MEV Myth Buster #5: You Need Better Tools to Comprehend MEV

Especially When the Searcher-Builder Integration Disrupts the Game.

🦄 Myth

Etherscan Tells the Whole Story About Transaction Costs.

Does Etherscan present the full account regarding transaction costs?

Gas used × gas price = fee paid. Easy.

However, Etherscan only provides basic data. You can’t understand MEV without figuring out the builder tips in some transactions. Because sometimes, the real payment to get into a block isn’t gas—it’s a direct ETH transfer from MEV players, hidden from the surface view. You will see the highest builder tips of 2024 in this liquidation.

🧠 What Happened

Market-wide liquidations hit Aave hard on Black Monday, August 5th, 2024. This liquidation saw 4.6K ETH being liquidated by a searcher, who paid 358.7 ETH to the builder as tips.

🔬Microstructure

🧬 Key Steps Breakdown

Step 0: The liquidator/searcher borrowed 4,569.9705 WETH from Balancer using Flash Loan.

Steps 1-5: The liquidator sent the borrowed 4210.8438 WETH to 1inch, who used the WETH to fulfill an ETH-buy limit order from 0x741, the famous 7 Sibliings fund, and return 9.8M USDC to the liquidator.

Steps 6-11: The liquidator repaid the borrower’s 9.8M USDC debt and received the 4,569.9705 WETH collateral.

Step 12: The liquidator repaid the borrowed WETH to Balancer.

Steps 13-16: The liquidator tipped the builder 358.7164 ETH and pocketed 0.4103 ETH.

🧑🤝🧑Key Entities

The liquidator/searcher is 0x645, shown as “to/liquidator” in the token flow chart.

The borrower is shown as a naval blue pentagon in the token flow chart.

The builder is shown as MEV Buildr 0x3B…

1inch v6 Router and AAVE related addresses are labeled as seen.

Next, we will show you that the liquidator/searcher and the builder are integrated in this case.

🔁 Not a Fluke

In a typical setup, searchers submit bundles to multiple builders—Flashbots, Titan, BeaverBuild—hoping one of them will include their transaction. It’s a competitive, auction-based process where the best bribe often wins.

But in this case, there was no competition. The searcher and the builder were vertically integrated. The searcher didn’t need to bid across the market. It simply constructed the block with its own builder and routed profits directly—privately, and efficiently.

The 358.7 ETH wasn’t a bid to win a slot. It was profit-sharing, internalized. There was no middleman, no auction, no leakage. That’s what full control of the block looks like: searcher-generated value flowing straight through to the builder it controls.

And the data backs it up. From October 2023 to November 2024, over 95% of builder rewards from this searcher—5,049 ETH in total—went to just one destination: 3Bee. Not BeaverBuild. Not Titan. Just 3Bee.

The 358.7 ETH wasn’t just a tip. It was vertical integration in action, which is separate from the gas fee shown on Etherscan.

More on Etherscan’s Transaction Data

The transaction’s detail page on Etherscan only shows Transaction Fee as 0.371006176298024201 ETH, which equals the Gas Price, 604.945101409 Gwei, multiplying Gas Used, 613,289.

In this case, the Burnt Fees equals the Transaction Fee, which is not always true.

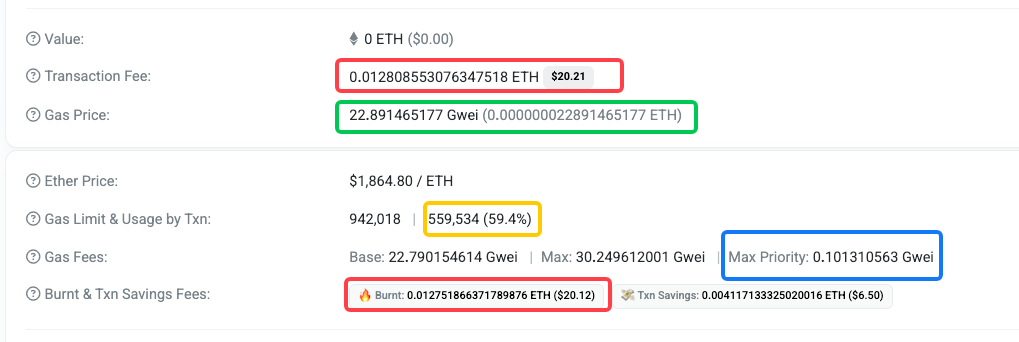

This transaction’s detail page shows that the user paid 0.012808553076347518 ETH as Transaction Fee, composed of approximately 0.012751866371789876 ETH burned as base fee and 0.0000566867 ETH paid as a priority fee (tip) to the block proposer, based on 559,534 gas used multiplying the priority gas being 0.101310563 Gwei.

Please note that the above does not include the direct transfer of tips to the builder in this case study, which amounts to 358.7 ETH. You can only find it in the Internal Transactions section of the page, but it is the actual cost to win the block.

⚠️ Your Takeaway

Etherscan’s surface data can’t expose the true MEV flows.

Searcher-builder alliances make dedicated MEV analytics a must.

Read all MEV Myth Buster series here:

All the MEV Myth Busters You Can't Miss

Behind every transaction is a battle-tested supply chain of searchers, builders, and validators—an ecosystem that rewards speed, creativity, and, sometimes, downright audacity. In this MEV Myth Busters series, we’ll dissect the real transactions that shatter people's comforting stories about DeFi.

You can click this link or open https://bit.ly/hfdefi to download the free ebook Head First DeFi, Decoding the DNA of Crypto Transactions & Strategies. We are adding more intriguing cases in 2024. Let us know if you want to be part of it.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram