Built to Centralize: How Ethereum's Winner-Take-All Design Creates a Centralization Crisis and Kills Innovation

Why You Should Invest Your $10M on Bitcoin Mining Instead of Ethereum Block-Building?

Key Takeaways

Just two builders control 95.7% of Ethereum's MEV-Boost block-building market, hijacking the whole ecosystem.

A $10M investment in Bitcoin Mining generates $180K daily, more than 20 times the amount of money put into Ethereum block-building.

Builder centralization costs validators, losing up to $60 million in 10 months.

Private order flows constitute 80% of block value, inaccessible to new builders who can’t afford to subsidize 7.4 ETH per month.

90% via stochastic block rewards and 10% redistributing are a good start to solve the crisis.

From Stake Diversity to Builder Monopoly

On September 15, 2022, Ethereum finished its most important upgrade: the Merge, along with the implementation of Proposer-Builder-Separation, PBS, the goal of which is to increase transaction processing efficiency via specialized roles.

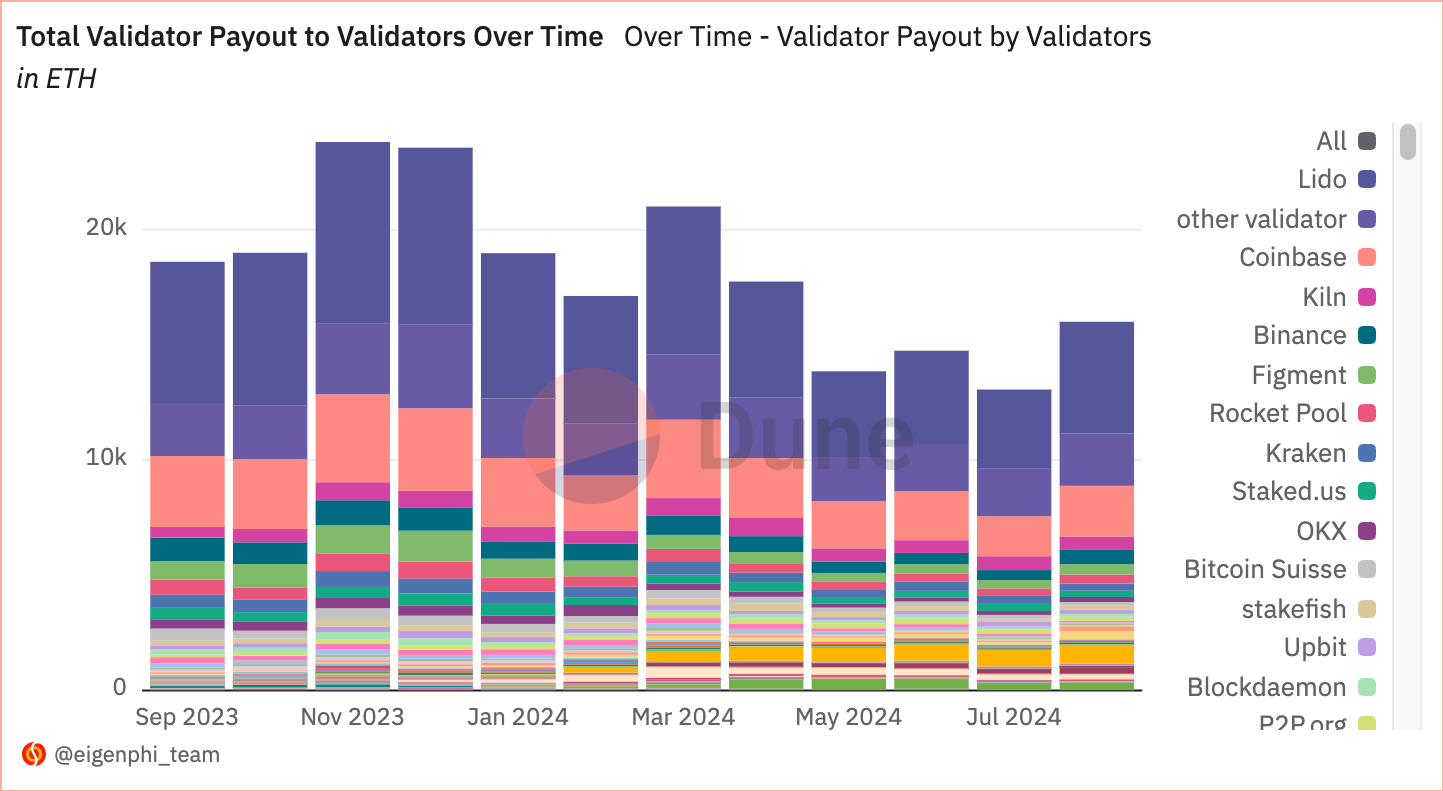

After the merge, the consensus system transitioned from Proof-of-Work, PoW, to Proof-of-Stake, PoS, which created a diversified staking landscape, illustrated in the chart below from the Builder Performance Analysis dashboard. It shows a diversified validator landscape from Sept 2023 to Aug 2024.

However, the key phase of interest allocation is not up to stakers. Instead, it's hijacked by very few top builders, who control the influx of transactions, including degens' snipping, market makers' solving, and, most importantly, searchers' MEV strategies.

The charts on mevboost.pics show that the top 2 builders are pushing other players out of the market. In the past two weeks, they have taken 95.7% of the total MEV-Boost block market, and their reward has been steadily around 90% of the total during the last 30 days.

The current monopoly has grown out of the winner-take-all design of Ethereum, which rewards the ONLY builder who finds the most MEV-optimized transaction order. At the same time, other builders—who also invest significant resources and may come close to an optimized solution—receive absolutely nothing.

This concentration stands in stark contrast to the diverse ecosystem that Ethereum's builders could and should be. Let's examine what we're losing through this centralization and why builder diversity is crucial for the network's health.

Disappearance of Builder Diversity

A more diverse builder ecosystem delivers tangible benefits across multiple dimensions and creates a healthier innovation environment.

In the ideal world, from an economic perspective, the diversity of builders leads to more robustness and better anti-fragility against unexpected disruptions, which is critical for the network's security. Different builders may specialize in different MEV extraction and transaction ordering strategies, yielding more efficient value capture and better price discovery. This diversity also guarantees that no single builder can censor transactions, and the geographic distribution of block production enhances network resilience.

Perhaps most importantly, lower barriers to entry and more accessible private order flows mean that new builders could join the ecosystem and contribute fresh perspectives, creating a competitive landscape fostering continuous improvement and preventing the vertical integration pressures we see today.

The two above charts from mevboost.pics show you the formation of the current centralization. Ethereum used to have a hugely diversified builder landscape right after the Merge. No builders could dominate the block-producing and take all the rewards. To keep Ethereum safe and stable, everyone has their contribution, which, sadly, did not generate fair rewards for most of them. Only one winner could get paid for outbidding others. A collaborative system in the real world has a distinct incentive structure.

While the benefits of builder diversity are clear, Ethereum's current design actively works against maintaining this healthy ecosystem. The root cause lies in its winner-take-all mechanism, which fundamentally misaligns incentives for participation.

Winner-Take-All: Systematic Neglection

As Time advances to 2024, the arena of builders, under the rule of the winner-take-all, has totally changed, favoring a select few builders.

When you look at the bidding process of a block, it's easy to see how intense the competition is. Many builders provide close bids, indicating they are as good as each other on transaction order optimization. It's just like the world's best top 10 Chess Grand Masters, whose point gaps are usually 2 or 3.

However, unlike the winning builder of a block, being rewarded with all the returns, the Grand Master can't receive all the bonuses of the tournament they just triumphed. Other players have the right to get their slices of the cake. And like all competitive sports, randomness, or what you could call luck, plays a critical role in deciding which Grand Master becomes the champion. Be it a hot day, some traffic jam caused by a small accident, or maybe just some unclean leaf in the green salad.

The attraction and thriving ecosystems around Chess and all competitive sports come from the instilled unpredictable elements, sharply opposed to Ethereum's winner-take-all certainty, which would make all sports dull. Even GOATs like Messi and Michael Jordan cannot win all the matches and titles. They are always under the influence of randomness, as all athletes do.

The fundamental flaw in Ethereum's design becomes clear through another simple analogy: commercial aviation. Consider how airlines structure their flight operations:

The Captain and First Officer both receive compensation for their expertise.

Each crew member has clear value recognition and career progression.

Safety and efficiency come from collaborative incentives.

Experience accumulation is rewarded at all levels.

Backup systems and redundancy are valued and maintained.

This proven model also radically differs from Ethereum's winner-take-all approach, where only the highest bidder receives compensation, regardless of others' contributions to network security and efficiency.

Bitcoin's mining ecosystem offers a compelling alternative. While only one miner wins each block reward, the system evolved to value and compensate all participants through mining pools. Small miners can earn steady income proportional to their contributed work, even if they never win a block directly. This collaborative model maintains competitiveness while ensuring sustainable participation at all scales—starkly contrasting Ethereum's current builder market, where runners-up receive nothing despite significant contributions.

Assuming you have $10M in hand and want to join a Bitcoin mining pool, the daily revenue from the $10M would be $180K, considering the current Bitcoin price being $93K. Even if it were re-adjusted to $60K, the daily revenue would still be $120K. That is to say, the APY is in the range of 438% to 657%.

Path to Monopoly: A Self-Reinforcing Cycle

Like an airline choosing to fly with minimal crew to save costs, Ethereum's current system sacrifices long-term security and efficiency for short-term economics. Without proper incentives for all participants, the system naturally tends toward monopoly, exhibiting declining competition and growing entry barriers.

This dangerous trend is already visible: in Sept 2023, Blocknative, one of the OG builders, quit building and suspended its relay for better “economically viable opportunities.”

In two years, Blocknative received $34M in funding. It's reasonable to assume that they invested $10M into being a builder since block-building was one of the biggest Unique Selling Points of Blocknative. Let's calculate whether $10M could sustain a legit builder business.

Our Builder Performance Analysis dashboard shows that Blocknative earned 4.62K ETH as builder rewards, composed of priority fees and builder tips, on building 43.3K blocks during the first 8 months of 2023. However, Blocknative had to pay validators 5.37K ETH to win those blocks. The 750 ETH deficit urged Blocknative to rethink, and then we all saw the result.

Blocknative quit in Sept 2023. The current builder market is much more competitive. Let's say $10M can earn you 1% of the overall share. According to Relayscan.io, after deducting the subsidy for validators, the overall profit of the last 7 days is 1.8K ETH, which means $10M can get you 2.6 ETH per day, worth $8.23K, less than 1/20 of Bitcoin mining daily revenue.

No wonder many small builders follow the Blocknative approach, as shown in this figure.

The bars in the figure display rewards received from public transactions by builders each month from Sep 2023 to Aug 2024. Different colors in each bar indicate different builders. Public transactions are essential for small or new builders since they hardly have access to ever-growing private order flows. The diminishing trend of small builders is obvious, with the bars becoming monotonous, signifying the block-building power concentration.

For new builders to access private order flow, they have a "chicken and egg" problem from the harsh reality: about 80% of block value comes from private order flows, largely inaccessible to new entrants.

Builders need private order flows to win blocks but can't access these flows without significant market share, which becomes a pressure point. A recent study shows new players must subsidize up to 7.4 ETH per month to achieve the minimum 1% market share required by key order flow providers like MEV Blocker. This cost continues to rise as dominant builders strengthen their position.

Moreover, even if you have $10M as the starting fund, it would become the sunk cost with high possibility. Because newcomers must join the unfair resource game of essential infrastructure, which requires high technical and capital costs to match the incumbent's high-end servers, superfast networks, and battle-tested software and teams, and don't forget to calculate the $120K revenue of Bitcoin mining as the opportunity cost.

In a fairer ecosystem, small players and newcomers should receive subsidies for their endeavors in diversity and innovation. Ethereum's failure to do so facilitates the current natural monopoly, manifested in measurable, significant losses for the entire ecosystem. Recent studies have quantified these costs, revealing the true price of builder centralization.

$60 Million in Losses and Inefficiencies from Monopoly

Lately, studies have articulated financial setbacks across the board due to builder centralization.

According to the paper Decentralization of Ethereum’s Builder Market, validators and proposers suffer notable losses, ranging from 5.6% to 11.5%, due to inequality in block-building capacities. An additional 0.5% to 1.7% of losses come from uncompetitive auctions, where only a few large builders dominate. These amount to 9.8K ETH to 21K ETH for all validators, worth $30 million to $60 million in the first 10 months of 2024.

The hypothetical efficiency that is supposed to arise from the winner-take-all design encourages monopoly, causing inefficiency during auctions because of less effective competition, as revealed in the same study.

The paper provides clear empirical evidence that 24.9% of all bidding auctions operate sub-optimally. Moreover, while private order flows constitute about 80% of block value, access remains limited to established players.

These numbers show that the monopoly market structure stifles innovation, and new builders’ novel approaches and technologies are being locked out of the market, thus never getting a chance to prove themselves.

The winner-take-all embedded PBS design was well intended to democratize MEV extraction. Still, the consequences emanate signs of instability as validators face mounting losses. This is particularly concerning because it distorts the MEV measurement system, making it increasingly difficult to implement crucial protocol improvements.

In turn, a complex web of interrelated challenges compounds over time. Protocol designers now work with increasingly constrained options for future upgrades, as any changes must navigate the entrenched interests of monopolizing builders. The network's decentralization mechanisms become less effective each month, creating a feedback loop where centralization reinforces itself through technical and economic channels.

Most critically, this centralization poses an existential threat to Ethereum's role as critical infrastructure for the entire cryptocurrency ecosystem. As the platform that powers most DeFi and other blockchain applications, Ethereum's builder centralization introduces systemic risk for thousands of dependent projects and millions of users. The concentration of power raises serious regulatory concerns, potentially attracting unwanted scrutiny that could affect the entire crypto industry.

These mounting losses and systemic risks demand immediate attention. Fortunately, we don't need to reinvent the wheel - successful models for fair value distribution already exist across various industries and systems.

Building Better For All with Stochastic and Redistribution

Examples of Sports and Bitcoin Mining tell us that the uncertain elements of a system appeal to more participants, not Ethereum's sureness of winner-talk-all, which ignores most members' contributions, smothers diversity and innovation, and introduces the existing and worsening natural monopoly.

To escape the current predicament, we must incorporate stochastic components on block rewarding mechanisms to promote diversity. 90% is a good parameter regarding the present monopoly.

Next, we can redistribute the remaining 10% to re-align interests and benefits for all roles in the system based on their contributions. Consider Airlines recognizes that travelers' safety and positive flight experiences depend on the captain, first officer, and all crew members being properly incentivized and rewarded for their efforts.

These mechanism modifications would demonstrate to the community that Ethereum is willing to make deliberate design choices to nurture competition and innovation to facilitate a sustainable economic system.

Ethereum needs to recognize the contributions of all participants; it cannot focus only on the numerator and ignore the denominator.

Click this link or open https://bit.ly/hfdefi to download the free ebook Head First DeFi, Decoding the DNA of Crypto Transactions & Strategies.

Follow us via these to dig more hidden wisdom of DeFi:

EigenTx | Website | Discord | Twitter | YouTube | Substack | Medium | Telegram