Unique BNB Chain Arbitrage Opportunities With The Launch of PancakeSwap V3

Unlocking New Opportunities for Traders, Searchers, Liquidity Providers, and Market Makers

We have conducted much research on the impact of MEV on major Ethereum-based DEXs such as Uniswap and Curve. Ethereum's ecosystem has introduced block builders, which has created an environment where MEV becomes a significant source of incentives. Additionally, the infrastructure of MEV-boost relays on Ethereum makes MEV more accessible and equitable. However, the MEV revolution has yet to arrive on BNB Chain. The network currently has 21 active validators who operate on a Proof of Stake consensus model and are responsible for validating transactions and ensuring the overall security of the chain.

Monitoring of validators on BNB Chain capturing MEV is leading to concerns of unfairness, centralization, and complaints from the community. It is encouraging to see that the BNB Chain is actively working to build a more balanced and inclusive DeFi ecosystem, as evidenced by their recent effort of discussion. Bringing MEV services to the network is a way to balance the protection of users and the introduction of more revenue streams for validators.

With lower operating costs on BNB Chain than Ethereum, launching PancakeSwap V3 with the same concentrated liquidity feature will create even more user opportunities.

Arbitrage revenue on BNB Chain and Ethereum

After thoroughly investigating arbitrage transactions between July 1, 2022, and March 26, 2023, we found that arbitrageurs extracted over $40 million from the BNB chain during nine months from July 1, 2022, to March 26, 2023.

Arbitrage transactions on Ethereum during the same time range were also investigated. Despite the total revenue from Ethereum being more than twice that of the revenue on the BNB chain, the high cost of arbitrage transactions on Ethereum led to a comparable profit level for arbitrage searchers when comparing both chains. Our data presented in the pie charts below shows 94.5% profit on BNB Chain compared with 45.8% profit on Ethereum.

Cost investigations of arbitrage strategies on BNB Chain and Ethereum

We investigated the cost-revenue ratio for each month within the inspected time range. We observed that the cost-revenue ratio of arbitrageurs on PancakeSwap on the BNB Chain is comparable to that of total arbitrage on the BNB Chain. Moreover, we also investigated the cost-revenue ratio for Uniswap on Ethereum. We observed that the high cost of Ethereum leads to a cost-revenue ratio of a maximum of more than 0.7. However, the cost-revenue ratio in BNB Chain is almost one magnitude lower than Ethereum. The same holds for comparing PancakeSwap and Uniswap on their respective chains.

Creating an arbitrage bot on BNB Chain is less expensive than on Ethereum. For instance, searchers created the bot with the most profitable transactions on BSC for just $4.6; on Ethereum, the same bot would cost $200.

MEV opportunities on PancakeSwap V3

PancakeSwap announced the launch of V3 on April 3 on both BNB Chain and Ethereum, introducing the concentrated liquidity feature that will give users, searchers, and market makers more opportunities. Proper utilization and management of liquidity are crucial in extracting value from the market. While massive exploitation of liquidity can lead to severe problems, efficient use can benefit users. Hence, understanding how to utilize and manage liquidity is vital in maximizing its potential.

PancakeSwap V3 arbitrage opportunities

Once V3 launches, there will likely be significant liquidity fluctuations in PancakeSwap pools, which can create more arbitrage opportunities.

We have observed quite a few arbitrage transactions conducted exclusively in PancakeSwap pools. With the launch of V3, these arbitrage bots may not need to change much in their approach, but they will have access to even more opportunities.

It is worth noting that in Ethereum, numerous arbitrage bots solely operate between Uni-V2 and Uni-V3, generating substantial profits. Furthermore, given the similarity in the AMM design between PancakeSwap on BNB Chain and Uniswap on Ethereum, it is possible for arbitrage seekers who currently operate between Uni-V2 and Uni-V3 to seamlessly transition to PancakeSwap once V3 is live without requiring significant changes to their existing strategies.

For example, we have observed a single arbitrage strategy between Uni-v2 and Uni-v3 in Ethereum that has generated a profit of more than $3 million. Similar opportunities will appear in PancakeSwap once V3 launches, allowing traders to take advantage of these profitable trades.

Market makers' opportunities with PancakeSwap V3

Concentrated liquidity offers several benefits, enabling liquidity providers and users to manage liquidity more efficiently. This feature has also attracted traditional market makers.

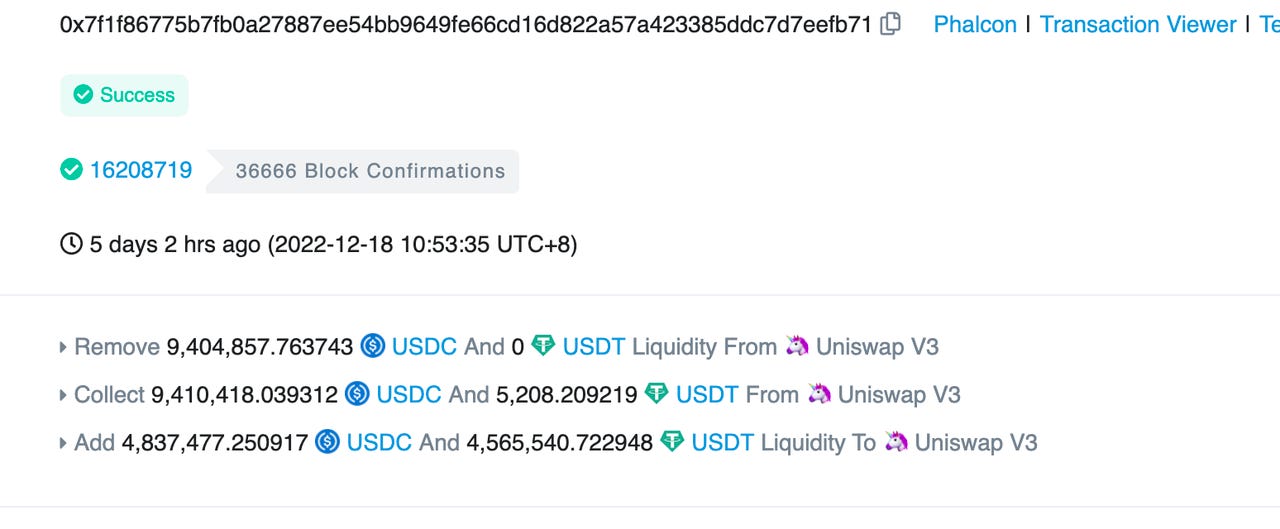

Here is an example of how market makers manage the liquidity on Uni-V3. The bot removes imbalanced liquidity in the pair by swapping tokens and re-adding them to the pool to ensure the current price falls within the acceptable liquidity range. The bot may perform this balancing act several times daily, resulting in daily profits of up to $2,000.

The token flow of the market maker:

However, market makers face a high cost when adjusting liquidity on Uni-V3 on Ethereum, which limits the frequency at which they can do so. We have even observed the loss of those market makers because the cost of adjusting liquidity is high. However, the lower cost of adjusting liquidity on PancakeSwap V3 may create more opportunities for market makers to adjust their liquidity more frequently and efficiently, potentially leading to increased profits.

Conclusion

Once PancakeSwap V3 launches, there will likely be significant liquidity fluctuations in PancakeSwap pools, which can create more arbitrage opportunities on the BNB Chain. In addition, the lower cost of adjusting liquidity on PancakeSwap V3 may create more opportunities for market makers to adjust their liquidity more frequently and efficiently on the BNB Chain.

Follow us via these to dig more hidden wisdom of DeFi:

Gm Gm, Really loving this piece and the work you do here. I also run a web3 news substack for underrepresented creators called Facesofweb3. Would you be open to a recommendation exchange? Our subscribers need to be able to find each other!

Great job, once again!