MEV Myth Buster #7: Mega Profits Can Be Built on Sequenced Multi-Pool Trades

A $271 K Flash-Loan Loop Proves Record MEV Gains Come From Choreographed Cross-Pool Moves.

🦄 Myth

Grand Profits Come From a Single Fat Mis-Price.

People picture a record-setting MEV haul as a lucky snipe on one wildly mis-priced pool—hit it fast, scoop the spread, and you’re done.

But that story ignores how DeFi’s composability generates the biggest payouts:

A liquidation distorts multiple derivative tokens at once, and the true windfall goes to the searcher who maps those distortions across pools, then chains them into a carefully ordered sequence.

🧠 What Happened

On 13 Apr 2024, ETH’s 15 % crash set off liquidations that warped the prices of a Curve pool.

In block 19649680, a flash-loan bot chained two arbitrages—borrowing 216 WETH and cycling crvUSD ↔ wstETH ↔ WETH—to pocket 90.5 ETH ($271K, 2024’s highest profit from one transaction) in its second leg, proving mega-profits come from multi-pool sequences, not single mis-prices.

🔬Microstructure

This is the arbitrage that generates the $271K profit on position 202 of the block.

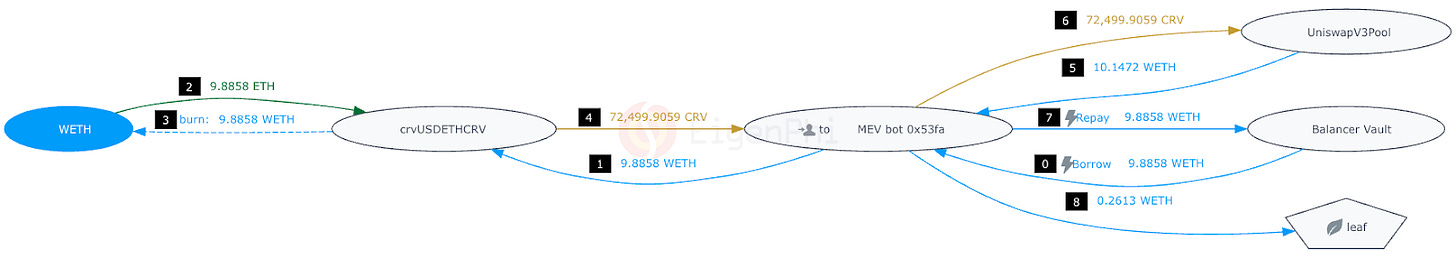

The token flow chart below is the arbitrage from the same bot on position 201 of the block. Its swap in Curve’s TriCRV(crvUSDETHCRV) pool opened the window for the above windfall.

🧬 Key Steps Breakdown

For this series of transactions, let’s look at the money maker first.

We simplified the 2nd arbitrage as below:

First, the bot borrowed 216 WETH through AAVE's flash loan.

Next, it swapped 216 WETH for 600K crvUSD in Curve's TriCRV pool.

Then, it exchanged for 286 wstETH in the TricryptoLLAMA pool.

Finally, it converted back to 329 WETH through Balancer.

After returning the loan and tipping the block builder 22.6 ETH, the bot walked away with 90.5 ETH, a $271K profit in a single transaction.

As we pointed out, the 2nd part is crucial for leveraging the pricing opportunities created by the arbitrage on position 201, part of which is exchanging 9.9 WETH for 72.5 CRV.

Looking at the summary section of the Arbitrage Transaction Profit and Loss page, it shows the signal transaction, which is a liquidation transaction on position 0.

The liquidation occurred on Curve’s crvUSD soft-liquidation-related pools, injecting 191,000 crvUSD into Curve's TriCRV pool. The injection triggered a price movement that was seized by the searcher who finished the two consecutive arbitrages.

🧑🤝🧑Key Entities

In the arbitrage on position 202:

Curve’s crvUSDETHCRV pool contains crvUSD (Curve's stablecoin), ETH (Ethereum), and CRV (Curve's governance token), allowing users to provide liquidity and earn trading fees from swaps between these three assets.

Curve’s crvCRVUSDTBTCWSTETH, TricryptoLLAMA pool, bundles CRV, USDT, WBTC, and wstETH in a single AMM pool, letting traders swap seamlessly among them.

The Balancer wstETH-WETH-BPT pool pairs wstETH with WETH and includes its own Balancer Pool Token (BPT), enabling low-slippage swaps between them.

In the liquidation:

The crvUSD Controller acts as an on-chain interface for creating loans and further managing existing positions. It holds all user debt information. External liquidations are also done through it.

LLAMMA-crvUSD AMM is the market-making contract that rebalances the collateral of a loan and is responsible for liquidating and de-liquidating collateral based on market conditions through arbitrage traders.

🔁 Not a Fluke

On April 13th, ETH suffered its biggest two-day loss in years, plummeting from $3,500 to $3,000. This triggered a cascade of liquidations across the ecosystem.

The searcher in this story is sophisticated enough to detect the ripple of price dislocations across derivative tokens and act on it with the two arbitrages.

Moreover, our simulation revealed something remarkable: had the bot executed these in reverse order, the first arbitrage would have failed completely.

The execution was flawless, like a perfectly choreographed dance.

This wasn't just algorithmic speed—it was strategic sequencing. The searcher had carefully optimized the order of execution to maximize profits across both arbitrages.

These transactions actually help the market by bringing prices back into alignment after liquidation events. It's one of those rare cases where profit-seeking improves the system for everyone.

⚠️ Your Takeaway

In crypto, one trader's disaster becomes another's golden opportunity.

Compose, sequence, repeat — the fattest MEV gains are choreographed, not chanced.

Read all MEV Myth Buster series here:

All the MEV Myth Busters You Can't Miss

Behind every transaction is a battle-tested supply chain of searchers, builders, and validators—an ecosystem that rewards speed, creativity, and, sometimes, downright audacity. In this MEV Myth Busters series, we’ll dissect the real transactions that shatter people's comforting stories about DeFi.

You can click this link or open https://bit.ly/hfdefi to download the free ebook Head First DeFi, Decoding the DNA of Crypto Transactions & Strategies. We are adding more intriguing cases in 2024. Let us know if you want to be part of it.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram