The cascading freezing effect of the market crash has extended to one of the most active investment firms: Three Arrows Capita, known as 3AC. On Wednesday, 20 forced liquidations, leading to being the victim of sandwich arbitrages due to assets sell-out to avoid future liquidations and potentially resulting insolvency, put the company’s future into question.

$61M Liquidation

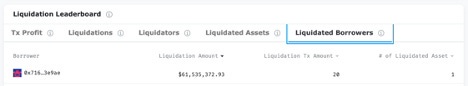

According to EigenPhi’s Liquidated Borrowers leaderboard, during the last few days, this address belonging to 3AC has suffered 20 liquidations with a total amount of over $61M.

Helping you to put that into perspective, EigenPhi’s data shows that the overall liquidation amount of the same period is about $251M, which means 3AC’s asset sale accounted for 24% of the total.

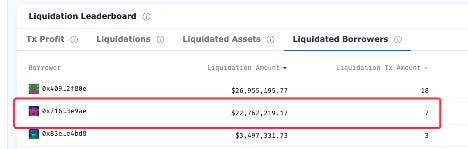

Who’s benefit from the auctions? Check out the No.1 liquidator’s detail page, and you can find at the bottom its connection to the 3AC address: a total of 7 liquidations for almost $23M.

The biggest profit of this liquidator is also out of the pocket of 3AC.

Click the row above, and you can examine the details below.

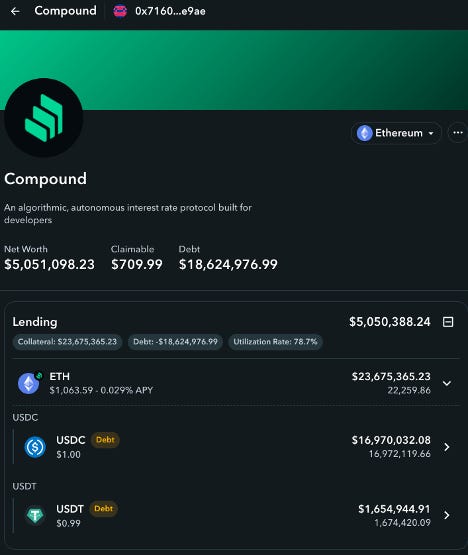

You will find the same pattern among other top liquidations as well and expect more to come. Why? Take a look at the address’ portfolio on Zapper.

As of writing, June 15, 14:19 AM EDT, this address’ net worth is $5.05M with a debt of $19M.The other address’s net worth is $6.88M with a debt of $19M.

4 Not-So-Delicious Sandwiches

Facing such urgency, all the investment firms would do the same thing as 3AC: strengthen its position, even at discount prices. For example, it swapped 30,000 stETH for 28,340 ETH via this transaction.

But, on the open blockchain, it’s easier to forget who’s lurking around when you are in a hurry.

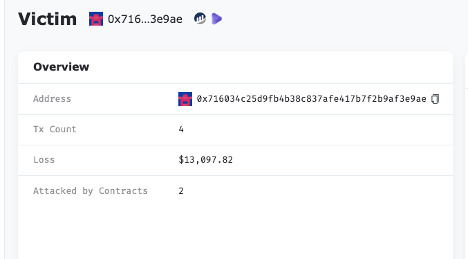

The address above has become a victim of Sandwich attacks during the last 2 days. The specifics are as follows.

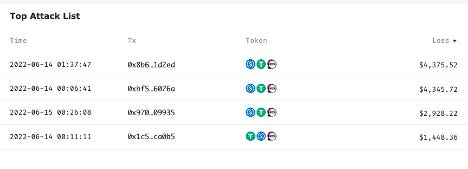

Open https://eigenphi.io/ and paste the address in the search box. You will be directed to the victim page. We can tell it had suffered 4 attacks with the loss of $13K.

The four attacks are listed below.

How did the attack happen? Click the arbitrage address, and there you go.

The victim tried to sell 1,999 WETH for USDT and became the recipe of a sandwich employing about $377K worth of assets.

Under similar onslaughts, the address eventually suffered a total loss of $13K.

Of course, this loss means nothing compared to the possible insolvency 3AC is facing.

Insolvency for real?

Having 22K $WETH in Compound is keeping 3AC safe for now.

However, if the price of ETH keeps dropping and reaches about $1,018, according to DeFi Analyst @DeFiyst, everything will crash for 3AC. Considering the systematic risks combined with the status of Celsius, that is definitely not the result we want to see.

For more real-time liquidation and sandwich frontrunning data, visit https://eigenphi.io/.

Follow us via these to dig more hidden wisdom of DeFi: