MEV Maximizing Strategies for Searchers and Traders: Navigating the Potential Impact of the Shanghai Upgrade on LSD

A highly anticipated surge in the trading volume of LSD on Ethereum presents a plethora of MEV opportunities.

Before exploring the MEV of LSD, don’t forget to set up a reminder for our incoming Twitter Space with guest speakers from 0x, Curve, Galaxy Digital, and Nomad. All are mega brains you can’t miss!

And, have you watched our MEV 2022 Retro?

The Shanghai-Capella upgrade hits the Ethereum mainnet on April 12 — this EIP will allow validator staking withdrawals on the main network. The upgrade will significantly impact Liquid Staking Derivatives (LSD). After The Merge, Ethereum shifted from POW to POS. Liquidity staking allows users to deposit ETH to the validator, and in return, the users receive LSD and regular rewards. After the Shanghai upgrade, users can burn their LSD tokens and withdraw their deposited ETH, creating a massive change to the LSD market. As a result, we expect the trading volume of LSD on Ethereum will significantly increase, creating more MEV opportunities. This article will look closely at the MEV opportunities in the last few months and provide predictions regarding future MEV opportunities.

Overview of LSD MEV opportunities

Here are some highlights regarding the LSD MEV market from May 2022 to February 2023.

The total revenue generated from MEV, including arbitrage, liquidations, and sandwich attacks, surpassed $4.84 million, with most coming from arbitrage.

The rising frequency of arbitrage trades and the declining average arbitrage revenue demonstrate the market's improving efficacy.

There was a reduction in the revenue-to-cost ratio for all three types of MEVs, indicating increased competitiveness in the LSD MEV market.

The size of the LSD MEV market

According to recent data, the total revenue generated by MEV involving LSD from May 1, 2022, to February 28, 2023, is an impressive $4844957.15. Regarding MEV frequency, most MEV concerning LSD (93.6%) is attributed to arbitrage, with sandwich attacks accounting for only 4.8% and liquidations for 1.6%. Interestingly, when looking at revenue distribution, the majority ($3.51 million) of the total revenue goes to arbitragers, followed by liquidators at $0.82 million and sandwich attackers at $0.5 million. These figures demonstrate the dominance of arbitrage in the LSD MEV landscape.

MEV opportunities are unevenly distributed over time. Most notably, two liquidation opportunities emerged in May and June, but no significant trade opportunities in most months. This unevenness is because liquidation opportunity emergence is closely related to the price fluctuation of the LSD token price. In addition, the massive arbitrage opportunity in November 2022 is due to the collapse of FTX, creating tremendous opportunities for arbitragers to back-run whale dumping.

The trend of the LSD MEV market

The figure illustrates the monthly revenue trends for different LSD MEV strategies. Arbitrage generated average monthly revenue of $351K, although it showed significant fluctuations due to market changes. Sandwich MEV bot had a smaller revenue scale, with an average monthly revenue of $50K. On the other hand, the liquidation bot had substantial revenue in May, June, and November, but its revenue reduced significantly in other months. It is also highly correlated to the risk contagion effect during these months.

It is important to note that revenue alone does not equate to profit. Profit is calculated by subtracting the cost, which includes transaction fees and Coinbase transfers, from the revenue. For the arbitrage strategy, the average monthly profit was $150K, while the sandwich MEV bot generated an average monthly profit of $15K. The liquidation bot had an average monthly profit of $43K. All three strategies were profitable overall, and the varying profitability of each strategy may be attributed to the market conditions and competition from bots who executed similar strategies.

In addition to revenue and profit, frequency is another essential factor in the LSD MEV market. The frequency of each strategy can provide insights into the market conditions and the overall effectiveness of the strategy. Looking at the data, we can see that the frequency of arbitrage strategies has increased significantly over time. Notably, there was a significant leap in frequency in January 2023 due to the adoption of a new algorithm in EigenPhi to identify arbitrage opportunities, resulting in the detection of more arbitrage transactions. The sandwich MEV bot also showed a significant increase in frequency. In contrast, the frequency of the liquidation bot varies depending on the market conditions.

Based on the figure above, it seems that the average revenue from different strategies is decreasing over time due to the increasing efficacy of the LSD market. This means small arbitrage opportunities are quickly identified and exploited, resulting in lower average profits. However, there was a significant increase in average revenue in November due to the closure of FTX, which caused market volatility and created some large arbitrage opportunities. Similarly, the Sandwich bot is also facing more cautious users, which is reducing the profit potential for the bot. It's important to note that these trends are not uncommon in financial markets, where competition and innovation can quickly lead to diminishing returns. Therefore, to maintain profitability, continually adapting and refining trading strategies may be necessary to stay ahead of the competition.

The decreasing revenue/cost ratio is another trend to watch. In this context, revenue refers to the net profit the MEV bot earns in a single trade, while cost includes transaction fees and Coinbase transfers. Coinbase transfer relates to the tips paid by the searcher to the validator/builder to execute the strategy successfully. For arbitrage and Sandwich bots, the decreasing revenue/cost ratio means the searcher is getting a smaller revenue share in LSD MEV. There are two main reasons for this trend. Firstly, the LSD MEV market is becoming increasingly competitive as more searchers focus on it. Secondly, the LSD MEV market is maturing, and opportunities are becoming more fully exploited. To maintain profitability in this environment, MEV bots may need to continually improve their strategies and find new ways to gain an edge over the competition. For example, the Shanghai upgrade might be a great opportunity. Additionally, they may need to carefully manage their costs, including transaction fees and tips paid to validators and builders, to ensure they remain profitable over the long term.

The distribution of MEV opportunities

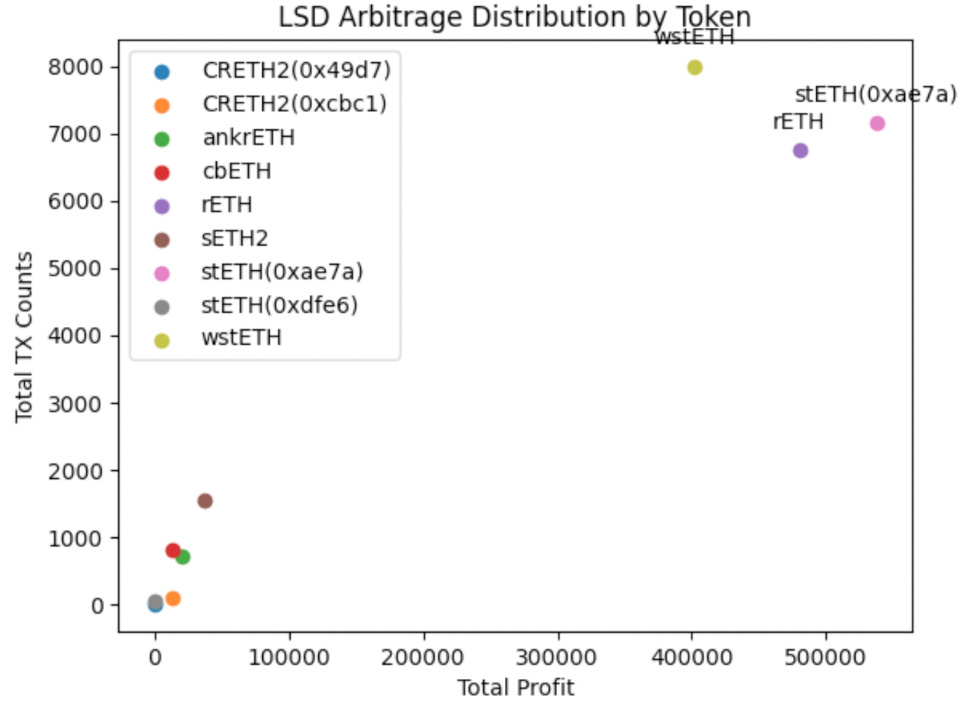

The arbitrage opportunity in the DeFi market often arises when traders back-run a large volume of trading or identify a price discrepancy in different decentralized exchanges involving the same tokens. In particular, most arbitrage opportunities in LSD involve stETH, wstETH, and rETH tokens, with an average profit of $75, $50, and $71, respectively. These findings suggest that there may be potential opportunities for traders to profit from price discrepancies in these tokens across different decentralized exchanges, highlighting the importance of closely monitoring these markets for profitable opportunities.

Additionally, it has been observed that sandwich attacks often occur in trading involving cbETH, wstETH, rETH, and stETH tokens. However, it is essential to note that profits from these sandwich attacks are not evenly distributed across all tokens. Specifically, sandwich attacks on stETH and rETH have a higher average profit of $217 and $225, respectively, while those on wstETH and cbETH have a lower average yield of only $96 and $38, respectively. These findings suggest that searchers should carefully consider each token's potential profits and risks before engaging in a sandwich attack strategy.

The liquidation of LSD (liquidity staking derivative) is a profitable opportunity, but it is not widely exploited across different tokens and protocols. Currently, all the liquidation involving LSD we have observed is happening on stETH on AAVE v2. Over 426 liquidation transactions have been implemented, resulting in a total profit of $432K. However, it is worth noting that AAVE v2 is not the only lending protocol that takes LSD as collateral. For example, MakerDAO onboards both stETH and rETH as collateral. As a result, there might be some liquidation transactions we have not detected.

The LSD MEV opportunity in the future

As the Shanghai upgrade approaches, the validators are expected to be able to withdraw staked ETH from Beacon Chain. The stakers are also likely to be able to burn LSD and get their staked ETH back. There might be some significant change that affects the LSD MEV market.

The price fluctuation of ETH. According to Beaconcha.in, as of March 14, 17,573,625 ETH have been in staking on the Beacon Chain. The shanghai Upgrade allows users to withdraw ETH and reduce their position in ETH. In a short period, allowing many users to withdraw ETH may cause a sharp change in the price of ETH in the DeFi market, bringing many options for arbitrage and liquidation and sandwiches. Therefore, it is recommended that users who plan to sell a large number of ETH in the DeFi market should prepare for the prevention and control of sandwich attacks. It is also recommended that users who use WETH as collateral pay attention to adjusting their debt positions.

The LSD arbitrage opportunity between staking protocols and the markets in the short term. For example, most LSDs have undertaken a significant price drop on the market in the last two years. However, after the Shanghai upgrade, most staking protocols will allow users to trade LSD tokens at a higher ETH price than the market, thus creating the opportunity for the market to arbitrage. However, different protocols may design their withdrawal mechanism to prevent those arbitrage.

Larger LSD MEV market in the long run. LSD tokens with good liquidity and additional rewards are expected to experience higher trading volume, creating more liquidity pools related to LSD and more lending protocols using LSD as collateral. Due to the extra rewards of LSD, it is predicted that LSD will replace a portion of WETH's liquidity on Ethereum. Therefore, after the Shanghai upgrade, there is expected to significant increase in LSD-related MEVs.

The MEV opportunity regarding LSD price change and overall MEV rewards. Most LSD rewards come from the MEV rewards in the market. Higher overall MEV rewards will result in higher LSD rewards, thus creating the LSD price raise. Some new trading strategies will emerge. For example, longing stETH and shorting ETH simultaneously is a great way to long the overall MEV in the market. Having a clear idea of the MEV trend would likely help searchers develop an excellent trading strategy regarding LSD.

Follow us via these to dig more hidden wisdom of DeFi: