Titan, Beaver, and Rsync Gave 85% of Rewards to Validators. How Are These Two Searcher-Builders Holding on to 50%?

Yoink and C0ffeebabe.eth maximize their monetization on MEV strengths.

Validators are one of the most important parts of the MEV Supply Chain. In the first nine months of 2024, validators extract 146.8K ETH, 75% of total builder rewards, including Priority Fees and Miner Tips. This conclusion, accompanied by the data we will explore below, can be discovered in our Builder Performance Analysis Dune Dashboard.

From January to September of 2024, builders earned 195,056 ETH as rewards. However, they had to pay validators 1467,787 ETH, accounting for 75% of the total.

This table shows individual builders who received more than 50 ETH rewards.

Unsurprisingly, Titan, BeaverBuild, and Rsync take the top 3 positions. A simple calculation shows that validators take 85% of their revenue while they build 74% of all the blocks.

In contrast, two searcher-builders have been enjoying the blessing from their unfair advantages: MEV Frontrunner Yoink, a.k.a. Builder “I can haz block?” who gives out 47.8% of their builder rewards, and c0ffeebabe.eth, who belongs to the same entity behind Builder “Ty for the block.” sending 54.2% of their earning to validators. Overall, Yoink and c0ffeebabe.eth only compensate validators 51% of their total income for their approvals.

The third lowest Validator Payout Percentage is from MEV Builder 0x3b, labeled Vanilla Validators. This entity has also been searching and gave 63.64% of its earnings to validators, as shown in our previous posts examining how they raked $3.5 million on Black Monday.

Next, we will show you how c0ffeebabe.eth employs its MEV power to push other builders out of competition for hundreds of eth rewards per block. And please feel free to check out our trilogy on MEV Frontrunner Yoink.

C0ffeebabe.eth’s Brewing Dominance

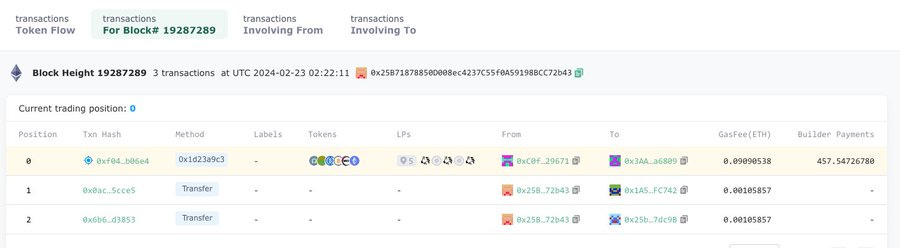

On Feb 23, 2024, Blueberry Protocol Foundation got exploited, resulting in a loss of 457 ETH, worth approximately $1.34M. The transaction, on Pos 0 of Block 19287289, was done by c0ffeebabe.eth, who sent the 457 ETH to the builder Ty For The Block.

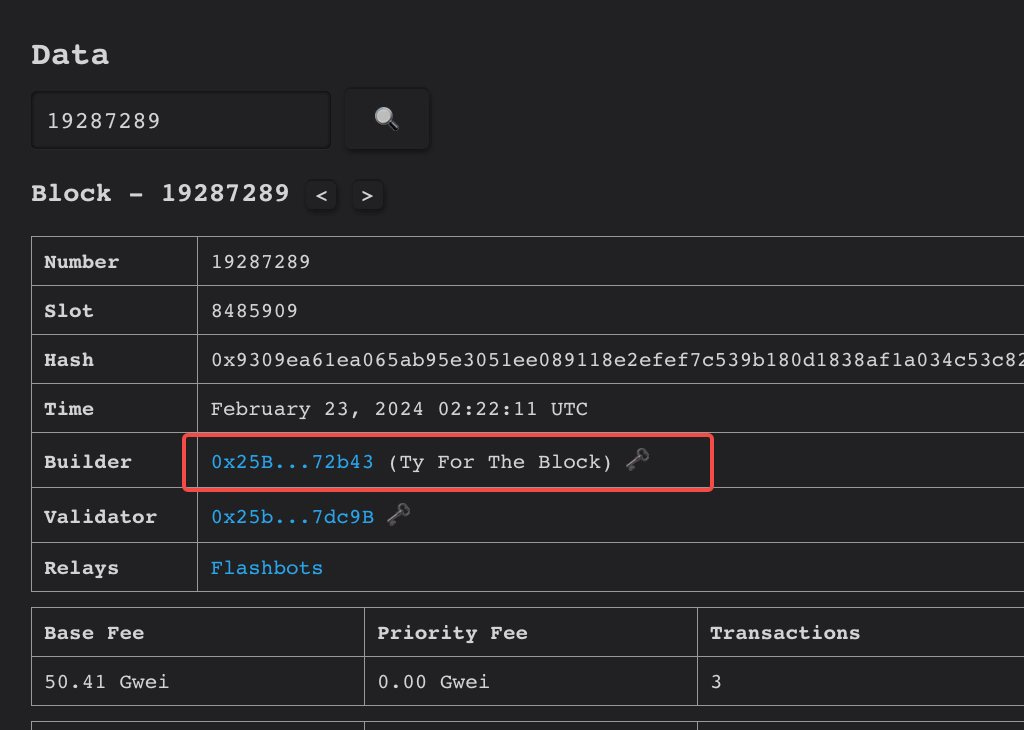

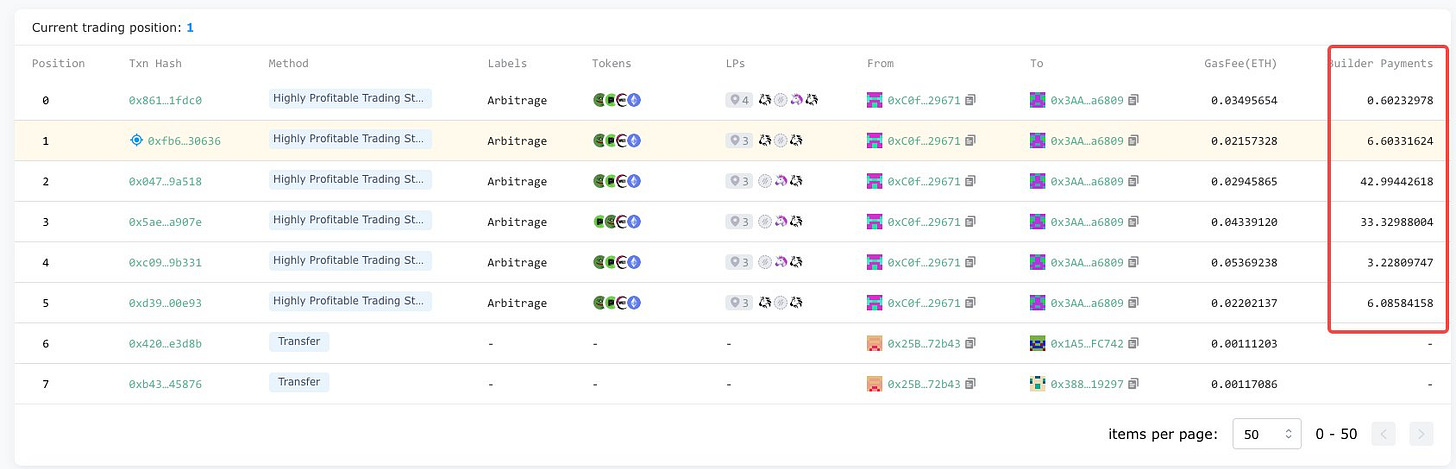

This is the block’s detail from Payload.de.

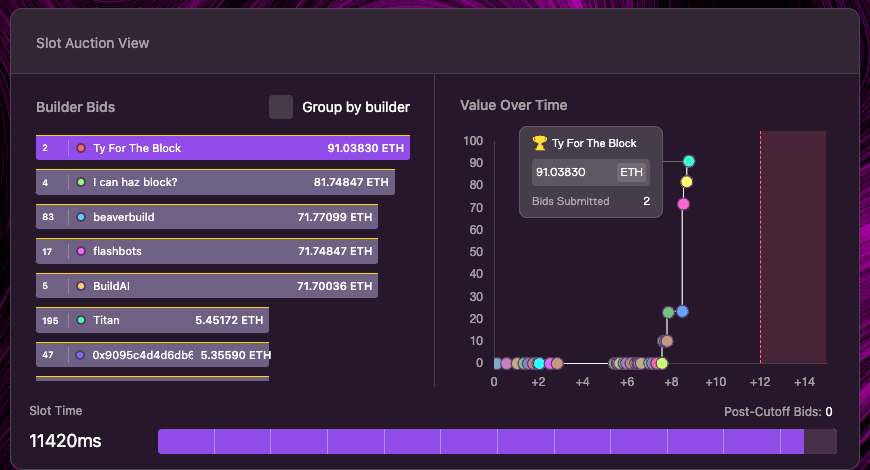

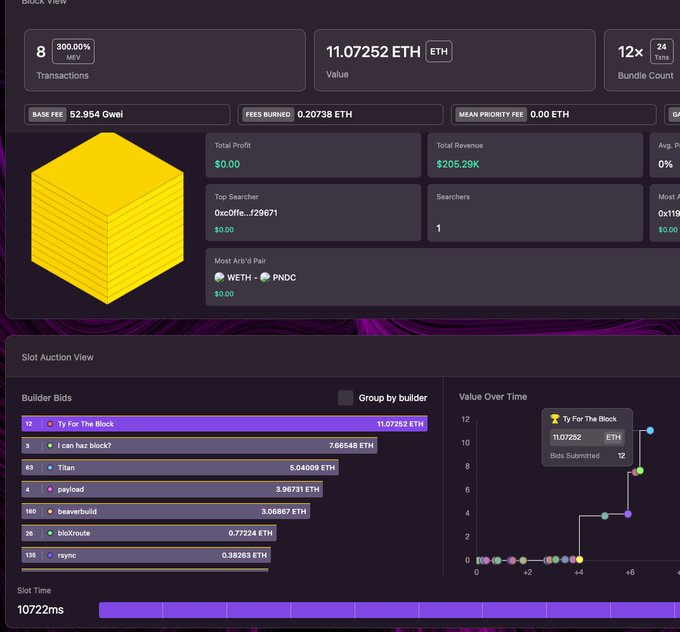

Sorella Lab displays the bidding process of the block.

This block only has three transactions. The left transactions are the builder address sending ETHs to c0ffeebabe.eth related EOAs. This is the block with the highest builder reward (priority fees + builder tips) for Ty For The Block from Jan to Sept of 2024.

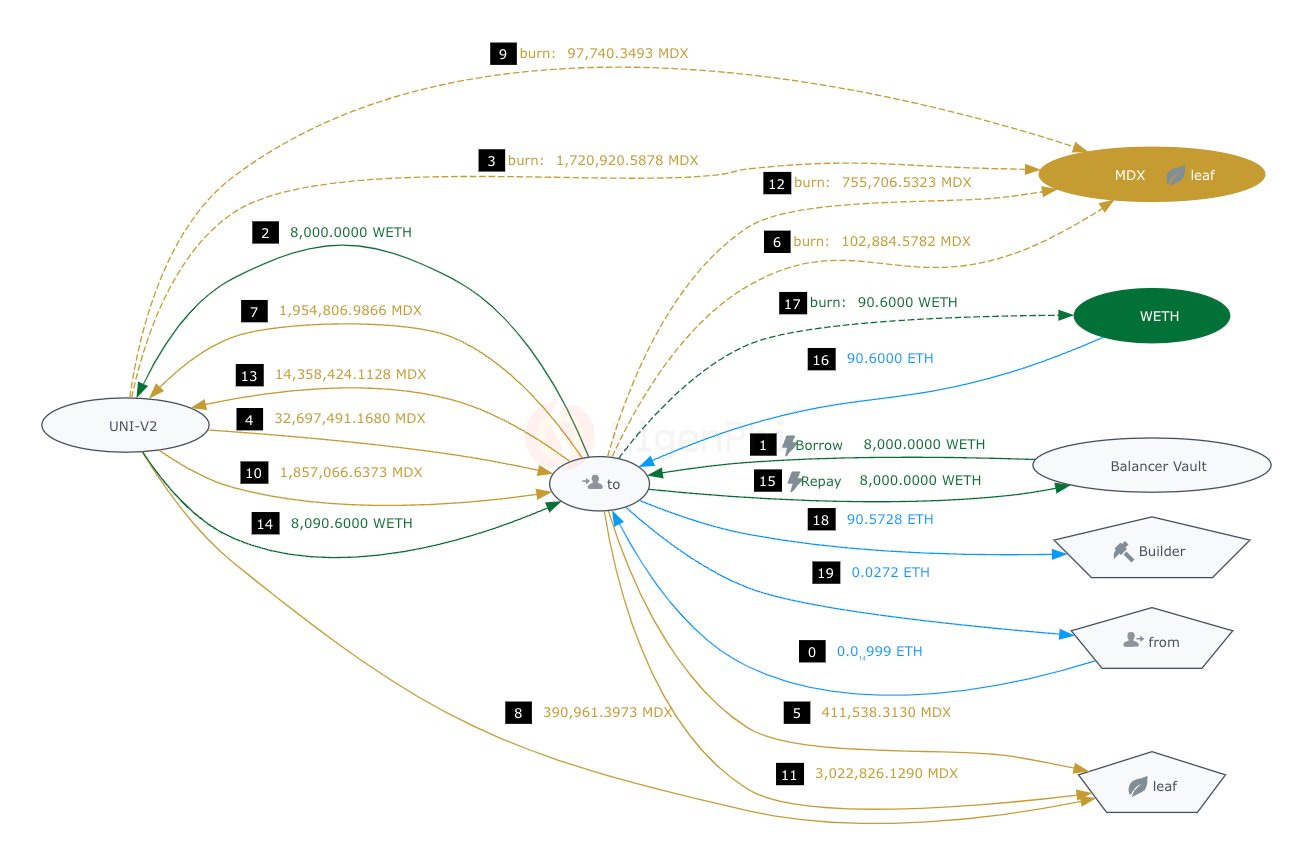

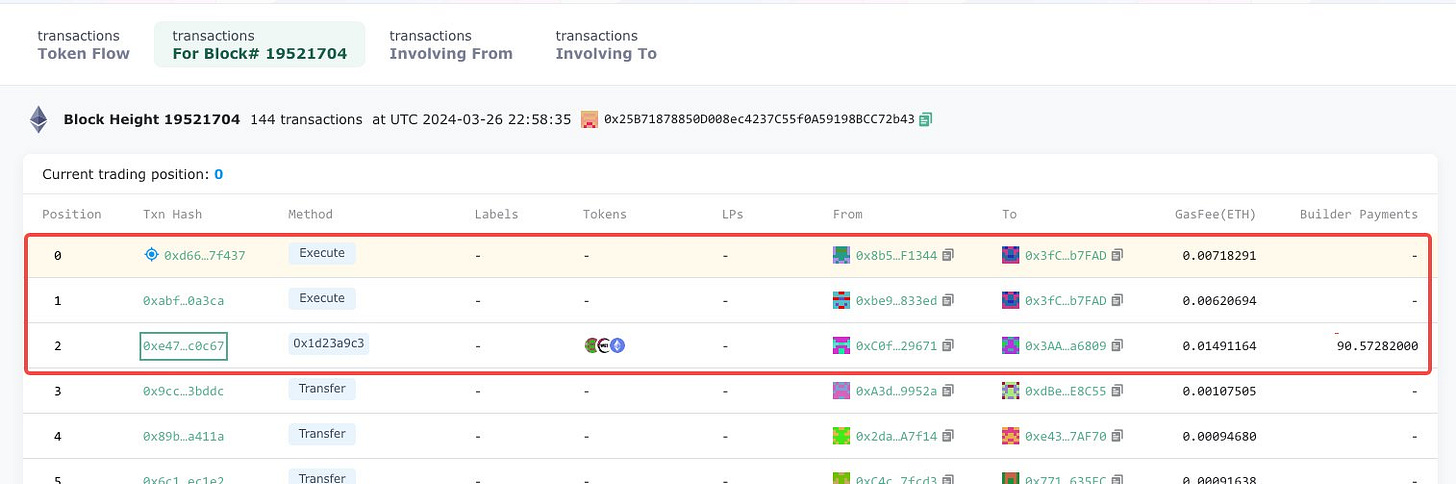

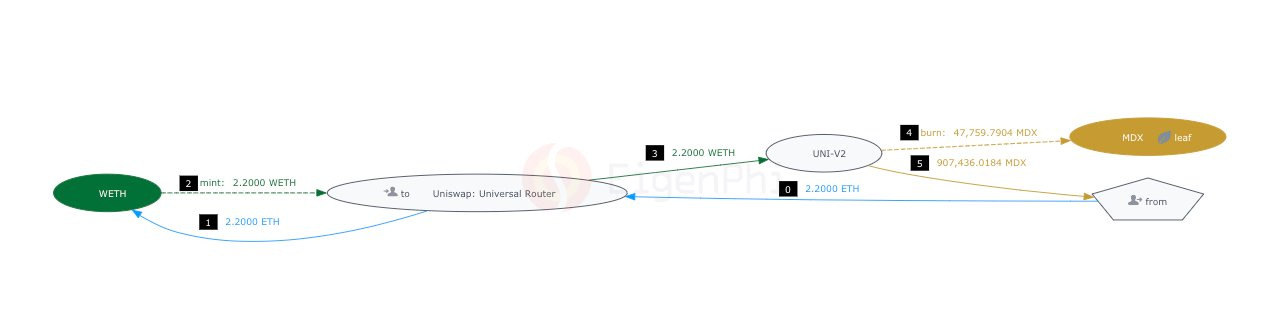

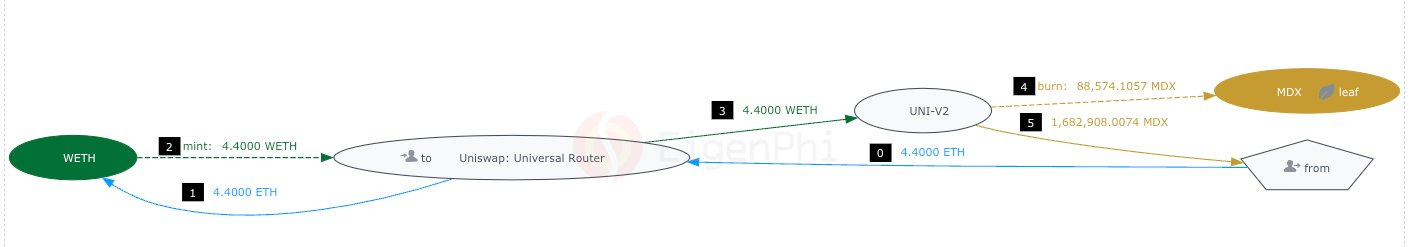

The second-highest builder reward is 90.6 ETH on Block 19521704, mostly from this transaction on Pos 2, back-running the two transactions swapping MDX on Pos 0 and 1 of the block.

The following images show the swapping of the first two trades.

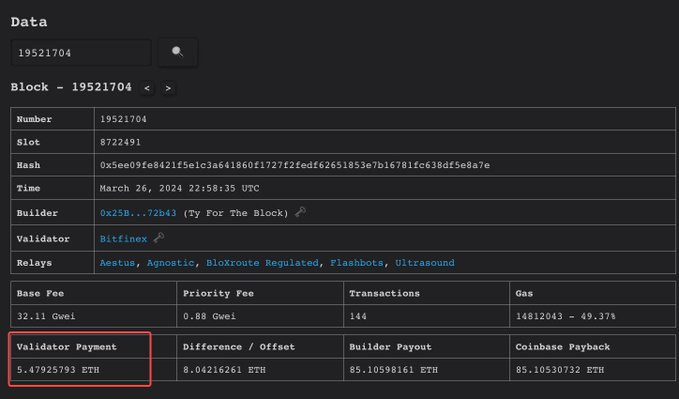

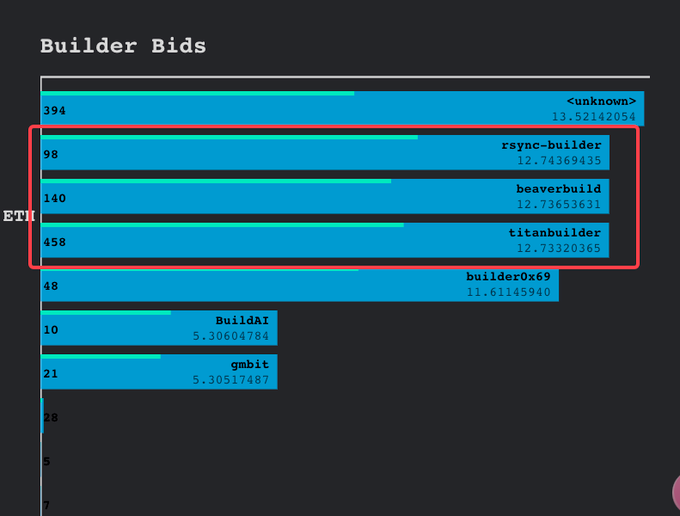

In this Block 19521704, c0ffeebabe.eth snagged it with just a 5.5 ETH bid for the validator, outsmarting heavyweights like BeaverBuild, Rsync, and Titan, who put up over 12 ETH each, as shown in the images below captured from Payload.de.

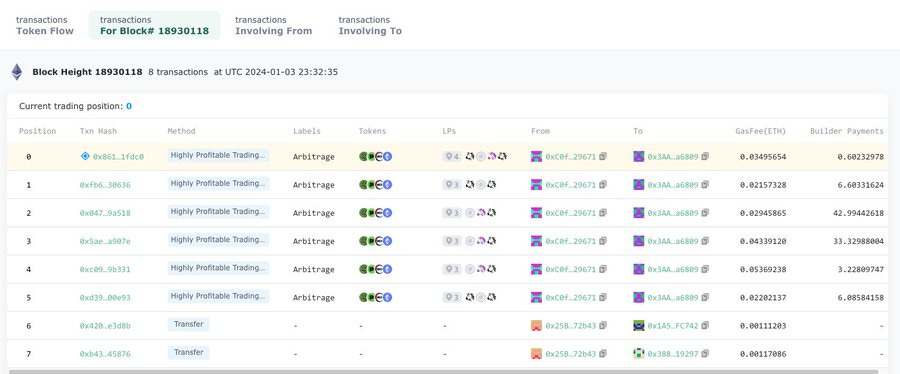

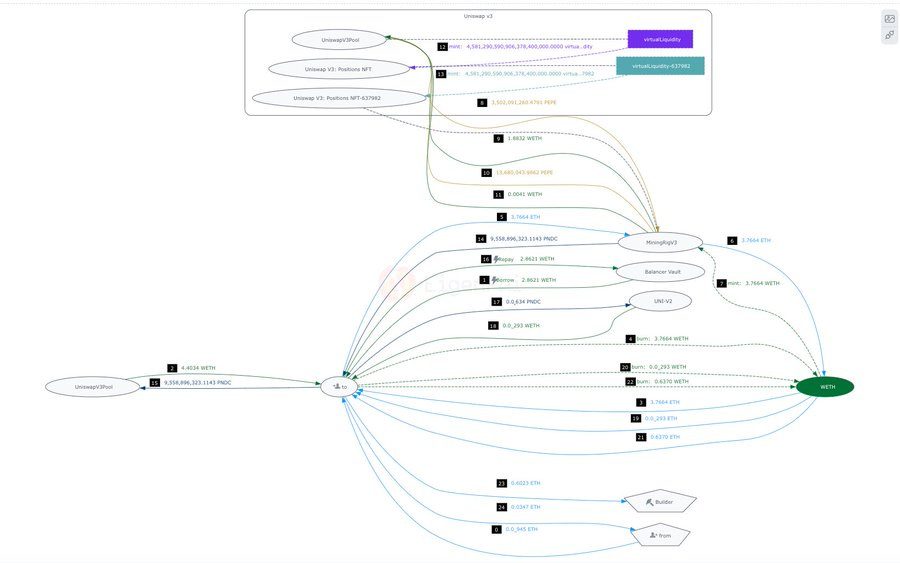

Block 18930118 claims the third-highest builder reward with just eight transactions, all linked to c0ffeebabe.eth. Six crafty arbitrages exploit $PNDC's "mining" and "spawning" tactics to unlock opportunities.

The first transaction uses the MiningRig contract of $PNDC to mint $PNDC and gets $PEPE out of the Uniswap v3 pool, essentially exploiting the token's issuing system and raking 0.63 ETH. It gets better in the following trades.

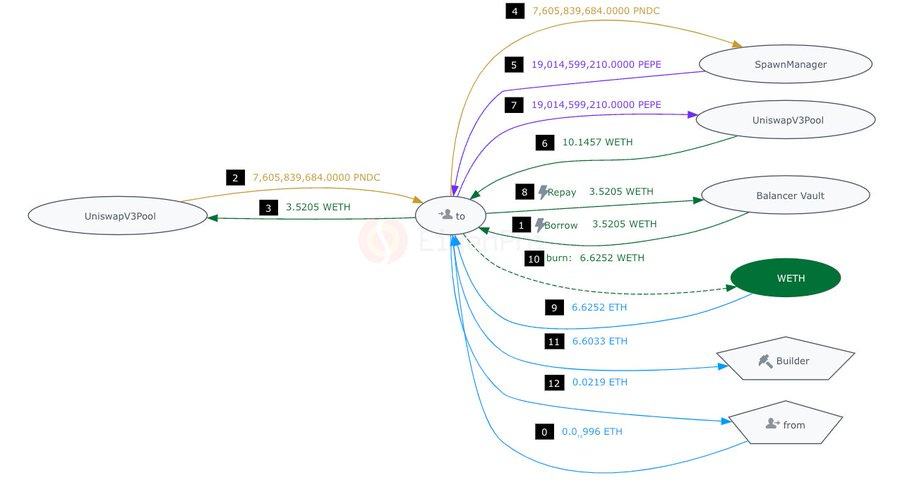

On Pos 1, this transaction leverages the "SpawnManager" of $PNDC to get 19B $PEPE and finishes a 6.6ETH-profit arbitrage. Again, it gets better and better.

Transactions on Pos 2, 3, 4, and 5 follow the same pattern:

Borrow a flash loan from Balancer Labs and swap it for $PNDC via 1inch.

Swap $PDNC for $PEPE via "SpawnManager"

Swap $PEPE for WETH via Uniswap V2, making dozens of ETH as profit.

Transfer the profit to its own builder.

These trades on Pos 1 to Pos 5 earned 92.2 ETH for c0ffeebabe.eth, who shared 11.1 ETH with the validator.

The unfair strength of searcher-builder integration could not illustrated better than the cases of c0ffeebabe.eth and MEV Frontrunner Yoink, which has been identified by Danning of Flash Bots and other researchers in this paper, summarized by Danning in this tweet with two charts.

First 3 Quarters Performance Evaluation of C0ffeebabe.eth

Select “Ty For The Block” builder in Section 4 of our Builder Performance Analysis dashboard with the time range setting as the first nine months of 2024, and we can review its productivity with the extraordinary searching ability of c0ffeebabe.eth.

The following numbers reveal that c0ffeebabe.eth values quality more than quantity, similar to the approaches of Yoink and MEV Builder 0x3b.

Using 0.02% of all transactions, c0ffeebabe.eth earned 2,364.8 ETH builder rewards, worth about $6M, 1.21% of all builder rewards. More importantly, after deducting the validator payout of 1,281.3 ETH, its net income is 1,083.5 ETH, accounting for 2.63% of all builder net income.

The dashboard gives another proof of c0ffeebabe.eth being behind Ty For The Block.

Most of the payment for the builder comes from the EOA address 0xc0ffeebabe5d496b2dde509f9fa189c25cf29671, whose first ten digits give the clue.

The top 2 bots in the Miner Tip Leaderboard are the MEV bots used most frequently by c0ffeebabe.eth.

Wanna find out more of its MEV trading tactics? Visit this contract portfolio page on EigenPhi.io.

If you are interested in exploring the 524 blocks built by this searcher-builder, visit this query from the dashboard.

The Rise of Searcher-Builders

The dominance of searcher-builders like c0ffeebabe.eth and MEV Frontrunner Yoink illustrates the evolving dynamics of the MEV supply chain, where validator compensation and builder rewards vary drastically based on strategic integration. While the top builders like Titan, BeaverBuild, and Rsync consistently yield 85% of their rewards to validators, entities like c0ffeebabe.eth and Yoink retain a much larger share, leveraging their MEV capabilities to minimize payouts and maximize profits. The detailed analysis of c0ffeebabe.eth’s block-building tactics reveal its exceptional ability to exploit market inefficiencies, demonstrating the growing influence and profitability of searcher-builders. As MEV strategies evolve, the balance of power between validators and builders will likely see further shifts, with those wielding advanced MEV tools poised to capture an even larger share of the rewards.

Have more questions about this worrisome trend? Leave your comment.

Wanna see how c0ffeebabe.eth managed a $5.4M arbitrage during the Vyper-Curve Exploit? Click this link or open https://bit.ly/hfdefi to visit the latest booklet: Head First DeFi, Decoding the DNA of Crypto Transactions & Strategies.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram