How to Make a Fortune with Trading Synthetic Tokens: A Step-by-Step Guide to 100x-Return Russian-Doll Style MEV Arbitrage

The bot pioneered early MEV arb-trading, exploring synthetic token opportunities & strategies via permissionless mint/burn.

On Jan 1st, 2023, When everyone was still enjoying the holiday, this MEV arbitrage bot flash-loaned 8668 $USDC, performed complex arbitrages across multiple protocols, and netted $3K profit with $30 gas fees. It's like trading a 4-layer matryoshka doll!

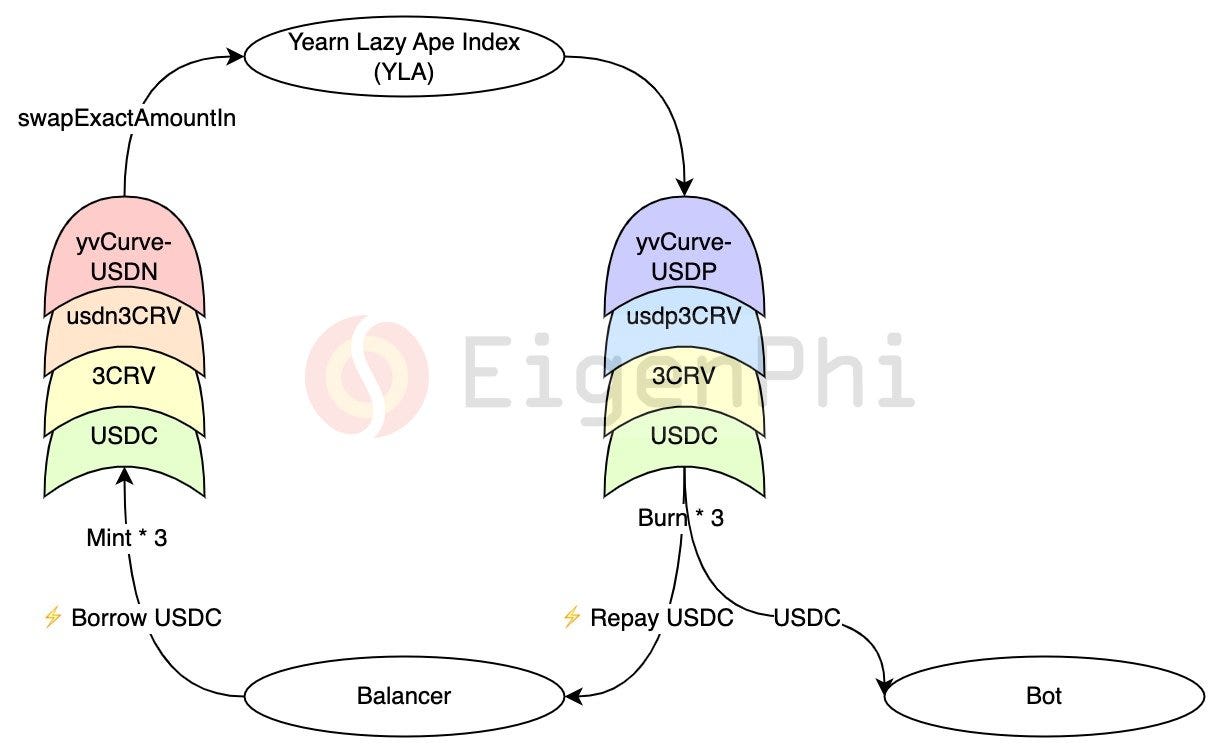

In this 100x return arb, the OG bot (https://bit.ly/3CdT4bi) used Balancer for flash loan and swapped 8 different tokens smoothly between Curve.fi's 3pool, USDN Metapool, Yearn.Fiannce's yvCurve-USDN, and PowerPool’s YLA index fund.

The bot pioneered early MEV arb-trading, exploring synthetic token opportunities & strategies via permissionless mint/burn. Profits from deviations in 4-layer YLA liquidity tokens & pool valuations.

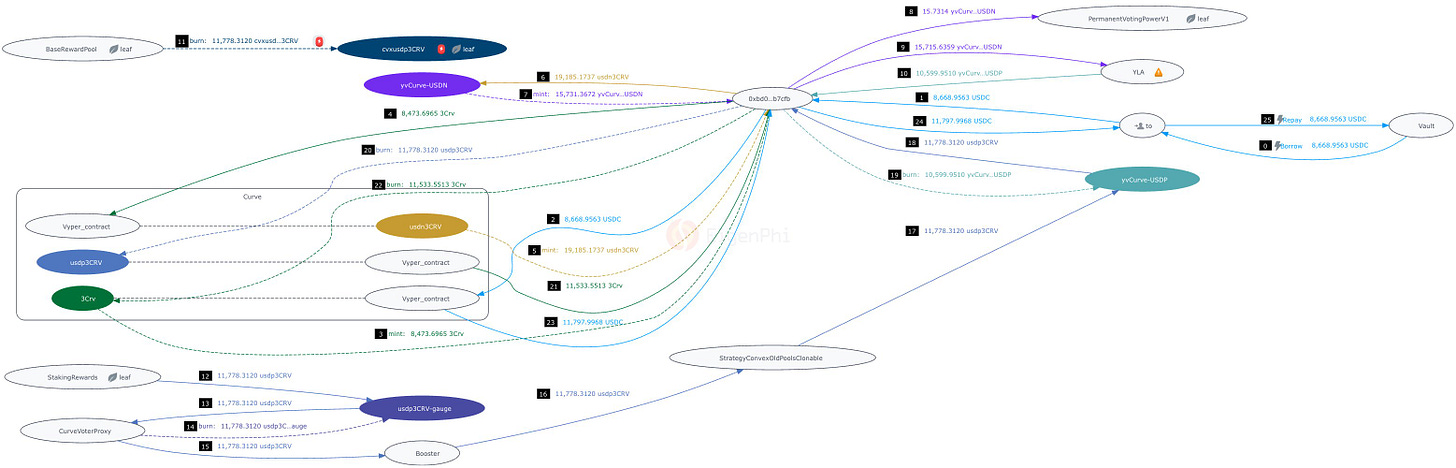

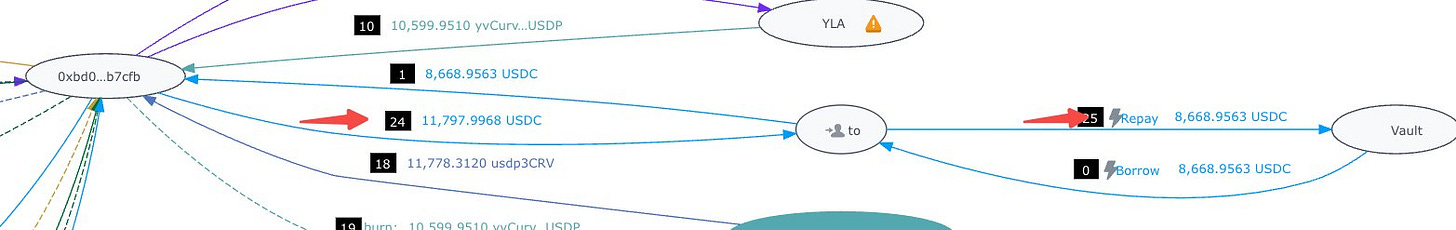

Here is the overall token flow chart.

Now let's see how the bot did it step by step!

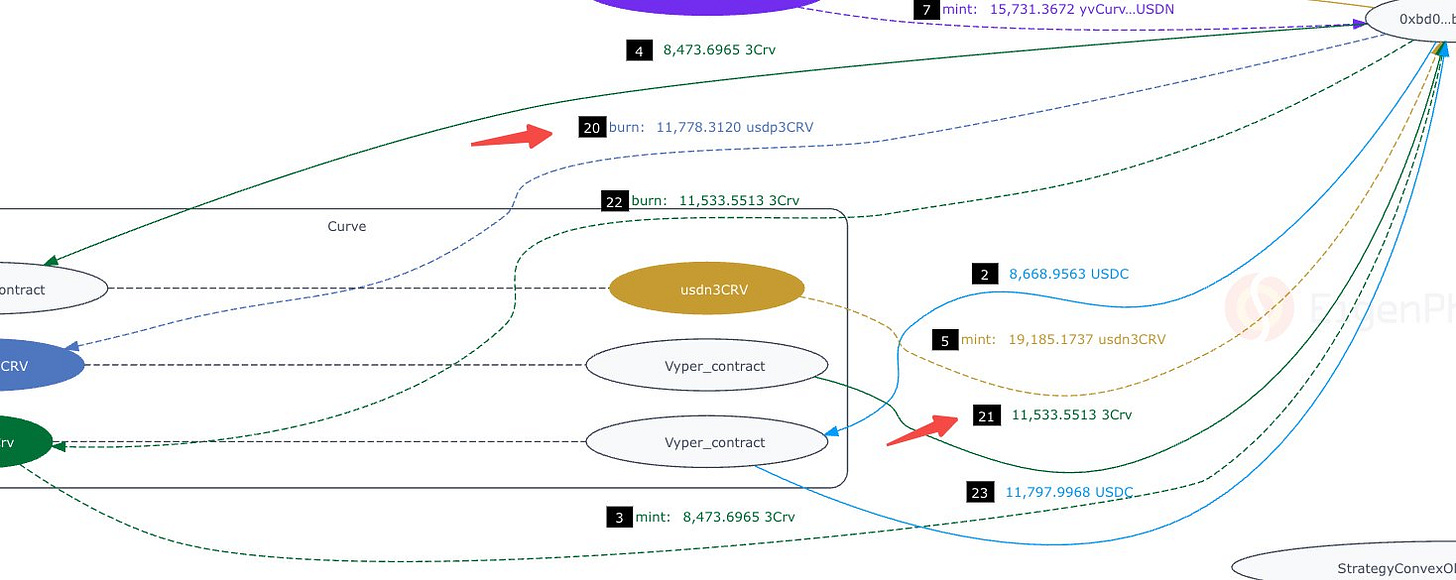

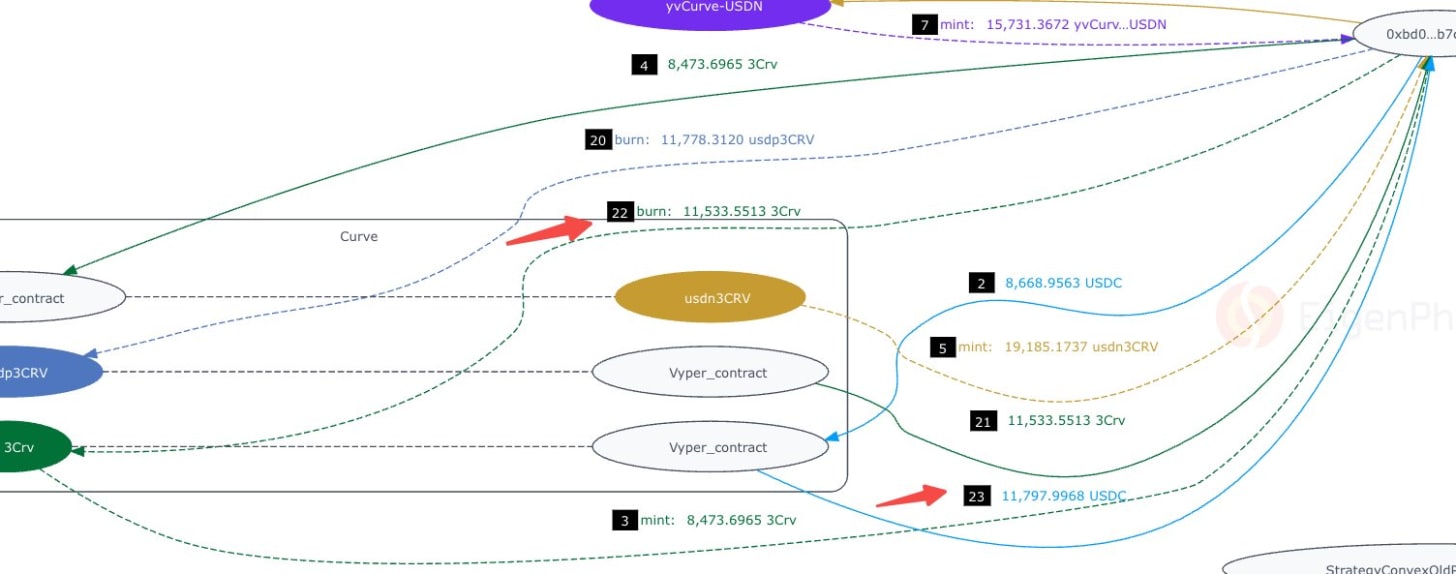

Steps 0-1: The “to” address borrowed 8668.9563 USDC from the Balancer Vault through a flash loan and sent it to the associated contract at address 0xbd06.

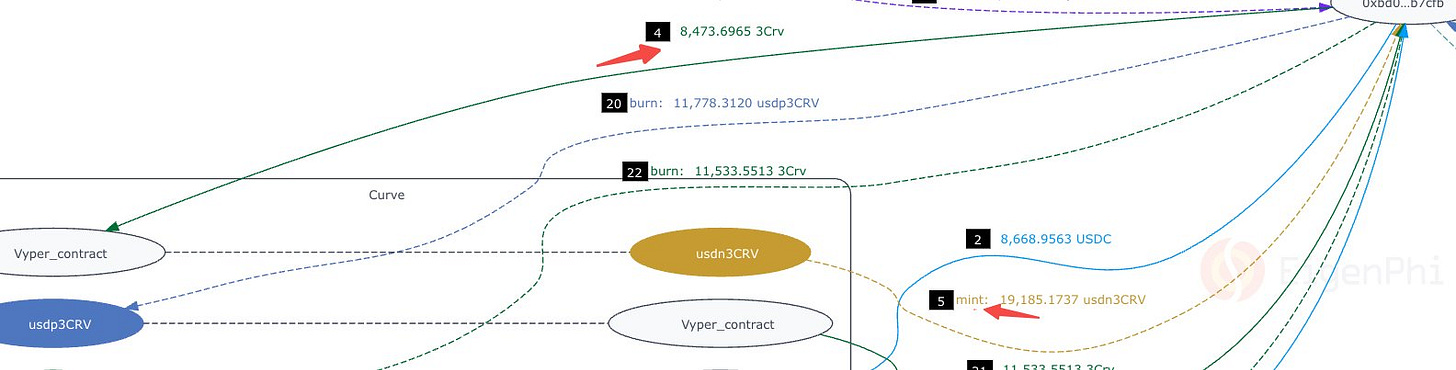

Steps 2-3: The contract 0xbd06 performed a liquidity-adding operation by depositing the USDC into the liquidity pool with the largest trading volume on Curve, 3pool. In return, the contract received 8473.6965 units of liquidity tokens 3Crv minted by the 3pool, and each unit of 3Crv was worth 1.023 USDC.

Steps 4-5: The contract 0xbd06 deposited 3Crv into Curve.fi: USDN Metapool, which provided liquidity for USDN. In return, the contract received 19185.1737 units of liquidity tokens called usdn3CRV, minted by the pool contract.

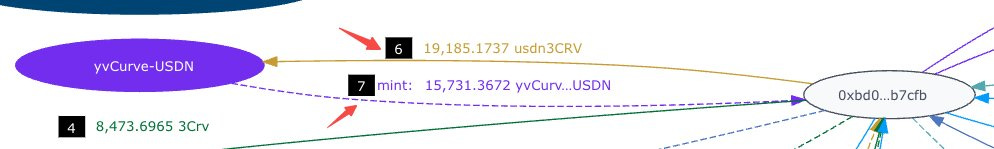

Steps 6-7: The contract 0xbd06 deposited the usdn3CRV tokens into the yvCurve-USDN asset management contract of Yearn Finance. In return, the contract received 15731.3672 units of yvCurve-USDN, minted by the asset management contract.

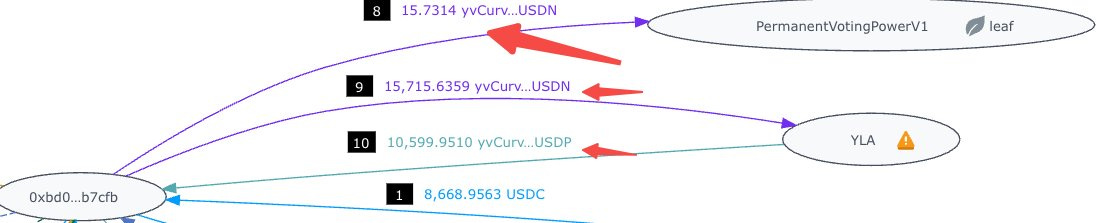

Steps 8-10: Using the index fund contract YLA offered by PowerPool, the contract 0xbd06 swapped the yvCurve-USDN tokens for 10599.9510 units of yvCurve-USDP.

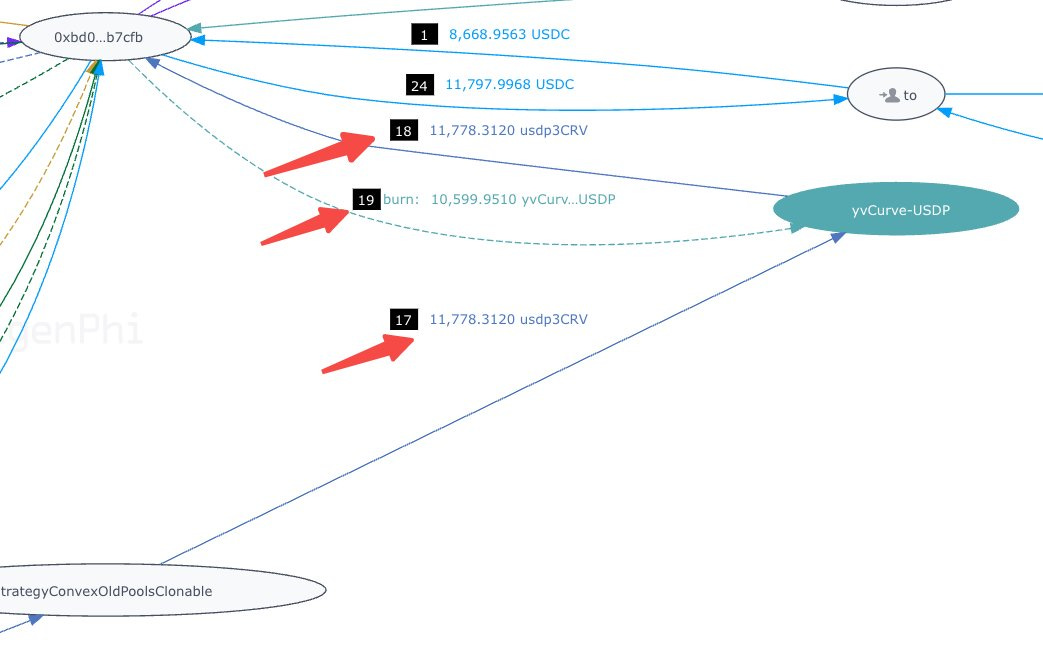

Steps 11-19: The contract 0xbd06 invoked the withdraw function of yvCurve-USDP, which destroyed yvCurve-USDP tokens and received 11778.3120 units of usdp3CRV tokens in return.

More specifically, steps 11-17: The intermediate process triggered by the yvCurve-USDP contract.

Steps 18-19: The burn and redeem operations.

Steps 20-21: The contract 0xbd06 called the remove-liquidity function of Curve.fi: USDP Metapool, and destroyed the usdp3CRV tokens to redeem 11533.5513 units of 3Crv tokens.

Steps 22-23: The contract 0xbd06 redeemed 11797.9968 USDC by destroying the 3Crv tokens and withdrawing from the 3pool.

Steps 24-25: The contract 0xbd06 sent the USDC to the “to” contract. The “to” contract returned 8668.9563 USDC to Balancer and kept 3129.0405 USDC as revenue.

The bot excels at arbitraging between liquidity tokens with one-to-many anchoring relationships. Taking this transaction with an ROI as high as 10230% as an example, the robot flash loaned 8668 USDC from Balancer and performed three minting, one swapping, and three burning operations in pools created by several protocols. Eventually, it earned a net profit of $3098.75, with a cost of only $30.29 in gas fees. It's like processing a four-layer matryoshka doll, trading it for a new one, and finally getting a more valuable one by opening the innermost layer.

The arb opportunity arises from the deviation between the valuation of 2 types of 4-layer liquidity tokens in YLA and the valuation of their pools. Using EigenTx’s consolidation settings, it’s easier to reveal the critical path by hiding the intermediate asset transfer.

Before opening the “Hide Intermediate Asset Transfer” option:

After opening the “Hide Intermediate Asset Transfer” option:

The graph above shows that 25 steps can be simplified to 16.

S0: Borrow ->S1: Transfer ->S2: Mint ->S3: Mint ->S4: Mint ->S5: Mint ->S6: Burn ->S7: Burn ->S8: Transfer ->S9: Transfer ->S10: Burn ->S11: Transfer ->S12: Burn ->S13: Burn ->S14: Transfer ->S15: Repay.

Even being regarded as the Dark Forest, transactions like this demonstrate that #MEV is still such an amazing world to explore. Wanna be the #Degen who can discover gold mines like this one? Please feel free to read our EigenTx Booklet to discover more use cases like this synthetic arbitration.

Follow us via these to dig more hidden wisdom of DeFi:

Website | Discord | Twitter | YouTube | Substack | Medium | Telegram