EigenTx Use Cases for Advanced Learners: Tax Token, Liquidation and NFT Arbitrage

An Explanation of What EigenTx Is and How It Improves the Transparency and Efficiency of On-Chain Transactions

Have you read our EigenTx booklet, which explains complex definition transactions? We've been making video versions available for your convenience. Don't miss out!

In the previous article, we used four real-world transaction examples for beginners: Simple Arbitrage, Back-Run, MEV Redistribution Using MEVBlocker, and Jaredfromsubway.eth, to help you get started in the DeFi world.

In this article, we will continue to break down three types of transactions for advanced learners, including Tax Token, Liquidation, and NFT Arbitrage, to help you engage with the DeFi world more efficiently.

Download our booklet to see more cases in advance: EigenTx: Examining the Lifecycle of Token Flows-A Guide to Analyzing Complex Transactions.

Case 1. Tax Tokens

Have you ever been frustrated by being taxed after trading certain tokens? 🚨We will use a simple case to break down what Tax Token is! Here is a BRC20 token transaction on BSC. The token $CUE in it is our Tax Token example.

In this transaction, the user swapped 0.1 BNB for 2.9897 CUE at PancakeSwap. But this swap process is more complex due to the CUE contract's tax collection process, as in Step 5 of the diagram.

The user received 2.9150 CUE instead of 2.9897 CUE as a result of the tax collection process. The remaining 0.0747 CUE was transferred to the Governance Wallet (leaf) of the Cue Protocol.

You can also download the Eigen Tx extension for your convenience. Understanding transactions solely based on textual information displayed on platforms such as BscScan.io can be difficult. As a result, for a more visual and clear understanding of the data, we recommend installing our EigenTx Chrome extension. This will allow you to view the token flow chart directly on the page.

Case 2. Liquidation

On May 25th, the cryptocurrency market liquidation surpassed $119 million. But how exactly does a liquidation work?

Let's look at a liquidation transaction that occurred on the popular BSC lending platform, Venus. In this case, the liquidator, or to address, used Flash Loan funds to trigger the internal liquidation contract process on Venus. This process allowed the liquidator to close the borrower’s vBUSD loan position and rake in tidy proceeds of 19 BUSD.

Steps 0-1: The to address borrowed a Flash Loan from PancakeSwap and transferred 373.2624 TUSD to the Liquidator contract to trigger the liquidation process.

Steps 2-6: The Liquidator contract of Venus transferred the returned assets to vTUSD vault and seized the corresponding collateral assets, 18892.569181 vBUSD, from the borrower. The corresponding 373.262386 virtualDebtTUSD was burned and 18033.816037 vBUSD was transferred to the to address, while the remaining part was collected as a fee.

Steps 7-8: The to address burned vBUSD and redeemed 392.825247 BUSD.

Steps 9-11: The to address repaid the Flash Loan and transferred the proceeds, 19.375761 BUSD, to its EOA address, and burned 55 CHI tokens to pay for gas reduction service.

The token flow chart provides a clear and intuitive illustration of the transaction process. One key feature to note is that the Venus associated contract is delineated by a rectangular border, allowing for easy identification.

Furthermore, it's worth noting that virtualDebtTUSD is utilized as an expression of internal accounting within EigenTx. This practice holds great significance as it ensures a balanced approach to the creation and depletion of resources during the liquidation process.

In Step 3, the Liquidator seized the collateral token vBUSD from the borrower's address. However, the position was left unbalanced without the corresponding Step 4 burning its debt being shown. This is common practice among many protocols, as their contracts keep an internal account of users' positions and do not emit logs of the corresponding rebalancing actions. This is where EigenTx's Complete Internal Accounting feature comes in, as it bridges the gap by providing a record of these accounting actions.

Case 3. NFT Arbitrage

Let's take a look at a non-atomic arbitrage transaction involving non-fungible tokens (NFT), which differs from previous ones such as atomic arbitrage, sandwich trading, and liquidation. NFT arbitrage is a clever way to make money. Since it went viral in March 2020, it has gotten a lot of attention in the crypto industry.

In comparison to other assets, NFTs are less standardized and illiquid. Users frequently place buy and sell orders for the same NFT on multiple trading platforms and wait for them to be filled. Smart and diligent bots can sometimes discover lucrative arbitrage opportunities in these fragmented markets.

One common technique for NFT arbitrage involves a bot that executes several transactions as part of the process. Fortunately, EigenTx can handle such scenarios with ease. By leveraging Flashbots, MEV bots conducting non-atomic trades can send multiple transactions bundled together to the builder. This bundling ensures that the order of the transactions remains intact during the trading process. To locate each set of bundles, EigenTx's Flashbots Bundle Exhibition feature is used. For instance, a detailed example of NFT arbitrage is available in the second set of bundles located at block height 16745918.

If you're interested in analyzing the transactions related to a specific NFT trade, you can easily do so using EigenTx. Three of the four transactions involved in a trade can be analyzed by inputting their unique hashes into the EigenTx search box. Once you've done so, you can view the token flow chart for each transaction separately, or you can use the Multi-txs In One Chart feature to get a comprehensive view of all three transactions in one chart. The second transaction involved in the arbitrage trade is related to setting approval for trading the NFT.

You can also view multiple transactions in one chart.

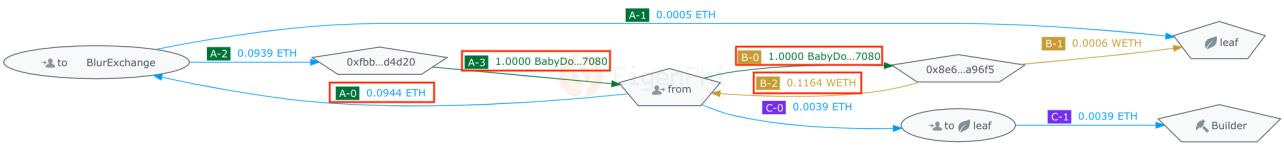

Uppercase letters symbolize transactions and show the order in which they occur.

Transaction A: The from address bought a NFT (Baby Doge #7080) at Blur Exchange. After receiving 0.0944 ETH from the bot, Blur Exchange transferred 0.0005 ETH to the leaf address and 0.0939 ETH to the NFT seller and triggered the NFT transferred from the seller to the from address.

Transaction B: The from address sold the NFT bought in previous transaction to another buyer 0x8e6…a96f5. The buyer received the NFT from the bot, then transferred 0.1164 WETH to the from address and 0.0006 ETH to the leaf address.

Transaction C: The bot sent 0.0039 ETH as a tip to the Flashbots, who provides bundling service, to ensure the atomicity of the transactions.

Overall, EigenTx is a useful tool for delving into the specifics of DeFi trades. Continue reading for more MEV case examples! Meanwhile, you can follow us on Twitter and download our latest booklet for free by clicking here.

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram