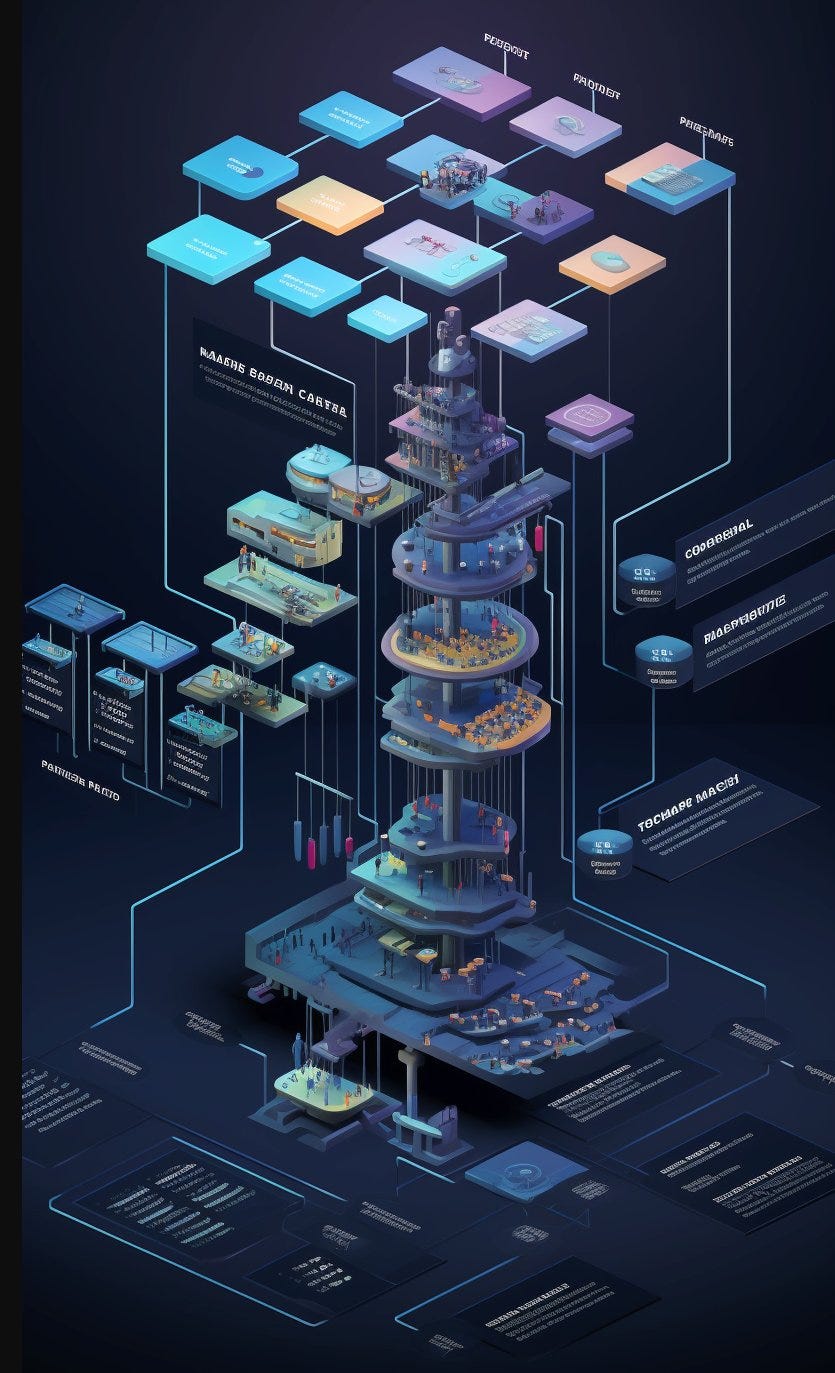

Order Flow Auction (OFA): 5 Key Components Transforming the MEV Landscape

OFA is the next big thing in MEV. We've broken down the 5 key components of OFA to show you how it remodel the MEV vista.

With the world of blockchain and cryptocurrency constantly evolving, understanding the dynamic changes is essential. One such development has been the shift in Miner Extractable Value (MEV). What was once likened to an exclusive high-roller poker game has been transformed, thanks to the Order Flow Auction (OFA), into an all-inclusive poker tournament. Gone are the days of exclusive VIP access and house rules.

So, what is OFA and why is it revolutionizing the world of MEV? Let's dive into its five-step breakdown.

Auction Setup:

Here, all pending transactions (txs) are routed into a private mempool. To ensure a fair game, this mempool remains private and is solely accessible to the auction participants. Its design ensures that all participants have equal access and prevents any potential manipulation of auction outcomes.

Bidding Phase:

This is where searchers come in and place their bets, deciding how they would arrange transactions to reap maximum MEV. Various factors influence these bids, including the types of transactions, current gas prices, and anticipated MEV profits. Importantly, the way bids are placed can differ, leading to a range of strategies.

Selection and Execution:

The highest bidder claims the victory and with it, the right to arrange the transactions in a way that extracts the most MEV. This winning arrangement then makes its way forward to be included in the upcoming block. The top bid not only determines the winner but also dictates how transactions are arranged for optimal MEV extraction.

MEV Redistribution:

This is where OFA truly transforms traditional MEV models. A part of the extracted MEV is evenly distributed among the participants. Serving as both an incentive and a mechanism to dilute the concentration of MEV extraction power, this step ensures a more balanced and equitable ecosystem.

Validation and Finalization:

The proposer, often considered the final authority in this setup, validates the block and adds it to the blockchain. Typically, the proposer is inclined to select the block that presents the most value, which encompasses MEV.

For those eager to delve deeper into leveraging the potential of Order Flow, this thread offers invaluable insights. Moreover, for a comprehensive guide on how MEV Evaluation can augment these processes, this booklet is a must-read. It serves as a potent toolkit for profit maximization, market insights, and risk mitigation, specifically tailored for Order Flow Originators and Auction Providers.

By embracing and understanding the OFA model, the doors to a fairer and more inclusive MEV landscape are opened wide. As blockchain technology continues to grow, staying updated with such advancements can be the key to optimizing one's position in this dynamic world.

This video would be helpful for Order Flow Originators to calculate the value of your Order Flow.

If you are an OFA provider, please feel free to check this video that helps you understand how MEV Evaluation enhances your execution quality.

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram | EigenTx