Rethink Gas Savings: On Uniswap V4, the Cheapest Move Is No Move at All

How v4’s “Locker” Changes What You Think You’re Seeing in Arbitrages and Sandwiches

There's a new 'gas saving' trick making the rounds on Uniswap v4, and it's changing how smart money runs—and how the rest of us read on-chain data. The twist? The biggest savings aren't from clever math at the edges. They come from not moving tokens at all.

Here's the big idea in one line: v4's PoolManager can act like a smart locker. Pros can park assets inside it between legs of a trade and flip those assets between 'stored' and 'tradeable' states without doing the usual ERC-20 transfers. That pattern leans on ERC-6909, a lightweight multi-token accounting standard designed to reduce gas and simplify flows. Less motion, less cost, fewer logs to chase.

Why does this matter? It rewires how we recognize strategies on-chain.

What Changed With Uniswap v4

Take a classic sandwich. You expect to see three obvious moves: frontrun -> victim trade -> backrun, with tokens visibly moving out and back in.

On v4, a sophisticated searcher can frontrun, swap into USDC, leave the USDC inside the PoolManager, and later unlock it for the backrun—skipping two external transfers. In the documented example below, this cuts gas dramatically compared with pulling tokens out and then pushing them back in.

The savings aren't marginal; they redefine what 'efficient' looks like.

PoolManager as locker. Centralized accounting for pools allows strategies to keep intermediate balances parked between legs rather than bouncing in and out of ERC-20 land.

ERC-6909 accounting. Lightweight, multi-token units that flip between stored and tradeable states, cutting gas and clutter.

Different footprints. Fewer external transfers means fewer familiar log patterns—so detectors misclassify flows.

Think of v4 like a casino with a players’ cage. Pros keep chips behind the glass between hands. Nothing leaves the cage, so there are fewer steps and no extra receipts. If you only count chips moving on the table, you miss the stack that never left the cage.

How to Change Your Mental Model to Adapt

State flips beat token trips. When you see v4 flows that appear 'incomplete,' consider that the missing step may be a PoolManager state change, rather than an ERC-20 transfer.

Labels affect decisions. Sandwich vs. arbitrage isn't a cosmetic difference; it changes how you size risk, evaluate protections, and attribute PnL.

Gas is edge. Designs that minimize ERC-20 transfers and lean on PoolManager accounting will routinely outcompete naive routes on cost.

A Guided Example

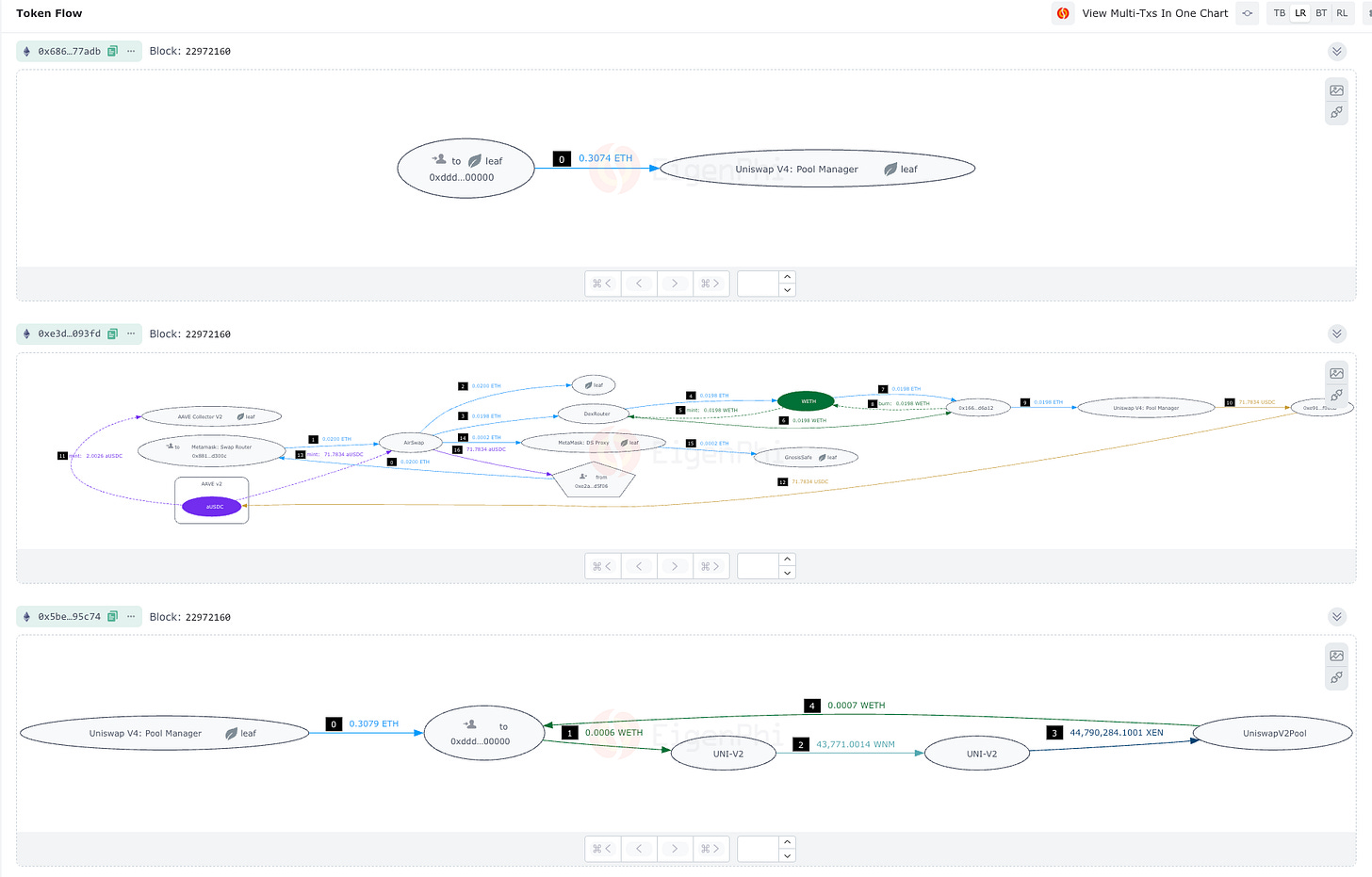

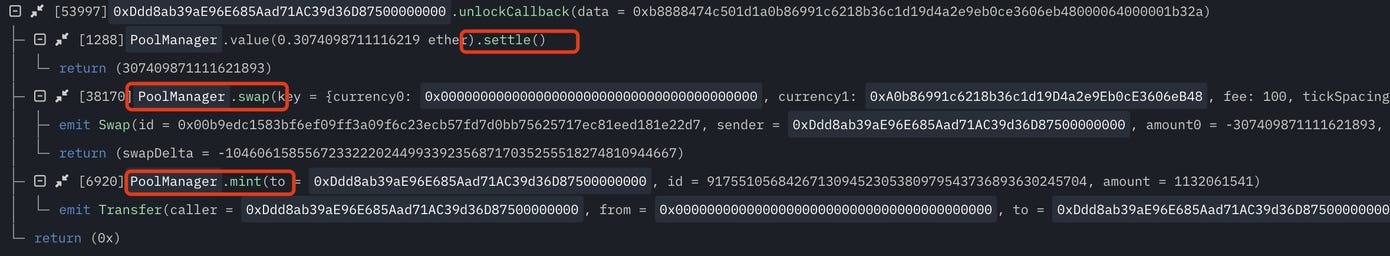

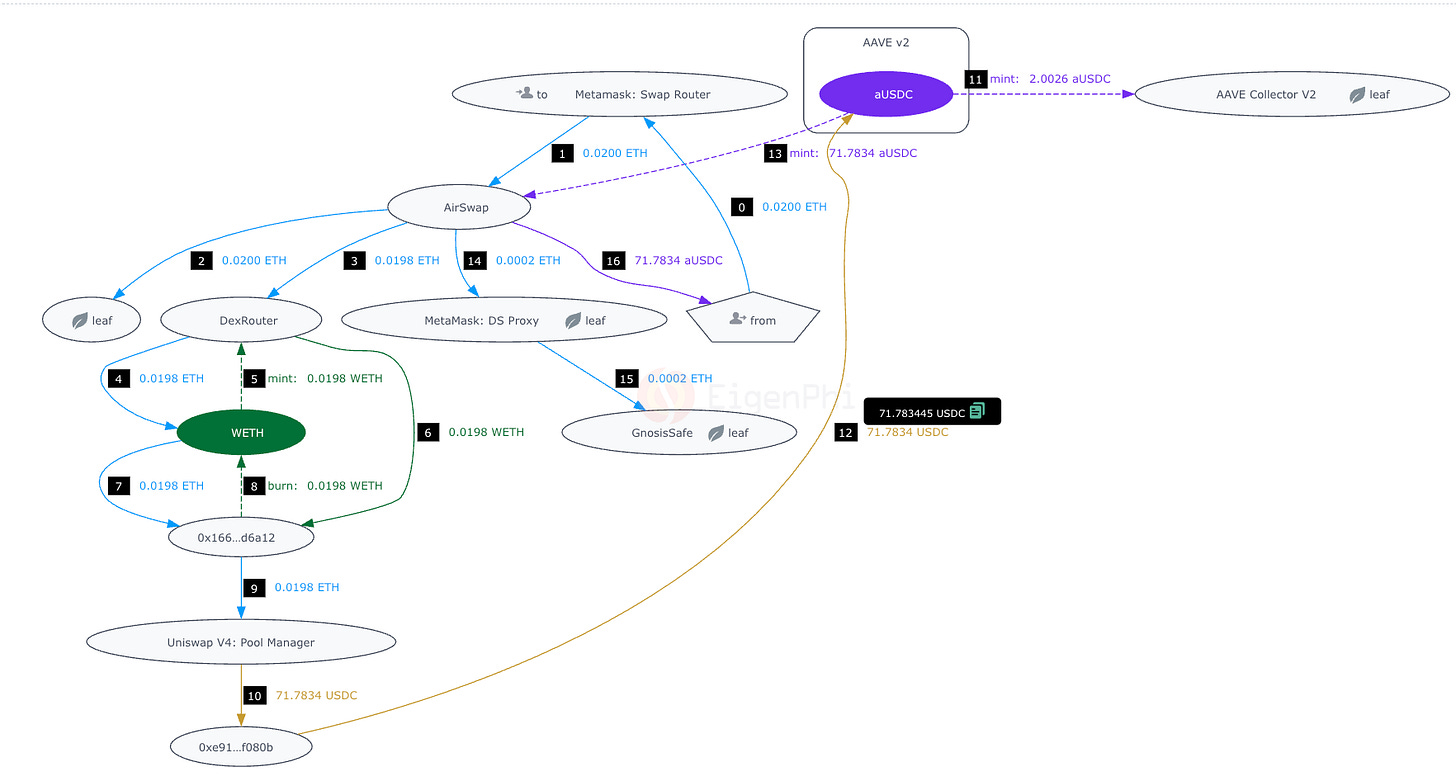

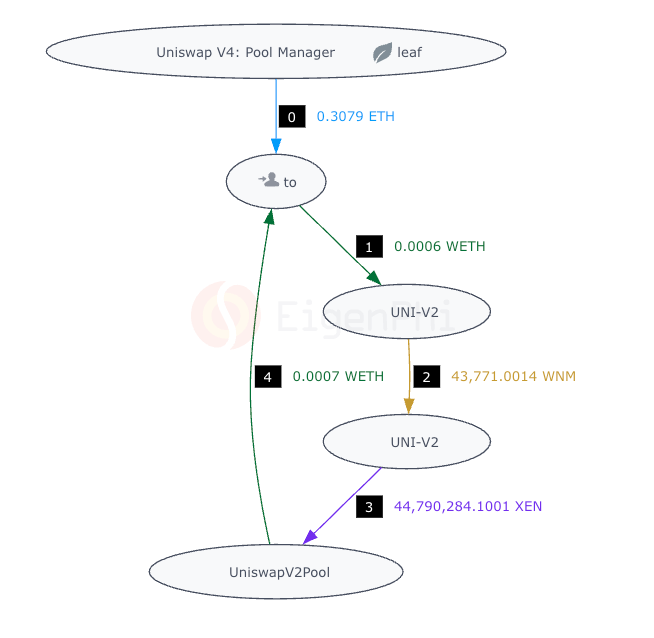

The chart below provides a comprehensive view of the sandwich.

Frontrun: Searcher swaps ETH->USDC and leaves the USDC credited inside the PoolManager (cheaper than withdrawing).

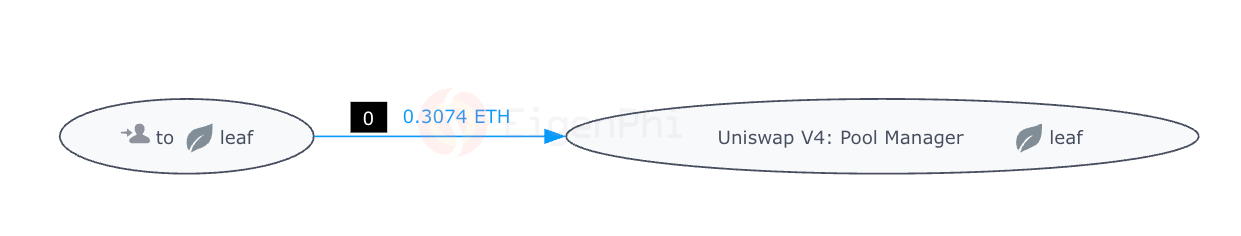

The detail can be seen here:

PoolManager.settle(): Attacker paid 0.3074ETH to PoolManager

PoolManager.swap(): Swap 0.3074 ETH for 1132.061541 USDC

PoolManager.mint(): PoolManager transferred 1132.061541 USDC back to the attacker, but saved it in PoolManager, which inherited ERC6909

Victim trade: Executes as usual by swapping ETH for aUSDC via Metamask.

Backrun: Searcher unlocks those USDC credits, swaps back to ETH, and only then withdraws what they want to realize.

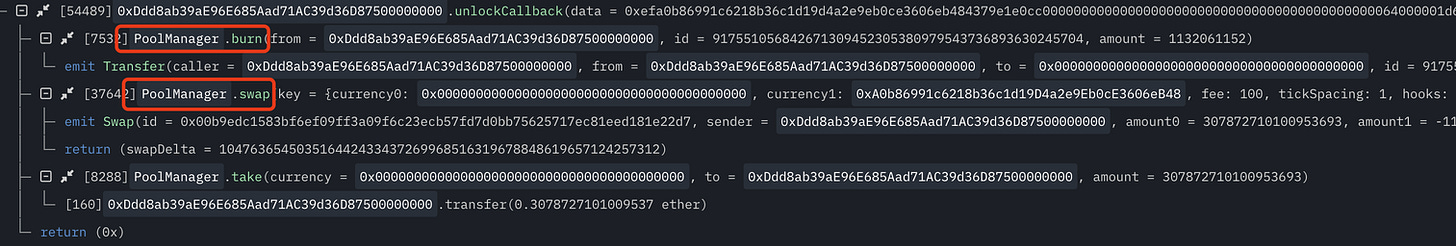

Here are the inner details.

PoolManager.burn(): Attacker transferred 1132.061152 USDC to Pool Manager in ERC6909.

PoolManager.swap(): Swap 1132.061152 USDC for 0.3079 ETH.

PoolManager.take(): Pool Manager transferred 0.3079 ETH back to the attacker

Net effect: same economic loop, different 'paper trail' — the value moved, but the most expensive token hops never happened on ERC-20 rails.

What to Watch Next

Strategy hygiene. As more pros adopt 'store-then-unlock,' gas tables will shift—and naive designs will look increasingly expensive.

Bottom line: Uniswap v4 plus ERC-6909 doesn't just lower gas—it reshapes the signature of profitable strategies.

Further reading & links

EIP-6909: https://eips.ethereum.org/EIPS/eip-6909

Uniswap v4 core – ERC-6909: https://github.com/Uniswap/v4-core/blob/main/src/ERC6909.sol

Wonder if you have any misconceptions about MEV? Download our latest free e-book: MEV Myth Busters - From Microstructures to Macro Impacts.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram