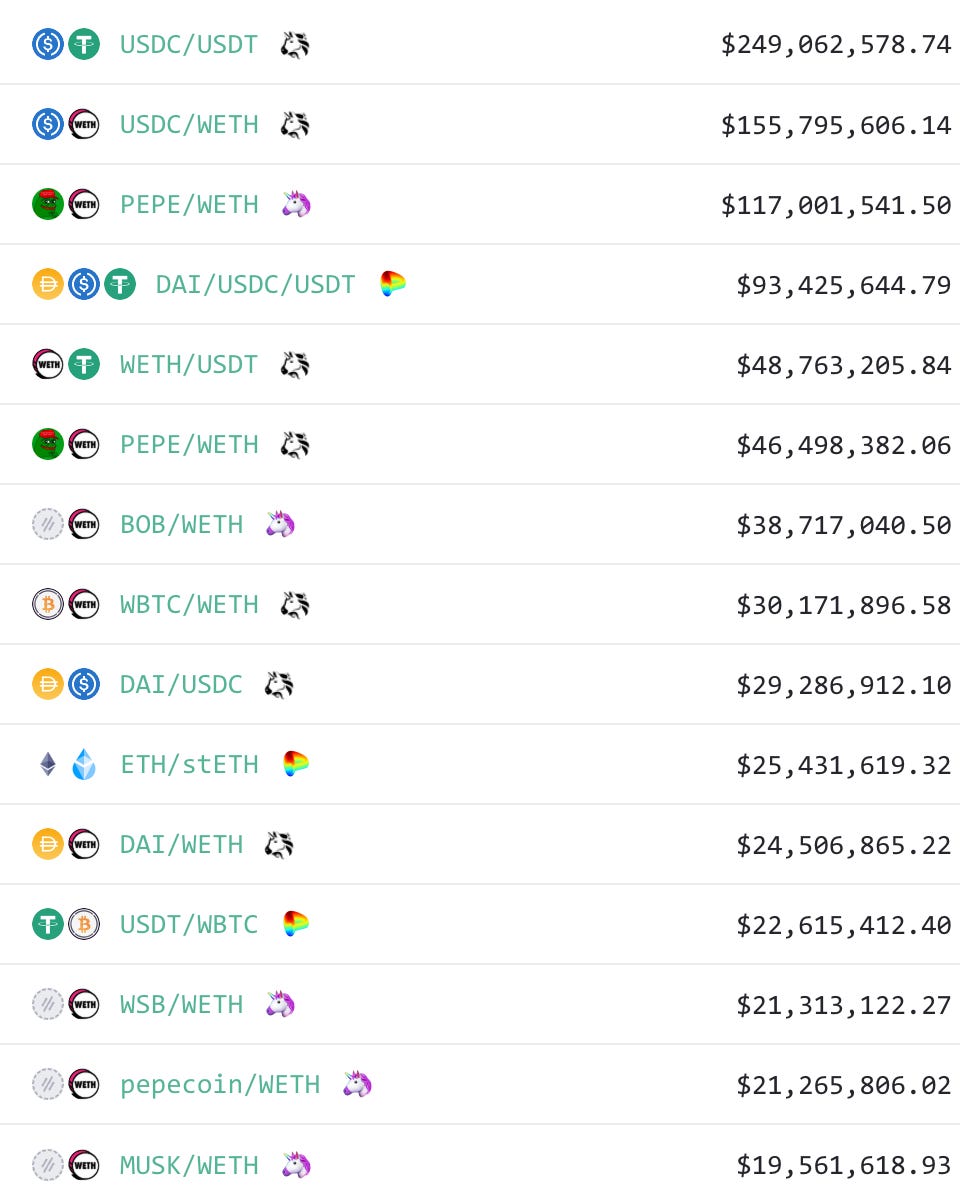

Hot Liquidity Pool (by trading volume)

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram