DeFi Daily Digest 2022-07-13: Bonds Beating BTC Multistate Investigating Celsius alike, While Zhu Su Facing Subpoena

$1B BTC Address, $418M stETH Celsius transferred, and $8M loss by Phishing Attack on Uniswap V3.

Macroeconomic Fundamentals

Bitcoin's (BTC) fortunes are more closely tied to the U.S. real or inflation-adjusted bond yield than ever, with the two increasingly moving in opposite directions.

The real yield has surged by over 170 basis points this year, putting pressure on risk assets, including bitcoin.

The higher the real yield, the lesser the incentive to chase returns from other assets like cryptocurrencies, stocks and gold.

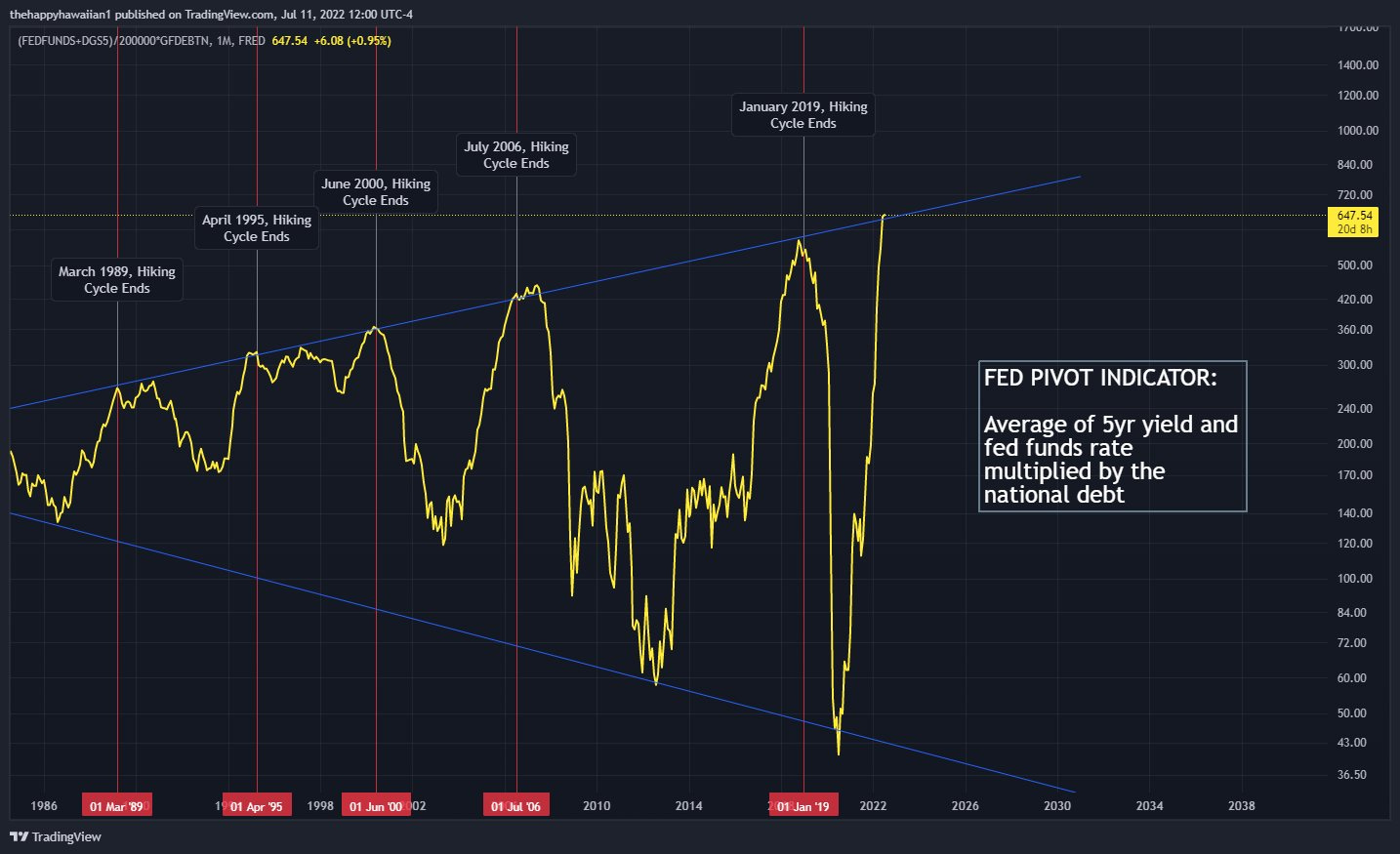

Technical analysis: Historical data suggests that the Fed should halt rate hikes at this point and move into easing, and there will be serious consequences if the interest rate continues going up.

Regulation

The Vermont Department of Financial Regulation has already joined a multistate investigation of Celsius arising from the above concerns.

The statement said Celsius "has not disclosed adequate or complete information to the public to enable investors to make informed purchases and sales of CEL." Investors who purchase CEL tokens are taking a risk that those tokens will sharply decrease in value, or even become worthless, in the future. Concerted efforts to manipulate the price of CEL may also violate state and federal laws.

Federal Reserve Bank of Cleveland: Lightning Network is turning Bitcoin into money. For more discussion, read https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4142590

California is investigating ‘multiple’ crypto lending companies.

The California Department of Financial Protection and Innovation (DFPI) says it is eyeing "multiple" companies that “offer customers interest-bearing crypto asset accounts,” or crypto-interest accounts, and service providers that “may not have adequately disclosed risks customers face when they deposit crypto assets onto [lenders’] platforms.”

More info about this investigation can be found at https://dfpi.ca.gov/2022/07/12/dfpi-is-actively-investigating-multiple-companies-offering-crypto-interest-accounts/

Banque de France is looking toward a fully operational wholesale digital asset by the beginning of 2023.

Digital dollar could benefit financial stability, says a U.S. federal researcher in a working paper.

The Office of Financial Research (OFR) – an arm of the U.S. Treasury Department that studies risks to the financial system – looked into how a central bank digital currency (CBDC) would affect the inner workings of U.S. finance, and the paper concluded that worries about a future panic driving people to rapidly move assets into digital dollars may be overblown.

Lending

BlockFi changed its position on GBTC and said it could accept GBTC as collateral.

A16z, Variant Lead $18M round for lending protocol Morpho Labs

Morpho is intended to plug into existing lending protocols such as Compound and Aave to offer higher yields through peer-to-peer liquidity.

Morpho-Compound launched a few weeks ago and has accumulated $30 million in liquidity, according to the company. Morpho-Aave will launch in the coming weeks.

CEX&DEX

A US bankruptcy court approved a legal administrator to manage Three Arrows Capital assets and subpoena its founders, while Zhu Su comes out of incognito mode on Twitter.

Celsius fully pays off Aave loan, freeing up $26M in tokens.

The company transferred its publicly known staked ether or "stETH" holdings – some 416K tokens, or $418M of worth – to another unlabeled wallet. Read analysis by DeFiyst.

At 4 am on July 13, the wallet linked to Celsius owes some $50M in USDC stablecoin to Compound, with 10K WBTC currently collateralized on the platform.

Binance misread a Phishing attack on Uniswap, which robbed users of nearly $8 million in Ethereum, as a potential exploit on V3 contract.

BitCoin

MEV

Insight: Flashbots, Kings of The Mempool. The article unpacks the secrets:

inside the mempool, the evolution of MEV-Geth & a peek into the future with MEV boost

how Flashbots changes the structure of Mempool and the MEV game forever.

Follow us via these to dig more hidden wisdom of DeFi: