Transaction Observability: Forget Top-of-Block Biddings; Back-of-Block MEVs On Private Order Flow are Moving Validators’ Cheese

Builders' privilege gives some of them the advantage of back-running exclusive private order flow being sent to these integated searcher-builders.

The MEV communities understand how crucial Top-of-the-Block bidding is, as it enables arbitrageurs to back-run transactions in the last block, causing price discrepancies between trading venues. However, an increasing number of people are noticing how the searcher-builder integration is transforming the MEV landscape, leading to back-running within the same block after signal transactions.

Monoceros's comprehensive report about OFA suggests the emergence of the BOFA(Builder-oriented Order Flow Auction) design. Builders can run “their own proprietary MEV strategies that extract value by inserting new transactions, reordering and merging bundles.”

Blair Marshall of Blocknative found a bot doing the same block back-running. He tweeted: “Since bundles are typically first, then most builder algorithms will place a reverting tx deeper in a block, but this is what the bot wants since it is backrunning the block,” which prompted Flashbots’ Robert Miller’s response.

danning.eth also acknowledged: “Introducing MSS for all atomic End-Of-Block searcher-builder: Merging Searching Separation.”

Even Rsync revealed the same kind of strategy in the Scraping Bits podcast.

The latest research on MEV Supply Chain by Uniswap has a clear message: Trust but Verify. The EigenPhi research team conducted this study, providing a perfect means to verify if you should trust your private order with some current builders. Of significant note for validators, the supply chain's value stands to be redistributed.

Privilege Unveiled: The Battlefield on Transaction Observability

By Sophie Liu, EigenPhi Research

Key Takeaways

Ethereum transactions have shifted their competitive focus from the order of transactions in a block to the observability of these transactions.

Builders receive private order flow and have the privilege of knowing which orders might appear on-chain in the next block. They integrate vertically with searchers to use this advantage and back-run private orders sent exclusively to them. Since builders are the only ones who can observe these exclusive private orders, back-running them could yield huge profits with significantly lower fees paid downstream in the MEV supply chain.

Searcher-builder vertical integration has also targeted OFA bundles. While OFA searchers must redistribute the MEV value, the Searcher-builder is not bound by the same rule.

Competitive bidding among searchers for the top block position directs a significant portion of the revenue towards builders and, subsequently, validators. However, the MEV market is transforming due to Builder-Searcher vertical integration. Previously, validators received most of the revenue, but now builders are using their privilege of private order flow to reclaim MEV flow from validators.

The current PBS system outsources the MEV-Boost and Replay designs, outsourcing consensus. In this system, builders receive bundles and transactions through their private RPCs, operating on a trust basis. However, there are no guarantees that builders will adhere to the gentlemen's agreement, avoiding practices like breaking bundles or engaging in front-running or back-running.

Introduction to Transaction Observability

A transaction on Ethereum can follow different paths:

it may either enter the public mempool, wait for inclusion in the next block by builders,

or travel through private channels to prevent front-running.

Transactions in the public mempool are widely observable and risk front-running, particularly with unreasonable slippage settings. In contrast, transactions via private channels have restricted visibility. While some orders sent to Order Flow Auctions (OFAs) are visible to a limited number of searchers, orders sent directly to builders' RPCs remain visible only to the block builders.

The level of transaction observability critically influences the flow of Maximum Extractable Value (MEV) through the supply chain—from searchers to builders and, ultimately, to validators. Public mempool transactions spark intense competition among searchers, leading to higher bribe payments to block builders and validators. Conversely, transactions with limited access through OFAs return some value to the orders. However, transactions being visible only to block builders eliminates the need for high bribes, as these orders are exclusively accessible to them.

EigenPhi's data indicates that, from October 15, 2023, to November 15, 2023, the market of atomic arbitrage generated $7.2 million in revenue. Notably, at least 18.5% of this revenue now comes from orders exclusive to builders, which bribe far less than others. This shift in MEV value results from the vertical integration of builder-searcher relationships, diverting value from validators.

Examples of Builder-Searcher Vertical Integration Using Builder's POF

The vertical integration of builder-searcher roles has sparked considerable debate. Builders enjoy the privilege of 'seeing' transactions before a block's creation, and they also receive information about the target block for private orders awaiting inclusion. When builders identify any private opportunities that could initiate an arbitrage transaction, they can send a back-run transaction to all other builders within the same block as the private order's target block. Suppose any builder includes the private order signal. In that case, they are also likely to include the subsequent back-run transaction, especially if the arbitrage transaction offers a significant tip to the builder.

Builders have exclusive visibility to several types of private order flow:

MEV searchers submit transaction bundles to builders. Except for some probabilistic searchers who don't use 'signals' and send the transaction to a public mempool, most MEV searchers, especially sandwich searchers, send their bundles privately to builders to maintain their "atomic" nature.

User orders go through OFAs and are bundled and redistributed by OFA searchers, which are sent privately to the builder's RPC.

Aggregators or Telegram bots, offering transaction protections, send user orders directly to the builder's private RPCs, ensuring private sandwich-free transmission.

We have observed the above private order flow, exclusive to builders, being utilized by searchers. Here are some examples:

Back-Run Builder’s POF From Telegram Bots

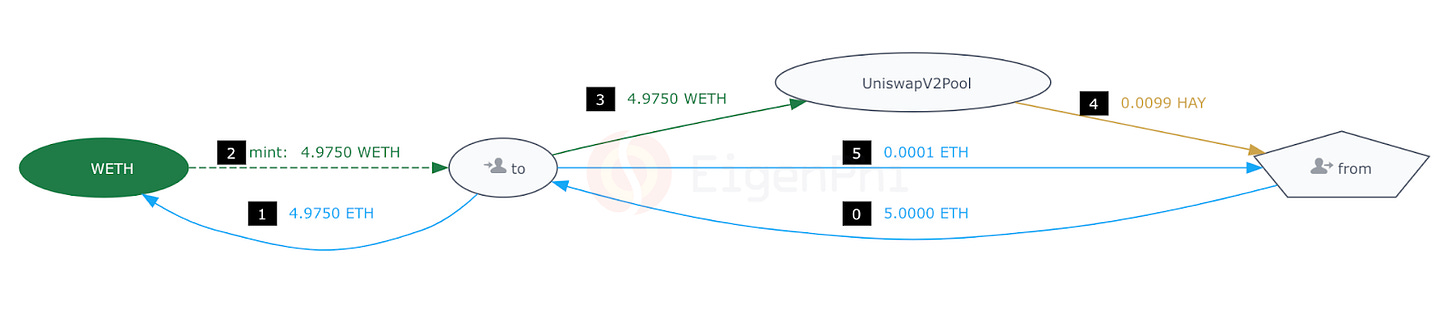

This transaction, originating from the Telegram bot ‘Banana Gun,’ does not appear in the public mempool (source: https://mempool-dumpster.flashbots.net/index.html). The bot has informed its users that it offers a service designed to prevent sandwich attacks, strongly suggesting that it routes its orders directly through the builder’s private RPCs. This transaction is positioned at number 3 within its block and aims to purchase HAY tokens using WETH.

However, a back-run transaction directly profits after it. EigenPhi identified this particular transaction, back-running the same pool that the Telegram bot used for exchange, and generated a revenue of $606. The arbitrage bot uses a simple spatial arbitrage strategy between UNI-V2 and UNI-V3 pools, a method common among many arbitrage bots. Typically, the median cost-revenue ratio for spatial arbitrage in UNI is around 99%. Yet, in this case, the cost-revenue ratio is about 11%, significantly lower than the usual rate. The cost-revenue ratio implies that other arbitrage bots likely didn't see the signal, enabling the bot to operate without competition and obviating the need for substantial bribes to builders.

This nuance raises the question of whether the bot must 'observe' the telegram bot’s signal that is only visible to builders to initiate the arbitrage transaction. To test this hypothesis, one could conduct a simple experiment. If we place this transaction before the user's transaction and simulate it, the result would be a reverted failed message.

The simulation suggests that there is no arbitrage opportunity between the two pools this bot uses when the last block is done, making it improbable for this arbitrage transaction to occur without detecting the signal.

It's crucial to note that the user sends a bundle to the builder, and the arbitrage transaction follows the user's transaction. While many builders exist in the market, only Flashbots disclose bundle information in their blocks. The absence of bundle information in this block complicates determining whether this user transaction is part of the same bundle as the back-run transaction. However, builders could unbundle the user transaction and then re-bundle it for dispatch, considering that the agreement to keep the bundle atomic is based solely on an informal agreement.

Back-Run Builder’s POF From MEV Searchers' Bundles

MEV searchers rely on a bundling mechanism. Sandwich searchers typically bundle front-run, victim, and back-run transactions in the required order.

Moreover, arbitrage searchers often bundle signals with back-run transactions to ensure both execute as planned. Generally, MEV searchers send their bundles to the builder's private RPC, making them visible only to the receiving builders. Here are some examples of how these searchers have used bundles from other MEV searchers for back-running.

EigenPhi labels Positions 0-2 as sandwich attacks in the mentioned block. Immediately following the sandwich bundle, an arbitrage transaction capitalizes on the pools under the influence of the sandwich.

Similarly, if you place this transaction before the sandwich bundle, it also reverts.

The searcher profits more than $1000 in a single transaction by back-running the sandwich bundle.

This block contains a back-run transaction using an arbitrage signal. Position 0 features a user transaction visible in the public mempool. Position 1 includes a typical arbitrage transaction with a bundle and back-run. Position 2 presents an arbitrage transaction that uses the arbitrage bundle as a signal. If one were to shift this transaction before the arbitrage bundle, it would fail and revert.

Here, we have the arbitrage transaction using a public mempool signal.

Here is the arbitrage transaction that back-runs the private signal.

A direct comparison of the costs associated with back-run transactions using similar strategies shows that traditional searchers pay 99% of their revenue, whereas the transaction relying on private signals incurs only 30% of the cost.

Back-Run Builder’s POF From OFAs

Here's another example of a signal visible only to the builder. This arbitrage transaction takes advantage of signals from an MEV-Share bundle, as Flashbots' API indicates. The MEV-Share bundle, originating from their OFA, remains invisible to ordinary searchers. However, this bot capitalizes on it to generate profit.

In the above example, the user who sends transactions to MEV Share successfully receives a portion of the MEV share in return.

Conclusion

In conclusion, Ethereum transactions are transitioning from competing based on transaction order to focusing on the observability of transactions. The Builder-Searcher vertical integration allows builders to 'observe' private order flow and back-run exclusive orders, thereby gaining significant profits while reducing fees paid downstream in the MEV supply chain. The current PBS system, based on trust, needs more solid verification that builders will stick to informal agreements. As MEV becomes a primary incentive for block building, the searcher-builder vertical integration will reshape the value distribution in the supply chain.

※ ※ ※

A big shout-out goes to the SMG team. We also extend huge thanks to Blair Marshall, Arthur Bagourd, and Eugene Chen for providing invaluable feedback!

Visit DeFi Strategies Case Studies by EigenPhi or bit.ly/head-first-defi to learn more trading tactic analyses.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram