Unraveling the Curve Vyper Exploit and Chain-Reaction Arbitrages: A Comprehensive Storyline by EigenPhi

Understand this havoc and the arbitrages amid it with us!

The ever-evolving DeFi landscape is complex, often leading to unforeseen vulnerabilities such as the recent Curve Vyper exploit. Utilizing our robust big data analysis tool, EigenTx, we dissect this event, unraveling its implications for traders, protocols, and the broader ecosystem. Here, we wrap up this event for you.

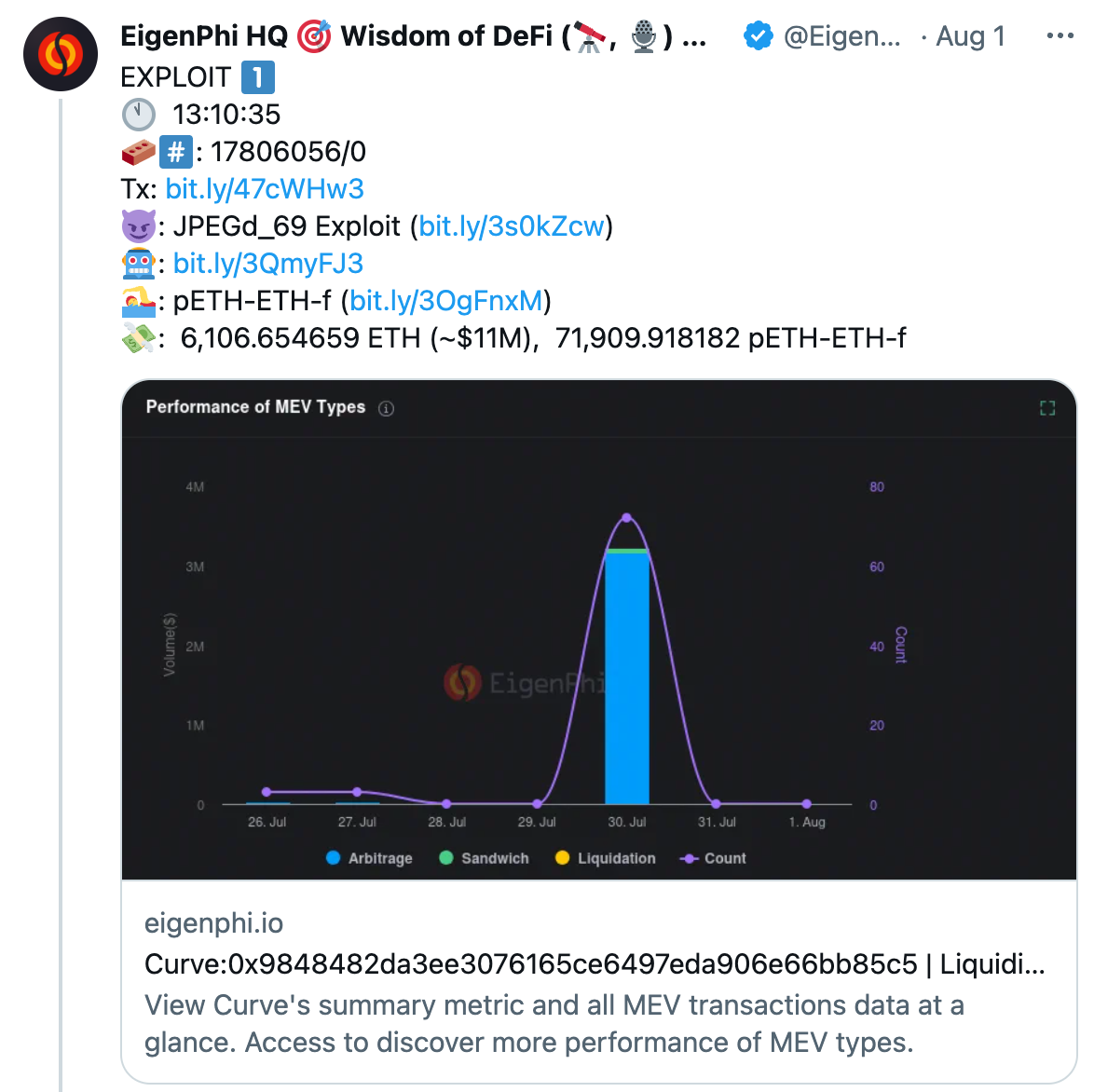

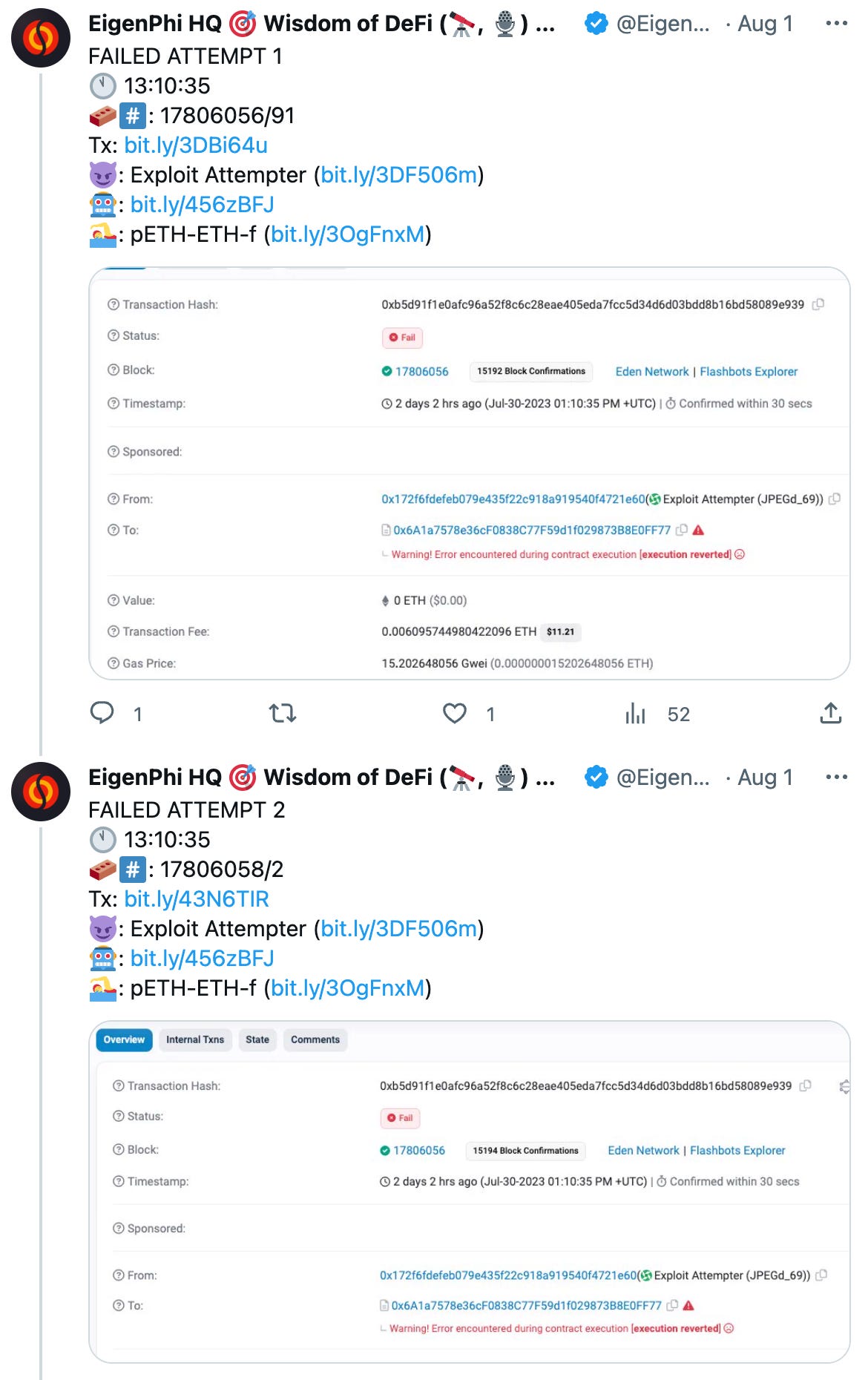

1. Timeline of Curve Vyper Exploit

We combed the timeline of these attacks 1 by 1 in this Twitter thread.

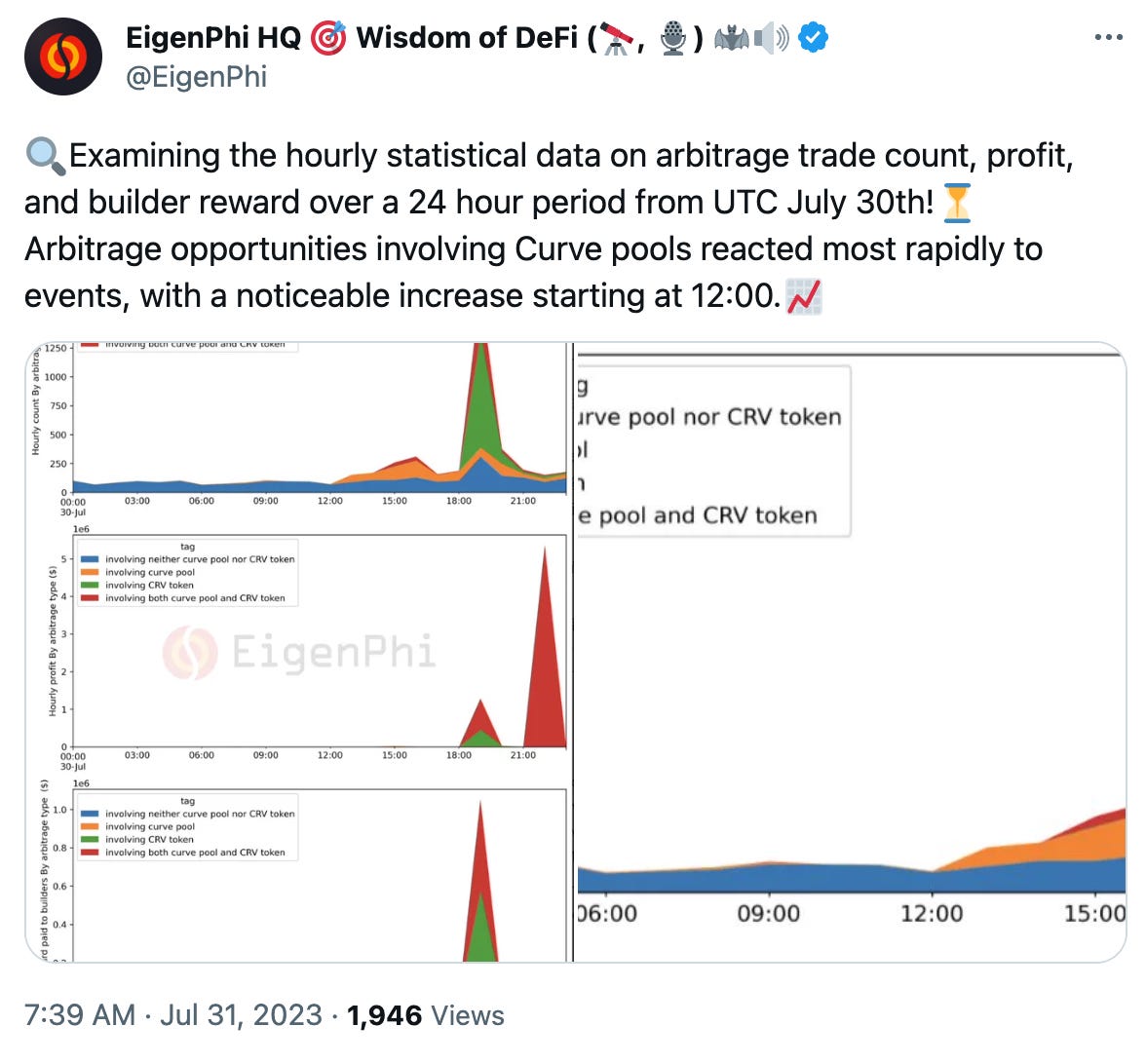

2. Hourly Breakdown

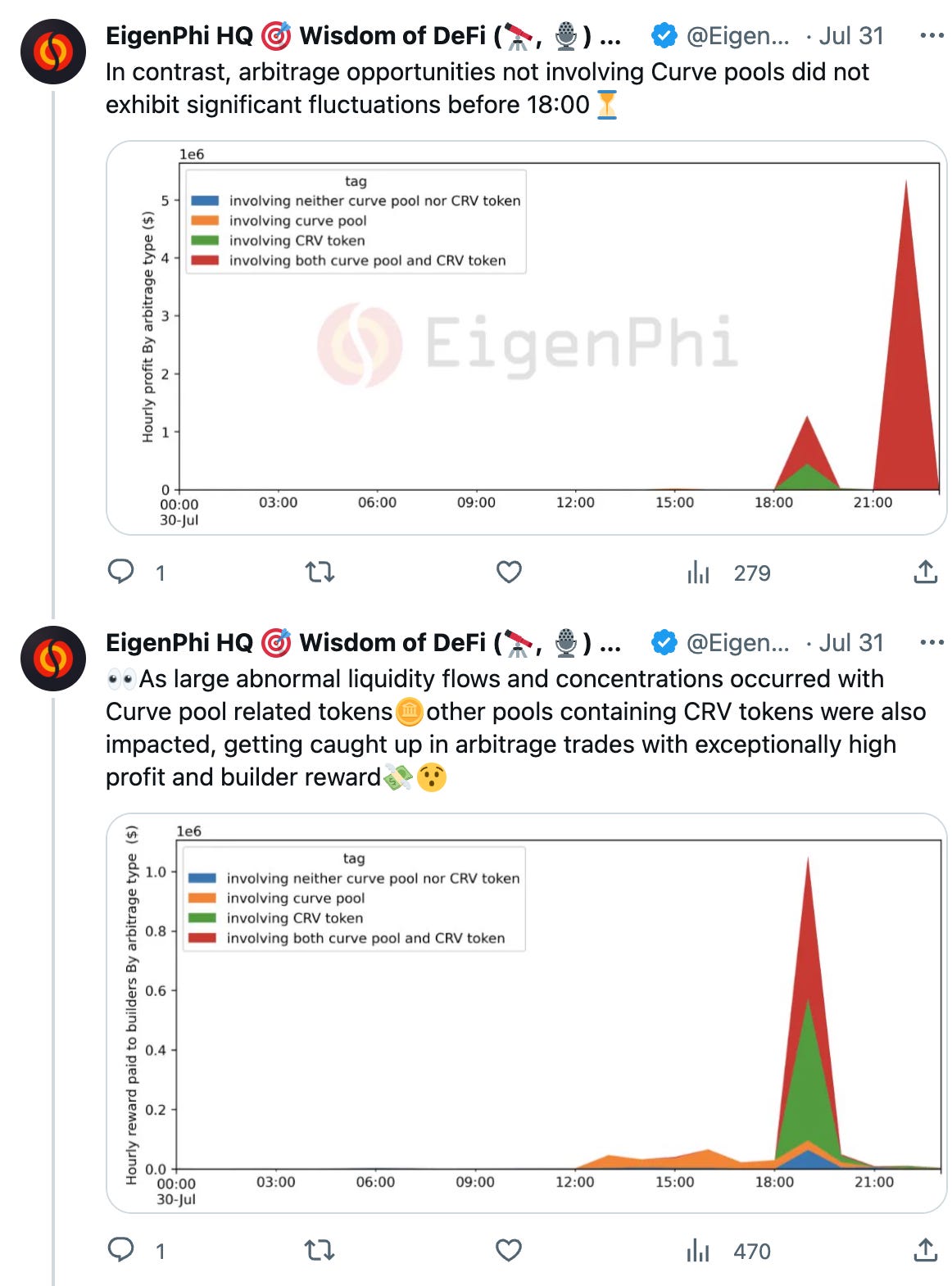

In the immediate aftermath of the exploit, we provided an hour-by-hour statistical snapshot highlighting transaction volume, gas fees, and other key metrics within the Curve Vyper protocol.

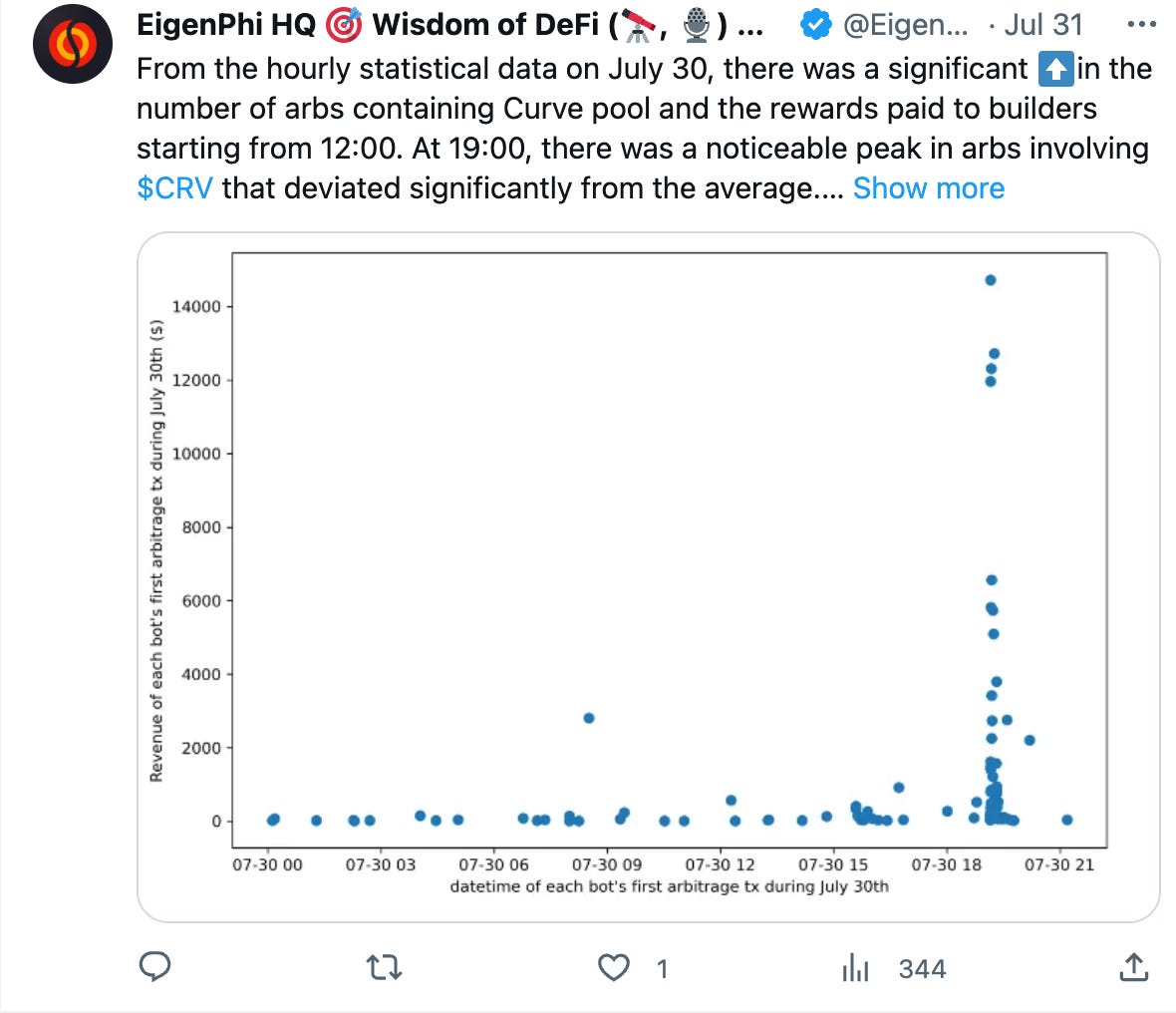

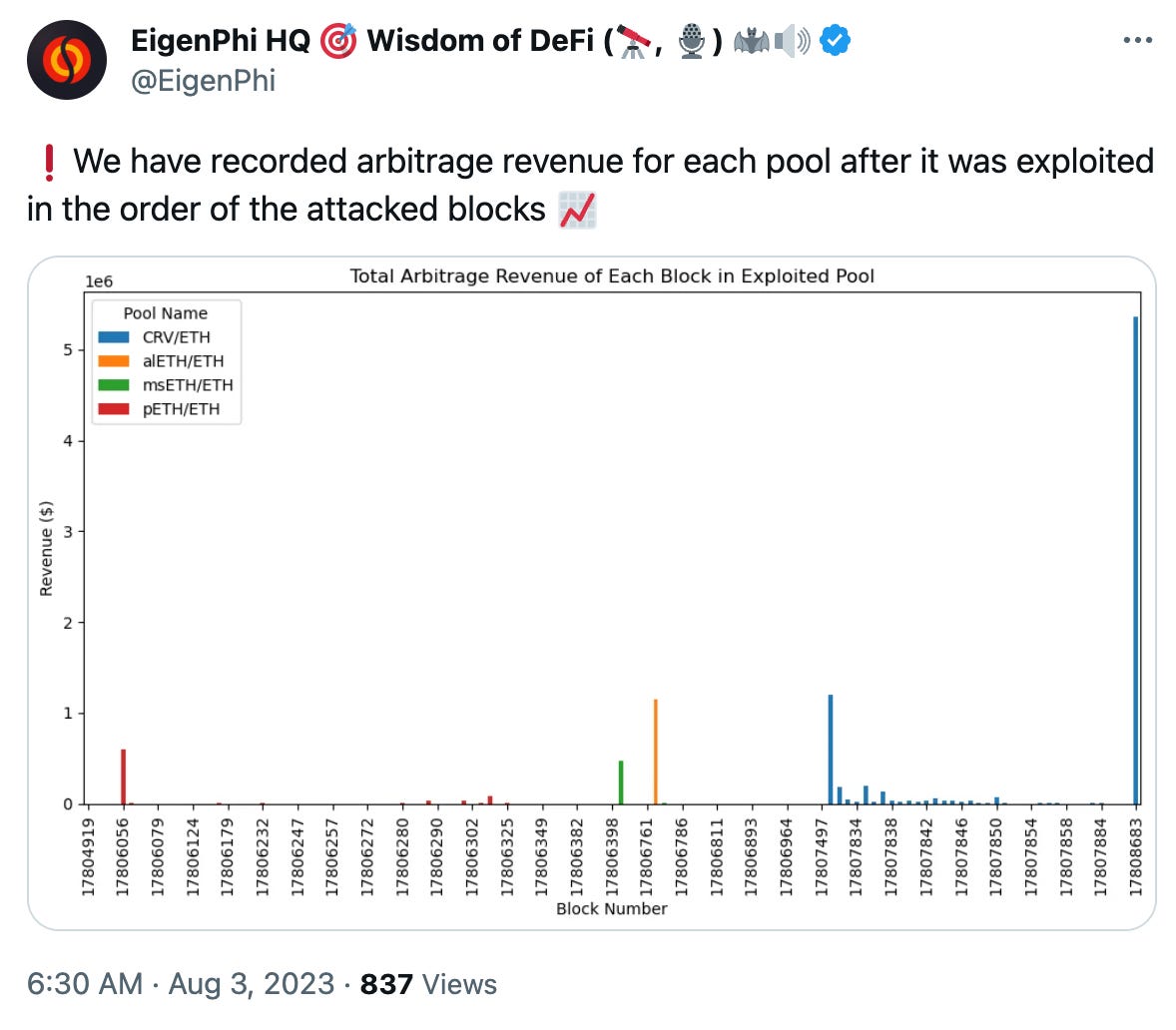

3. Arbitrage in the Wake of the Exploit

In the aftermath of the exploit, swift arbitrage actions were observed across the crypto market. We traced these actions, providing valuable insights into the immediate financial repercussions of the exploit.

4. A Deeper Examination of 0xc0ffeebabe.eth's $5.4M arbitrage

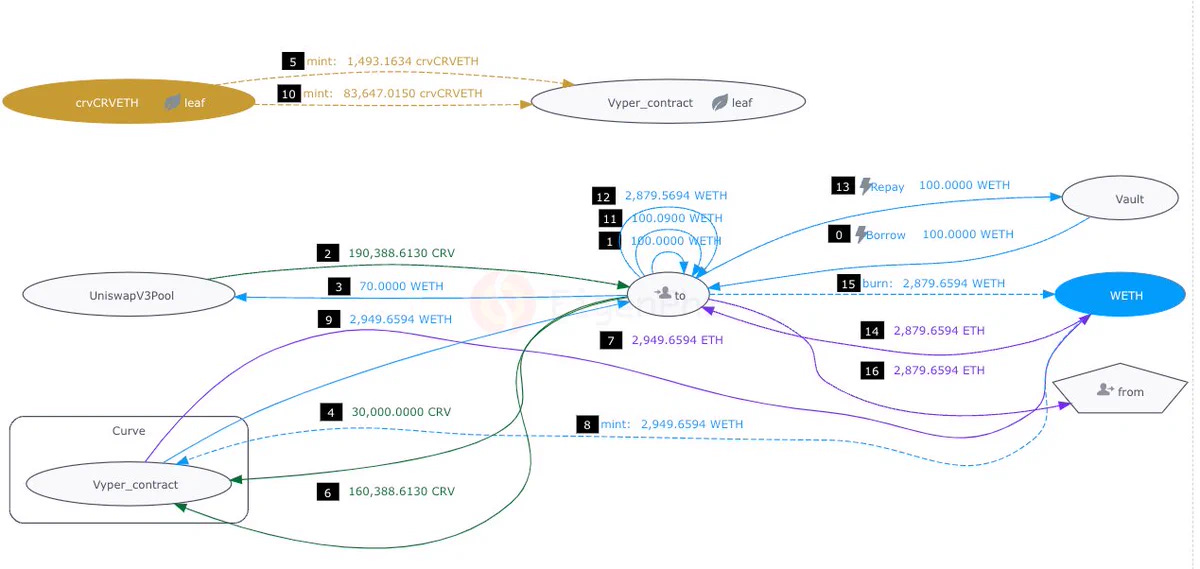

Whitehat c0ffeebabe.eth did a wonderful job protecting the assets of CurveFinance. Meanwhile, it's super important to understand the attacking vector here to prevent future malicious attacks.

This post on Substack examined this arb step by step:

The Great Arbitrage, the Great Curve Escape Thanks to the Great Whitehat

The Vyper’s vulnerability derived an arbitrage with a $5.4M profit, topping 2022’s over $3.2M back-run. The searcher has an insight that after the reentrancy attack, there could be a massive discrepancy between the exploited contract's internal accounting status and the real remaining balances.

Another thread gives you the bigger picture of what c0ffeebabe.eth had done on the day of 30th July using her bot.

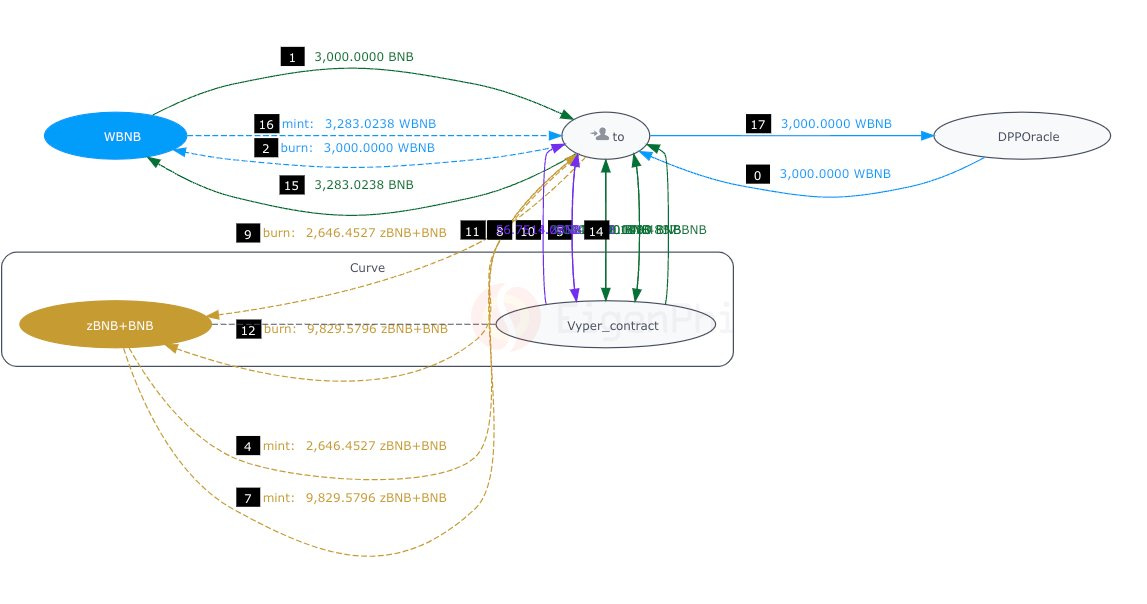

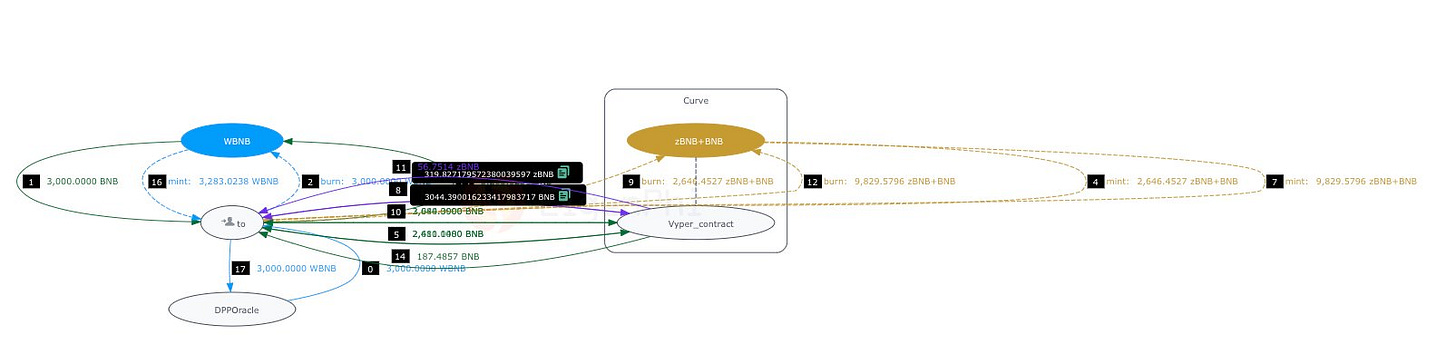

5. BNB Chain was not safe as well

We have located one attack on ellipsis.finance, with a loss of 283 $WBNB. https://bit.ly/43S5ukq, shown here in two different flow chart directions.

6. A Video Playlist: Unpacking the Exploit

Our YouTube channel hosted a video guide illustrating using EigenTx to dissect and understand such exploits.

The guide, designed for both technical and non-technical audiences, aided in the comprehensive understanding of the exploit's technical and financial facets.

Video1: How to find out arbitrage opportunities due to the curve vyper exploit?

Video2: How to find out the builder received 158 ETH from MEV bot from curve exploit?

Video3: How to find top arbitrage strategies by MEV bot back-running curve hacking?

Video4: How to find out the arbitrage MEV bot paid 158 ETH to Rsync Builder?

Video5: How to find out how many EOA wallets benefit from the arb MEV bot in exploit?

Start from this!

7. Meta-Analysis: Collating Community Perspectives

For more information and analyses about this event, we prepare a wrap-up thread for you here! We curated a meta-list of these diverse discussions, providing a more rounded view of the exploit and its implications.

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram | EigenTx