In 30 Days, MEV Accounts for a Whopping 45% of Validators' Income

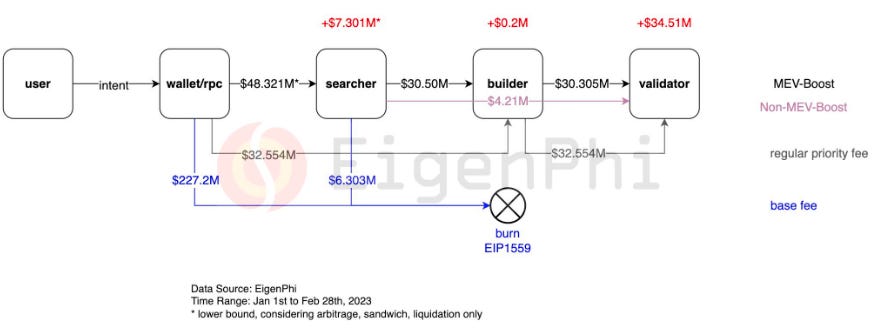

Take a look at the value allocation of the MEV supply chain.

Our previous posts show you the MEV supply chain’s value allocation in Jan and Feb of 2023, and the emerging and endangering PBS.

$30M, 72% of Searchers' MEV Revenue Went to Validators in 2 Months

PBS in Danger? Our Latest MEV Supply Chain Data Tell You Why

Now let’s check the whole picture of MEV supply chain data from June 11th to July 11th.

Here are the takeaways.

From June 11 to July 11, MEV searchers took $20.45M from all users’ transactions via wallets and RPCs, out of which $10.94M went to builders via MEV-Boost. Another $7.14M out of the $20.45M was sent to validators directly via the non-MEV-Boost.

Builders sent $9.29M of the $10.94M to validators.

On-chain MEV related Profit distribution:

searchers - $4.98M (21.7%);

builders - $1.54M (6.7%), which has increased from the $200K of Jan and Feb of this year.

validators - $16.43M (71.6%).

45% of the validator's income comes from MEV. ( $16.43M out of [$16.43M + $19.9M])

Out of the validator's MEV income, 43% does not originate from the MEV-Boost. ( $7.14M out of $16.43M)

Out of the $20.45M, $3.74M was burnt for EIP 1559 by the searchers. And $110K was burnt by builders on sending the $9.29M to validators.

$19.9M, as priority fees from normal transactions, was transferred from wallets and PRCs to builders, then to validators.

Normal transactions from wallets and PRCs burnt $122.62M for EIP 1559.

Searchers' $4.98M only considers arbitrages, sandwiches, and liquidations. The same applies to the $12.6M out of the $18.08M (= $10.94M + $7.14M) being sent to builders and validators. The left $5.48M of the $18.08M was generated from searchers' priority fees and builder payments, originating from unknown MEV sources.

The picture below shows similar data ranging from Jan 1st to Feb 28th, 2023, updated on splitting MEV income into MEV-Boost and non-MEV-Boost.

On EthCC's main stage on July 17th, our data scientist Dr. Sophie Liu dived into the world of MEV in Post-merge Ethereum, discussing profitable market crashes for MEV searchers and benefits for builders, validators, and liquidity providers. Check out the video:

You can find out the slides used in the video, along with more about how to use EigenTx to parse and visualize transactions: bit.ly/eigentx

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram | EigenTx