Finding Fortune in the $BLUR Craze: Arbitrage and Sandwich Attacks Shake Up the Market

You are not the only one waitng for airdrops of new tokens.

On Valentine's Day, the popular NFT trading platform Blur generously airdropped its governance token with the ticker $BLUR, to reward its players. The token's value skyrocketed to $5 following the airdrop, but within an hour, it drastically plummeted to $0.6. This sudden and significant price drop turned $BLUR into a lucrative opportunity for traders, arbitrageurs, and sandwich chefs alike.

It's no wonder that $BLUR has captured the attention of savvy and adventurous traders, given the potential profits at stake. Within 24 hours of the airdrop, $BLUR quickly rose to become the fourth most popular token in the DeFi market, with a total trading volume exceeding $49M. By rough estimation, $BLUR's trading volume for MEV transactions had reached $118M in just two days.

The token's extreme volatility made liquidity pools for swapping $BLUR the best places for MEV. Consequently, a $BLUR/$WETH pool on Uniswap was the fifth hottest liquidity pool, with a trading volume of over $30M. You can find more transactions within this LP.

Arbitrageurs grabbed profits from LPs like bloodthirsty sharks, while as the top transactions were nearly all arbitrages.

Let's take a look at how an MEV searcher was able to harvest over $36K in profit from a single atom arbitrage transaction. You can check out the details of this incredible trade here、.

First, the searcher identified that an EOA account, 0x345, was purchasing $BLUR using 50K $USDC (step 3). They then sent 0.4432 $ETH as a builder's reward to the arbitrage bot to initiate the transaction (step 0). The bot completed the arbitrage by taking advantage of the price difference between two orders. On the one hand, 50K $USDC could swap for 45,454 $BLUR in the 0x345's order in the mempool. On the other hand, you could use only 12,915 $USDC to purchase the same amount of $BLUR from another Uniswap V3 liquidity pool.

After paying the builder's reward, the searcher made a profit of 37,084.6 $USDC. It's amazing to see the potential profits that can be made from a well-executed arbitrage trade.

It's crucial to keep an eye out for potential dangers that may be lurking in the background, even while focusing on immediate gains. Unfortunately, sandwich attackers have found their way into the mix, chasing profits and dominating the profit ranking over the next several hours with their 🥪 attacks.

As we review the profit rankings, we can see that almost all of the victims of these sandwich attacks are NFT holders, which is not surprising. In the following sandwich attack transaction, the attacker was able to make a profit of $3,305.2; by swapping 28,922 $BLUR for 9.4 $WETH in the Uni V3 pool to raise the price of $WETH. As a result, the victim @mondoggg, who is the Co-creator of @alphadoggg_, received less $WETH than they had expected. Similar situations occurred with another NFT holder @0xcari.

However, in this Valentine's Day attack, the victim lost over $11,000 in just three transactions. This leading NFT holder @garrettedvf became the biggest target of the sandwich attack.

The implementation of the BLUR token can certainly increase platform activity. However, for NFT players venturing into the DeFi field, they need to take the risk of MEV seriously. As we stated in the report of The Tokenomic Trilemma: A Theoretical Framework for Anticipating and Diagnosing DeFi Protocols' Flaws and Risks: "On the one hand, unlike Bitcoin and Ether, it is increasingly difficult to capture value for native tokens issued independently by new protocols. The total value of these native blue chip tokens based on certain innovative consensus is limited in size", which has led to high price volatility. Additionally, the process of liquidity change represents the process of entropy increase, and there is a time window until stability is restored.

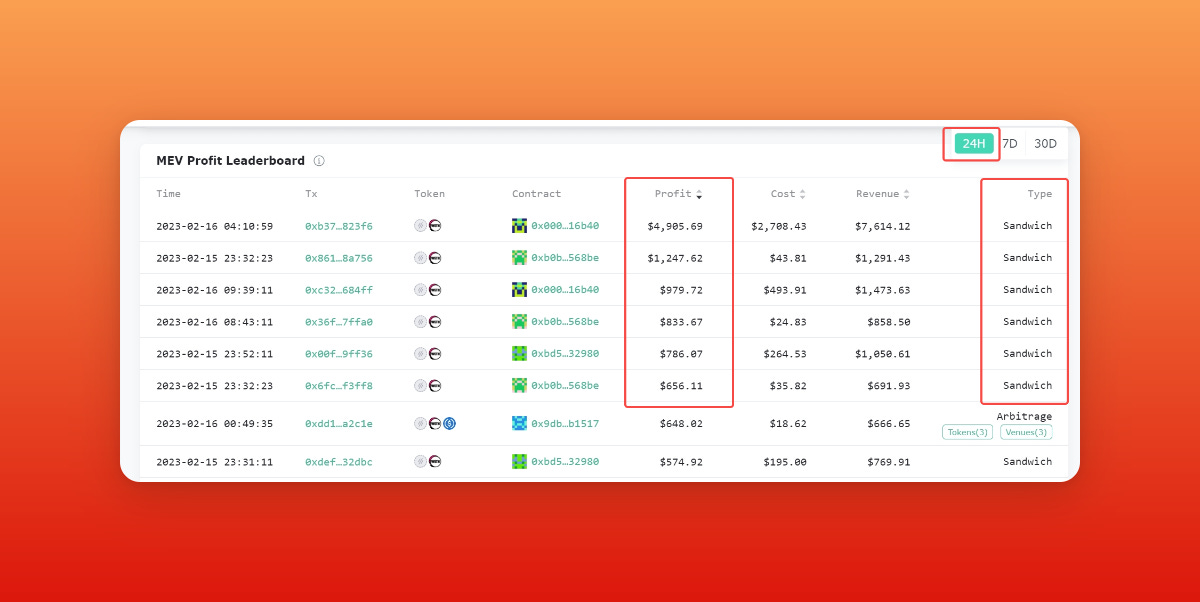

You can check whether you're the one that was exploited by the sandwich attack on our websites. Find the latest MEV opportunities from the profit leaderboard and live-streaming MEV transactions using $BLUR.

Follow us via these to dig more hidden wisdom of DeFi: